AAVE defies the marketplace pattern with a 13% rally, as open hobby soars.

These days, 68.50% of most sensible investors on Binance dangle lengthy positions, whilst 31.50% dangle quick positions.

Amid ongoing marketplace uncertainty, Aave [AAVE] is outperforming marketplace traits, attracting emerging hobby from the crypto group.

Aave defies marketplace pattern

As of press time, the wider cryptocurrency marketplace is suffering, together with primary belongings like Bitcoin [BTC], Ethereum [ETH], and Solana [SOL]. In the meantime, AAVE is main the marketplace with a fifteen% upward momentum.

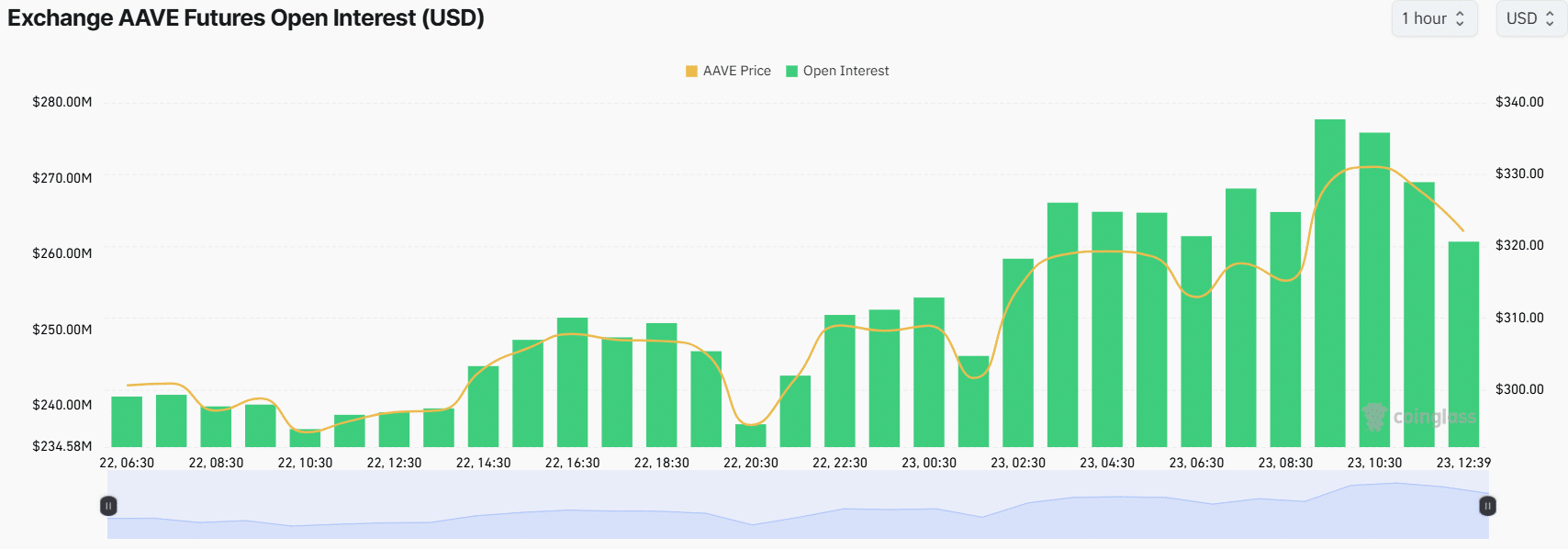

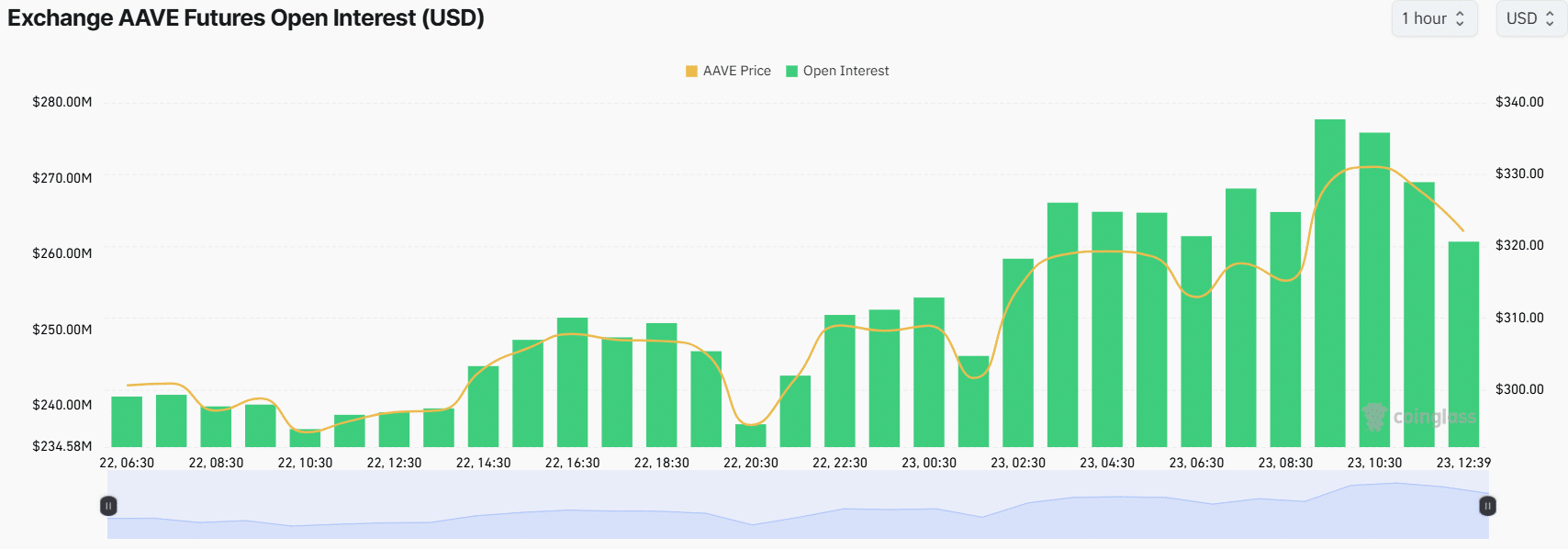

This bullish momentum is pushed via heightened dealer hobby international, as reported via the on-chain analytics company Coinglass.

In keeping with the knowledge, AAVE’s futures open hobby has surged via 15% previously 24 hours, highlighting how investors are capitalizing at the present marketplace sentiment and construction new positions.

Supply: Coinglass

Supply: Coinglass

68% of investors pass lengthy

Along with on-chain metrics, Binance’s AAVE/USDT lengthy/quick ratio these days stands at 2.10, indicating sturdy bullish marketplace sentiment amongst investors.

On-chain knowledge additional finds that 68.50% of most sensible investors on Binance dangle lengthy positions, whilst 31.50% dangle quick positions.

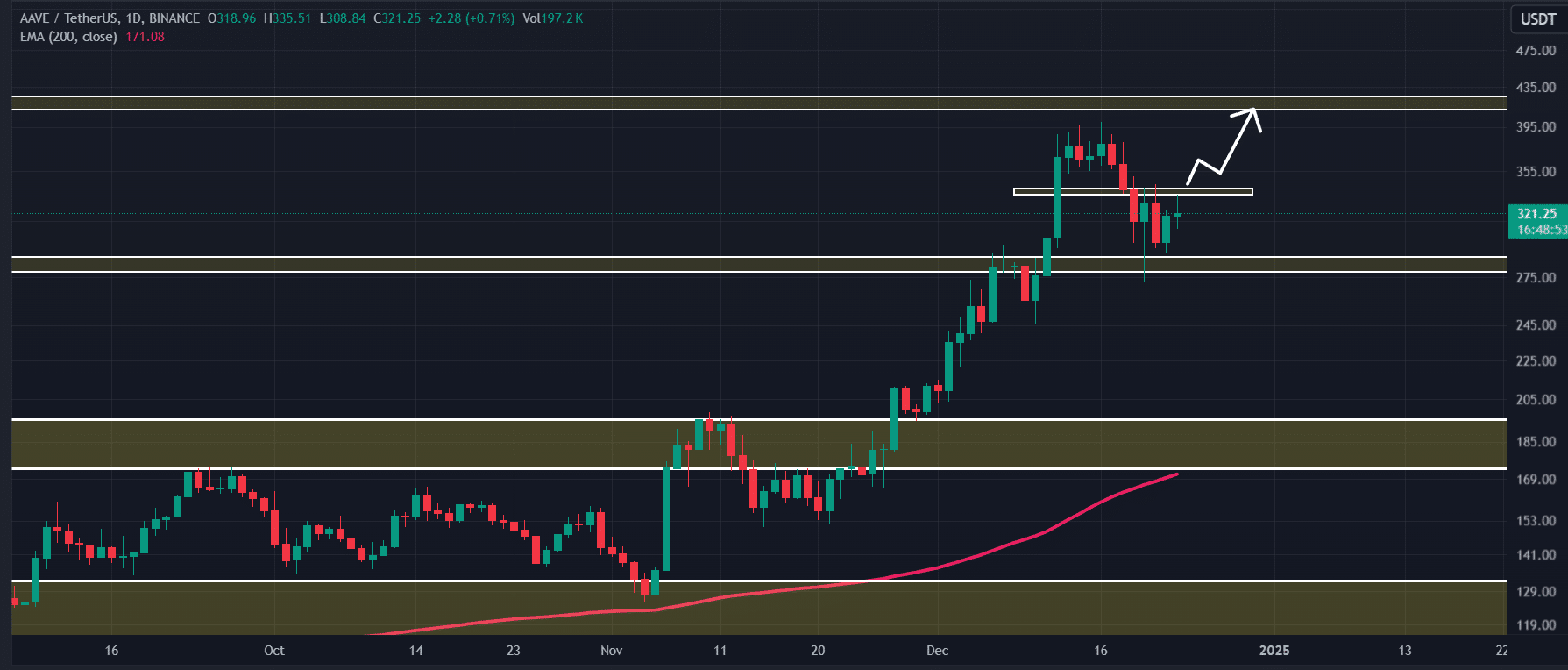

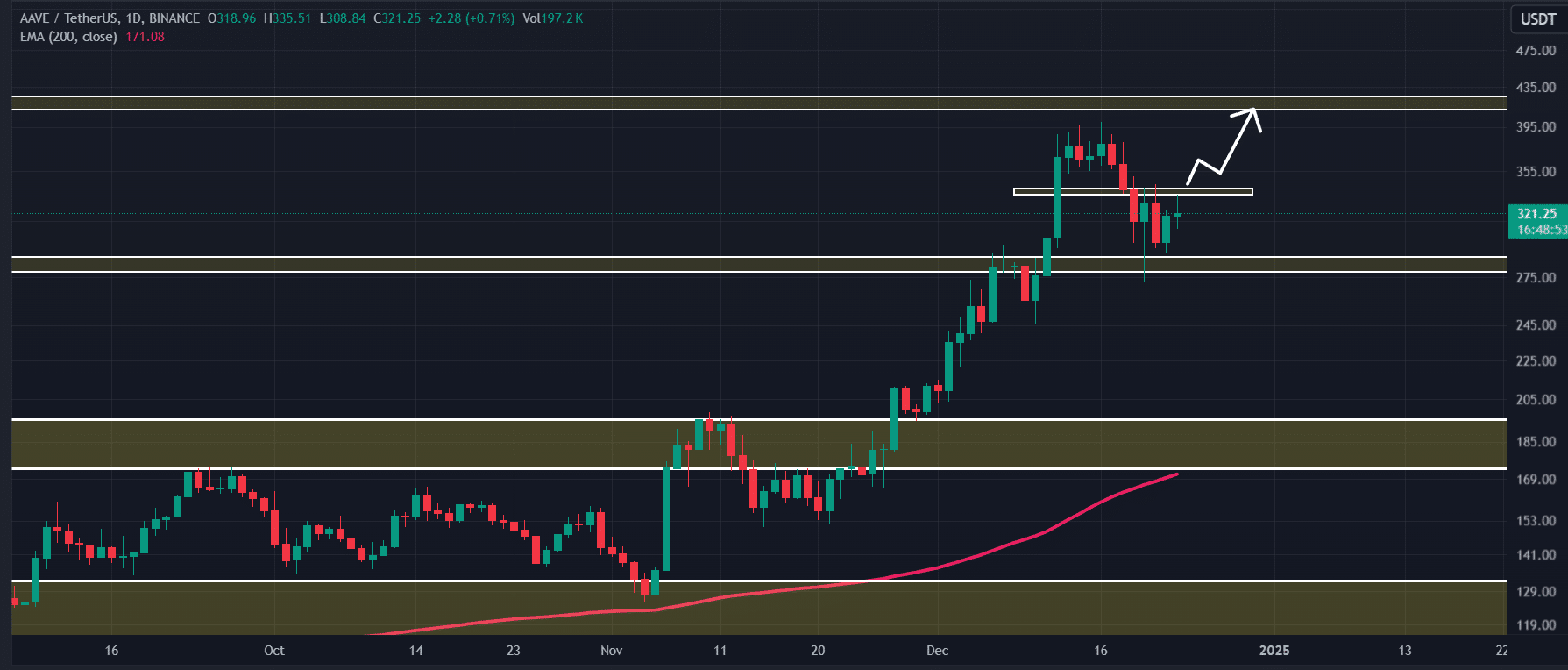

On the other hand, this surge in participation in AAVE follows a a success retest of a an important breakout degree, a transfer the altcoin had no longer completed till now after the breakout. In brief, AAVE has shaped a bullish worth motion trend.

AAVE technical research and key ranges

In keeping with AMBCrypto’s technical research, AAVE has shaped a bullish engulfing candlestick trend on the an important toughen degree of $290 however these days seems to be suffering close to the resistance degree of $337.

Supply: TradingView

Supply: TradingView

In line with fresh worth motion and ancient momentum, if the altcoin closes a day-to-day candle above $340, there’s a sturdy risk it would jump via 25% to succeed in the $415 degree within the close to long run.

Along with its bullish outlook, AAVE’s fresh worth dip is considered as a worth correction, which now displays indicators of a possible rebound.

Learn Aave’s [AAVE] Value Prediction 2024-25

At the certain facet, AAVE’s Relative Energy Index (RSI) these days stands at 57, as regards to the overbought area, indicating that the altcoin has enough room to realize additional upward momentum.

At press time, AAVE was once buying and selling close to $330 and has skilled a worth surge of over 13% previously 24 hours. All through this era, its buying and selling quantity has higher via 15%, reflecting heightened participation from investors and traders amid a bullish outlook.

Subsequent: Bitcoin worth prediction: BTC headed to $168K? Mayer More than one says it may well be