XRP used to be susceptible to a breakdown after buying and selling inside a consolidation section, with analysts predicting a imaginable drop to $0.4319.

Supporting proof from quite a lot of marketplace signs strengthens the forecast of an imminent fall.

At the day by day chart, Ripple [XRP] has been underperforming, and the fad seems set to proceed. It has already skilled a 1.71% decline, with expectancies of additional decreases.

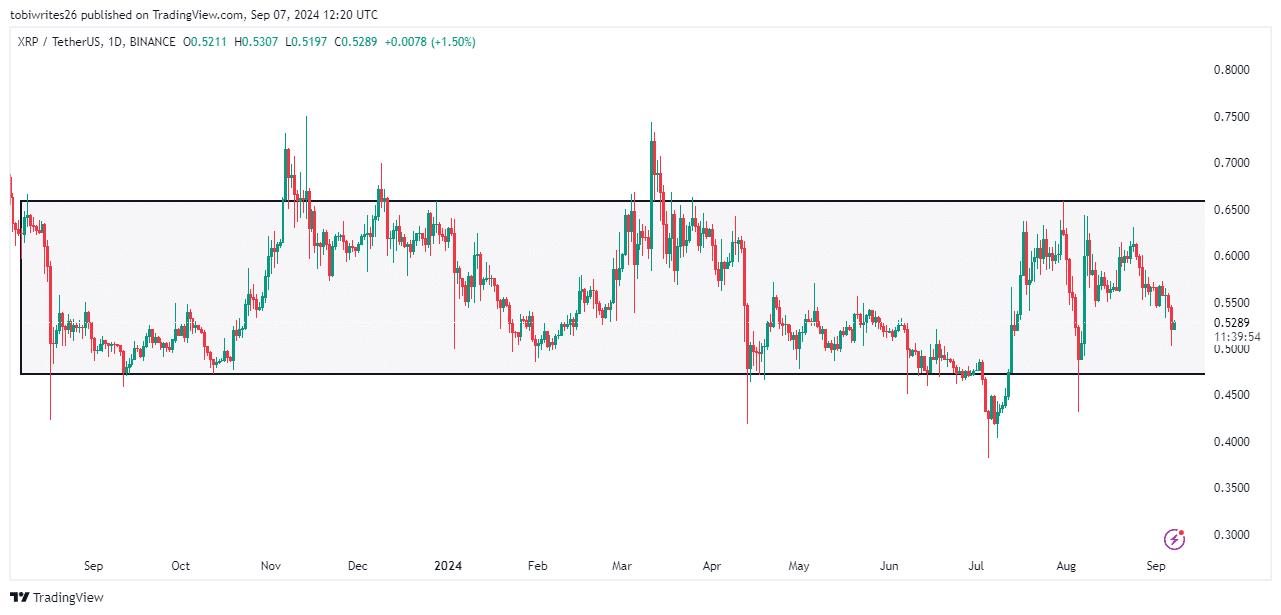

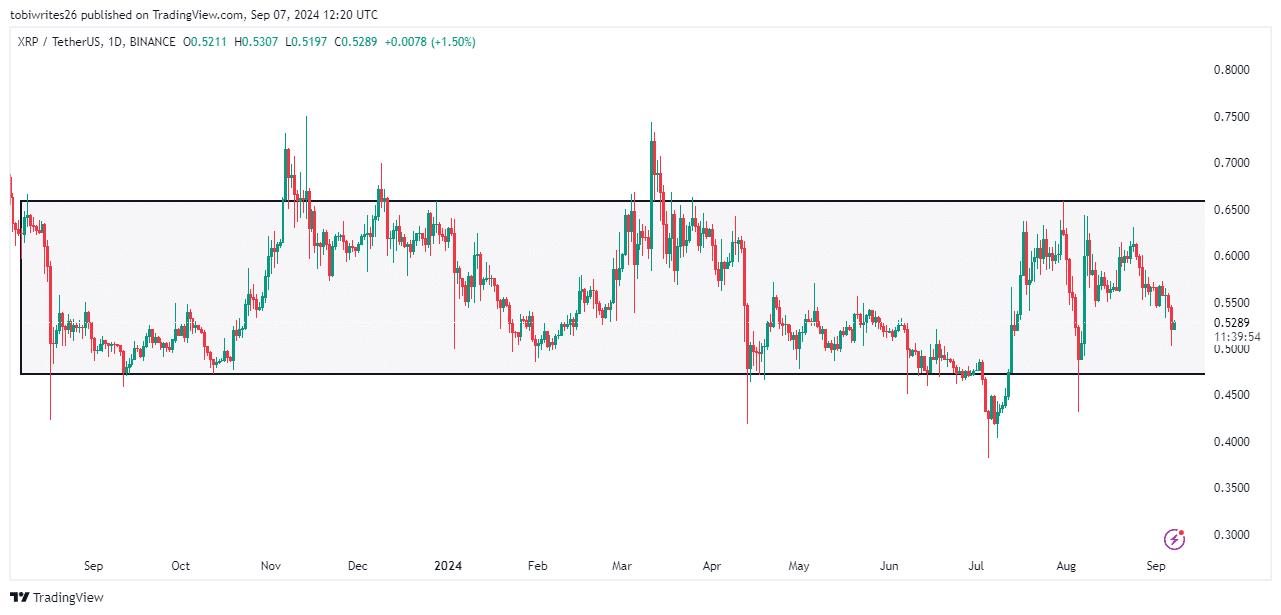

XRP consolidation may just result in a breakdown

XRP has been consolidating inside an outlined day by day vary for over a 12 months, a motion that started in August in step with AMBCrypto’s chart research.

Consolidation levels usually constitute sessions of accumulation, the place the associated fee oscillates between the higher and decrease bounds of a rectangle, regularly surroundings the degree for both an important breakdown or breakout.

As of this writing, XRP has lately rebounded from the higher sure or resistance line and is prone to descend to the ground of the channel the place purchasing force may just doubtlessly pressure its worth upper, proceeding its development of oscillation.

Supply: Buying and selling View

Supply: Buying and selling View

On the other hand, AMBCrypto reviews that the marketing force has intensified, suggesting that the decrease sure or strengthen line would possibly not cling which can motive an additional decline within the asset’s price.

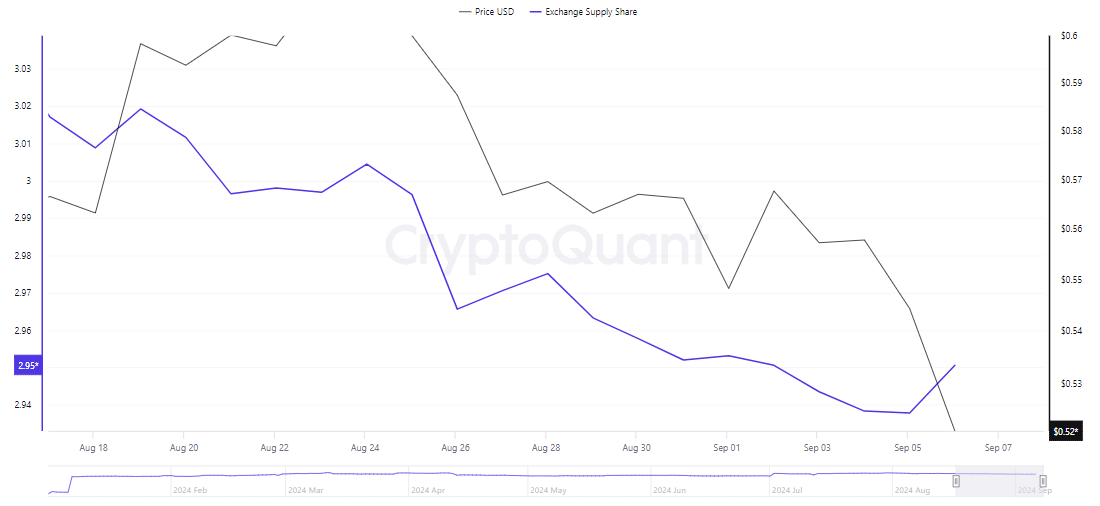

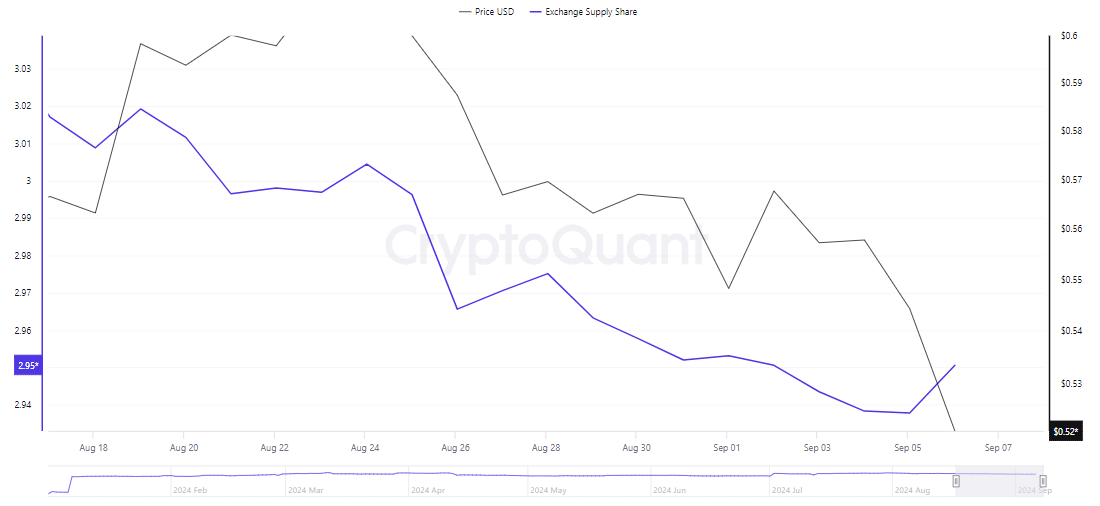

Higher provide puts promote force

AMBCrypto’s research the usage of knowledge by means of Cryptoquant signifies a notable build up within the Change Provide Percentage of XRP during the last 24 hours, suggesting a possible main drop in its worth.

This build up issues to the next availability of the token on exchanges, developing downward force on its worth because of the inflow of attainable dealers.

Supply: Cryptoquant

Supply: Cryptoquant

An important surge in provide, regularly influenced by means of whales shifting massive amounts of XRP to exchanges on the market, has been seen.

Just lately, Lookonchain recorded a transaction the place a whale moved 95 million XRP, an identical to over $49 million, in fresh hours with extra transactions recorded.

Additionally, in step with Cryptoquant, there was a gentle upward push within the change influx of XRP because the starting of the month, additional expanding the full provide on exchanges.

Retail investors’ task provides to bearish transfer for XRP

An in depth research of Open Pastime (OI) from Coinglass, which tracks unsettled transactions, displays an important decline of seven.02% to $563.97 million which means that retail investors are increasingly more lively, with attainable implications for a decrease XRP worth.

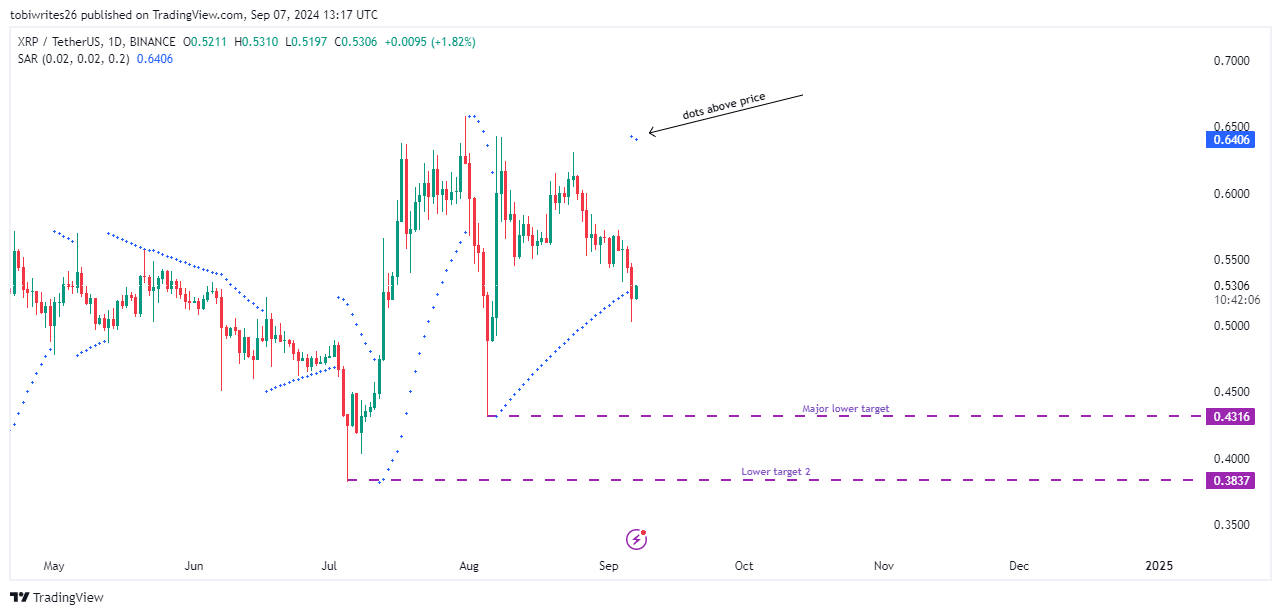

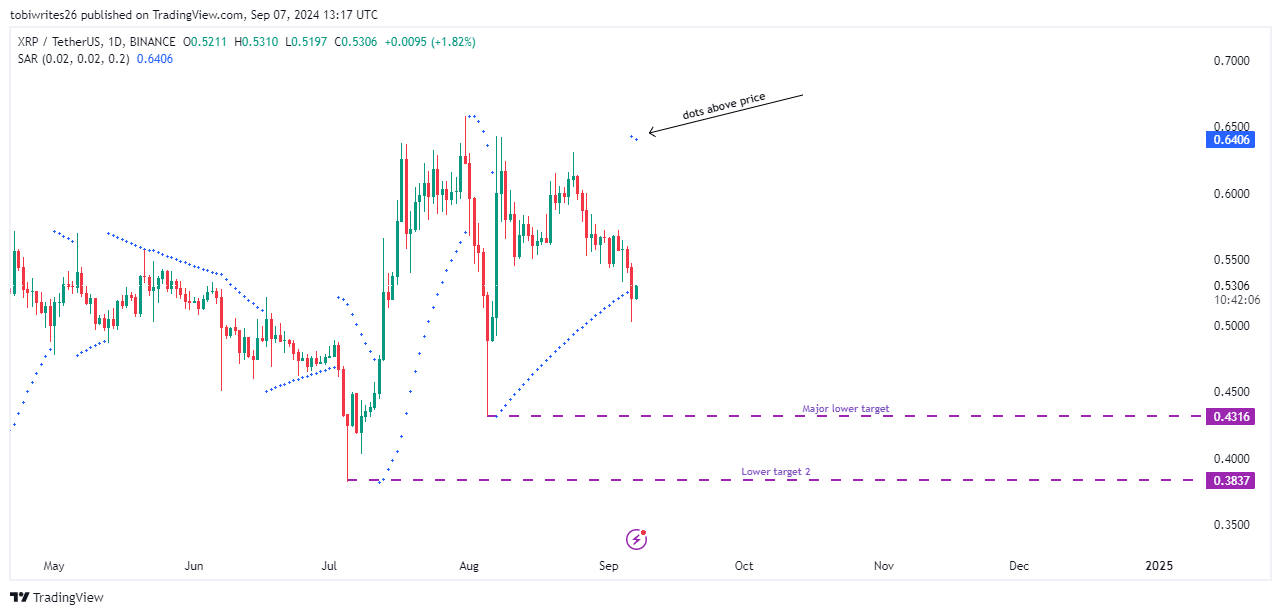

This bearish outlook is additional supported by means of the Parabolic SAR (Prevent and Opposite) indicator.

The Parabolic SAR is helping establish attainable worth reversals and momentum, marked by means of dots that seem above or under worth bars on charts. A metamorphosis within the place of those dots signifies a development shift.

Supply: Buying and selling View

Supply: Buying and selling View

Learn Ripple’s [XRP] Value Prediction 2024-25

For XRP, the Parabolic SAR has gave the impression above the associated fee bars which indicators an expected decline in its price within the upcoming buying and selling periods.

If this downward force continues, the token may just doubtlessly drop to strengthen ranges of $0.4319, and even decrease to $0.3823 if promoting force intensifies.

Earlier: Toncoin’s 13% drop: What took place and will TON soar again?

Subsequent: Pepe’s double whammy: Value slips under key stage as community task slumps