One more reason why the Fed can let the CRE swoon rip.

By means of Wolf Richter for WOLF STREET.

The multifamily phase of Industrial Actual Property – flats – is keeping up higher than place of job, retail (the Brick-and-Mortar Meltdown since 2017), and accommodation, even though it’s cracking too with some impressive defaults during the last twelve months or so. But, US banks and thrifts and overseas banks hang just a small-ish portion.

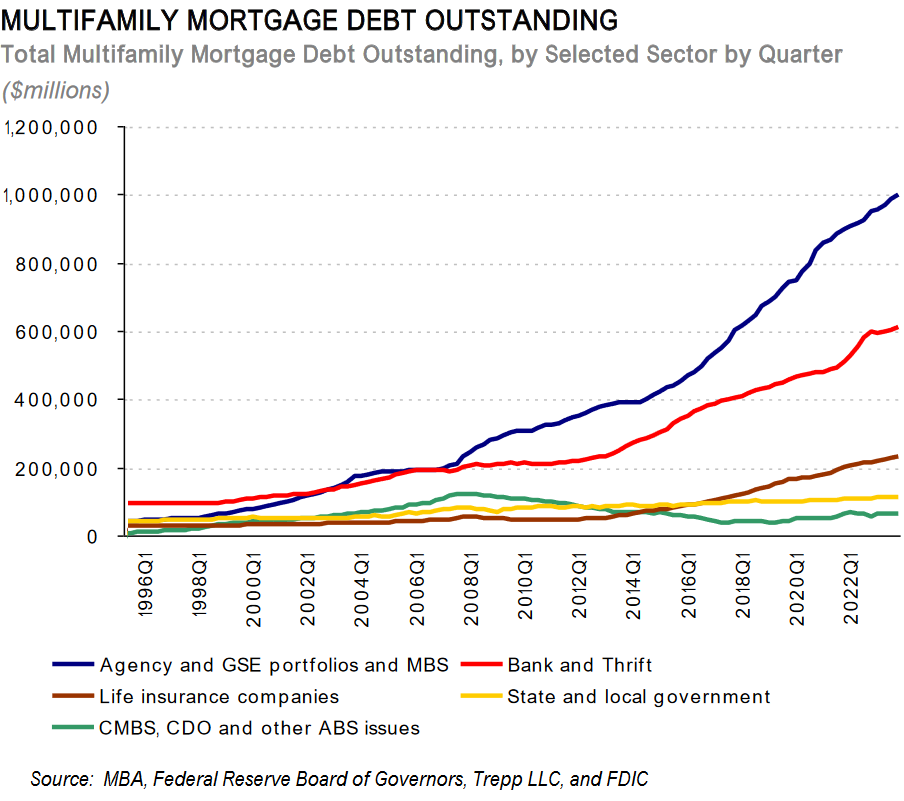

General mortgages subsidized through multifamily homes rose through 4.4% year-over-year in This autumn, or through $88 billion, to $2.09 trillion, consistent with the Loan Bankers Affiliation, based totally by itself information, and on information from the Federal Reserve, Trepp, and the FDIC.

Of the ones mortgages:

US authorities businesses, US Executive Backed Enterprises (GSEs, reminiscent of Fannie Mae), state and native governments, and state and native authorities pension price range held 54.8%, or $1.09 trillion.

US banks and thrifts and overseas banks held 29.3%, or $612 billion.

Lifestyles insurers held 11.3%, or $235 billion.

Every other 3.2%, or $67 billion, were securitized into private-label (now not government-backed) CMBS, CDOs, and ABS, and the ones securities have been held through buyers.

Different buyers, together with inner most pension price range and REITs, held 2%.

The blue line represents federal authorities subsidized entities – together with MBS issued and warranted through the ones entities. Relatively a captivating pattern (chart by the use of MBA):

The MBA excludes loans for acquisition, building and development, and loans collateralized through owner-occupied business homes.

For roughly a yr, we’ve been reporting on how non-bank entities, from CMBS holders to PE corporations, have been at the hook for place of job and different CRE mortgages, how the largest losses have hit those buyers, specifically the CMBS buyers, and now not banks. And a number of the banks that it did hit, there have been a slew of overseas banks.

However with the multifamily phase of CRE, it’s most commonly federal, state, and native authorities entities, together with their pension price range which are at the hook – which means the taxpayers are at the hook for 54.8% of all multifamily mortgages.

And the Fed couldn’t care much less about taxpayers. The Fed is anxious in regards to the banks, now not a couple of particular person banks, however about contagion around the banking gadget triggering a banking panic. However with the 4,026 US banks with $23 trillion in general belongings keeping best $612 billion in multifamily mortgages – smartly, that’s not up to 3% in their general belongings. In different phrases, the banking gadget total isn’t basically threatened through dangerous multifamily mortgage.

Although most of the banks’ $612 billion in multifamily loans default, they’re secured through multifamily structures with some price, so the losses are going to be best fraction of the $612 billion, unfold over 4,026 banks with $23 trillion in general belongings.

As all the time, some smaller banks with concentrated publicity in some markets would possibly ultimately topple underneath defaulted multifamily loans. Fitch thinks 49 tiny banks are closely uncovered to distressed multifamily loans, and a few of the ones banks would possibly topple. In just about once a year, some banks toppled, and it’s simply a part of the dangers within the banking gadget, and it’s the FDIC’s process to mop up the ones native messes at buyers’ expense.

Experience studying WOLF STREET and need to beef up it? You’ll donate. I recognize it immensely. Click on at the beer and iced-tea mug to learn how:

Do you want to be notified by the use of e-mail when WOLF STREET publishes a brand new article? Join right here.

![]()