In spite of a drop in day-to-day energetic addresses, BNB’s day-to-day transactions rose

BNB gave the look to be checking out a the most important fortify degree at press time

BNB Chain [BNB] has been identified for its powerful task for a number of years now. The excellent news is that the blockchain as soon as once more proved that because it outshone all its competition on a key entrance. Will this in spite of everything lend a serving to hand to the bulls to push BNB’s value up?

BNB’s newest fulfillment

Coin98 Analytics just lately shared a tweet revealing a big building. In line with the similar, BNB was once the number 1 blockchain on the subject of distinctive addresses during the last 30 days, as its quantity exceeded 463 million.

Although the expansion share was once just one% in comparison to the former month, BNB nonetheless crowned the desk. Except BNB Chain, Polygon [MATIC] and Ethereum [ETH] additionally made it to the highest 3 at the identical listing. Whilst MATIC’s per thirty days distinctive addresses have been 452 million, ETH’s quantity stood at 277 million.

AMBCrypto then checked Artemis’ information to higher perceive BNB Chain’s community task. We discovered that the blockchain’s day-to-day transactions larger during the last month. Alternatively, it was once unexpected to notice that regardless of topping the desk, BNB’s day-to-day energetic addresses declined during the last 30 days.

Supply: Artemis

Supply: Artemis

After a pointy hike, the blockchain’s TVL additionally began to drop at the charts.

However, the whole thing on the subject of captured worth gave the impression positive. This was once the case as each its charges and earnings received upward momentum over the previous couple of days.

Bears proceed to dominate

Whilst BNB Chain hit a brand new milestone, its value motion remained below bears’ keep watch over as its worth dropped via over 8% and 5% within the ultimate seven days and 24 hours, respectively. On the time of writing, the coin was once buying and selling at $538.20 with a marketplace capitalization of over $78.5 billion.

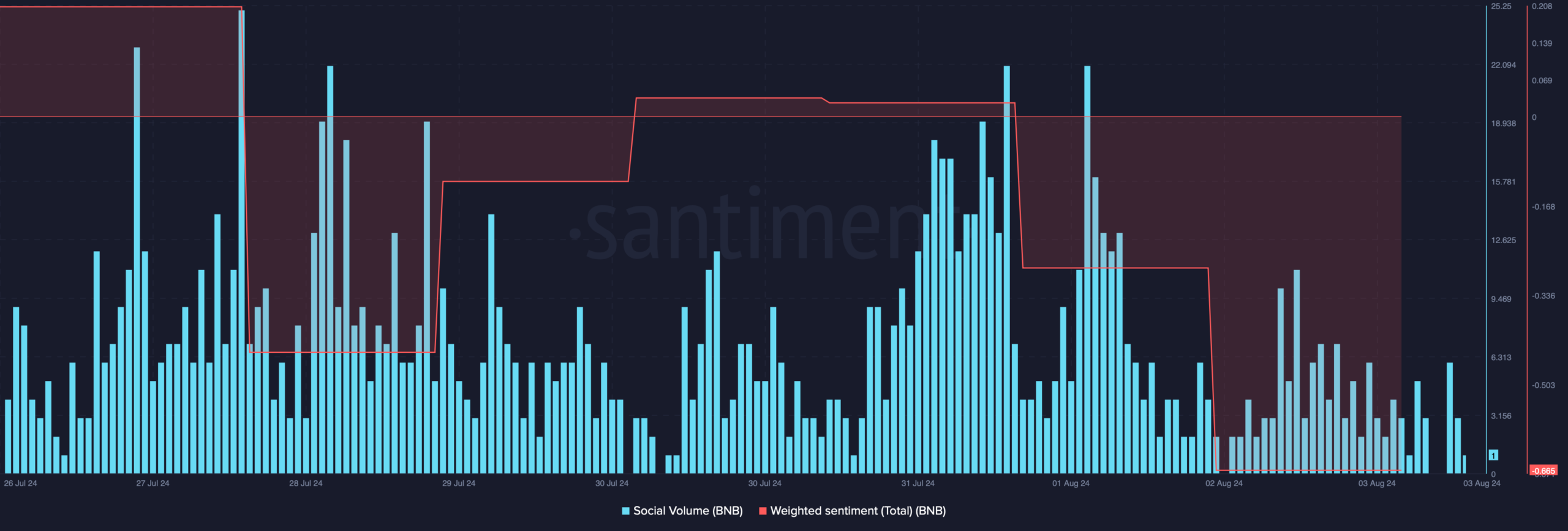

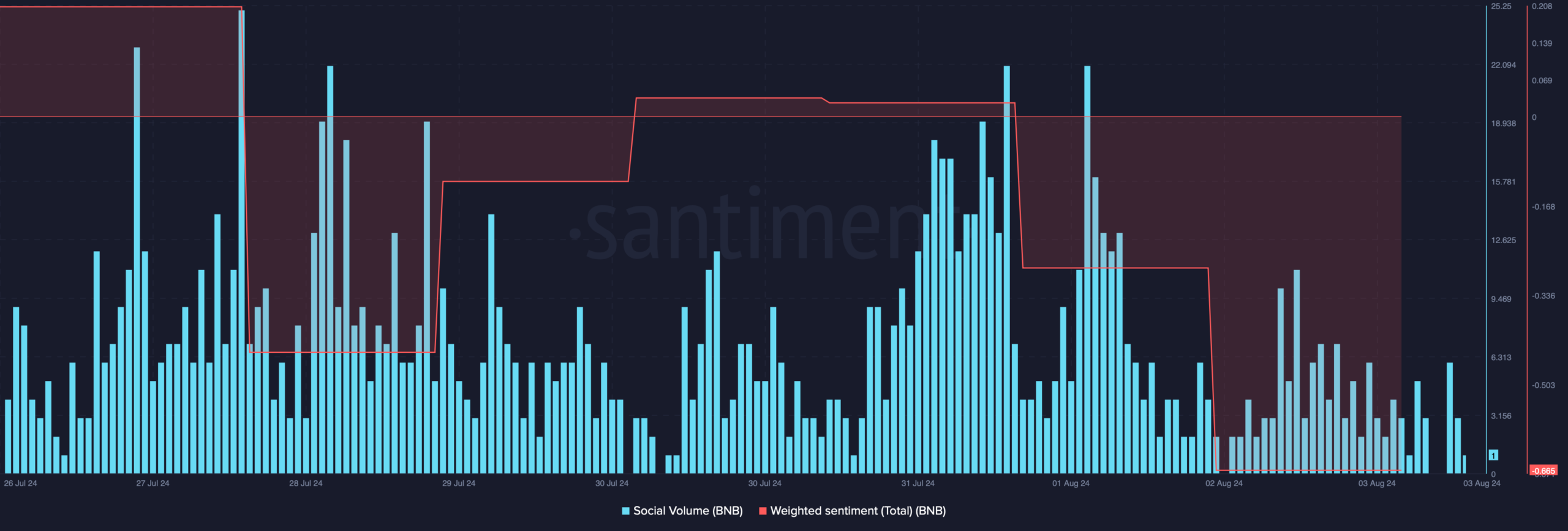

The altcoin’s bearish value motion had a destructive affect on its social metrics.

For example, its weighted sentiment dropped, which means that bearish sentiment was once dominant out there. To the contrary, its social quantity larger, reflecting BNB’s recognition within the crypto house.

Supply: Santiment

Supply: Santiment

AMBCrypto then took a take a look at Coinglass’ information which published that BNB’s lengthy/quick ratio registered a pointy downtick.

This advised that there have been extra quick positions out there than lengthy positions – A bearish sign.

Supply: Coinglass

Supply: Coinglass

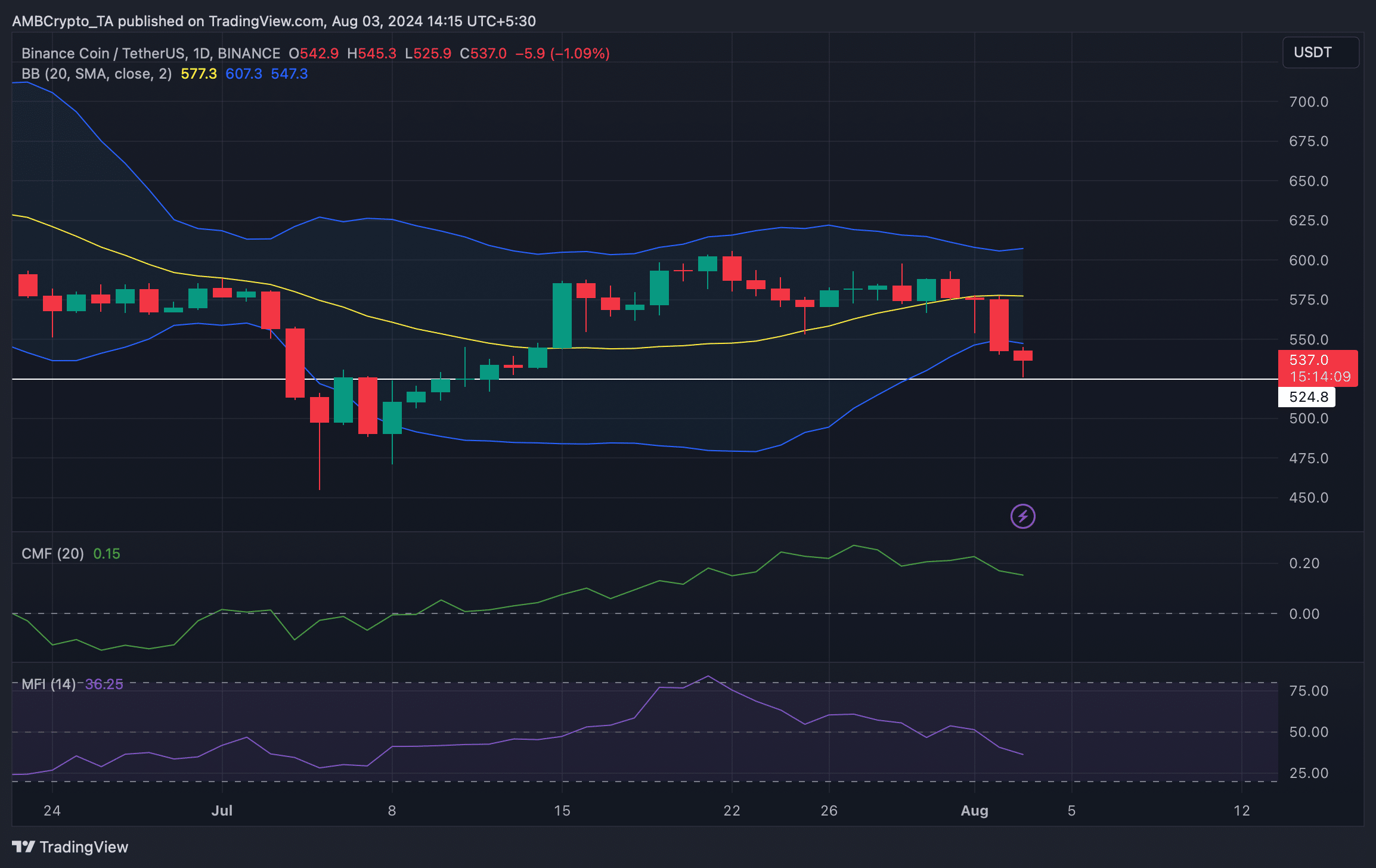

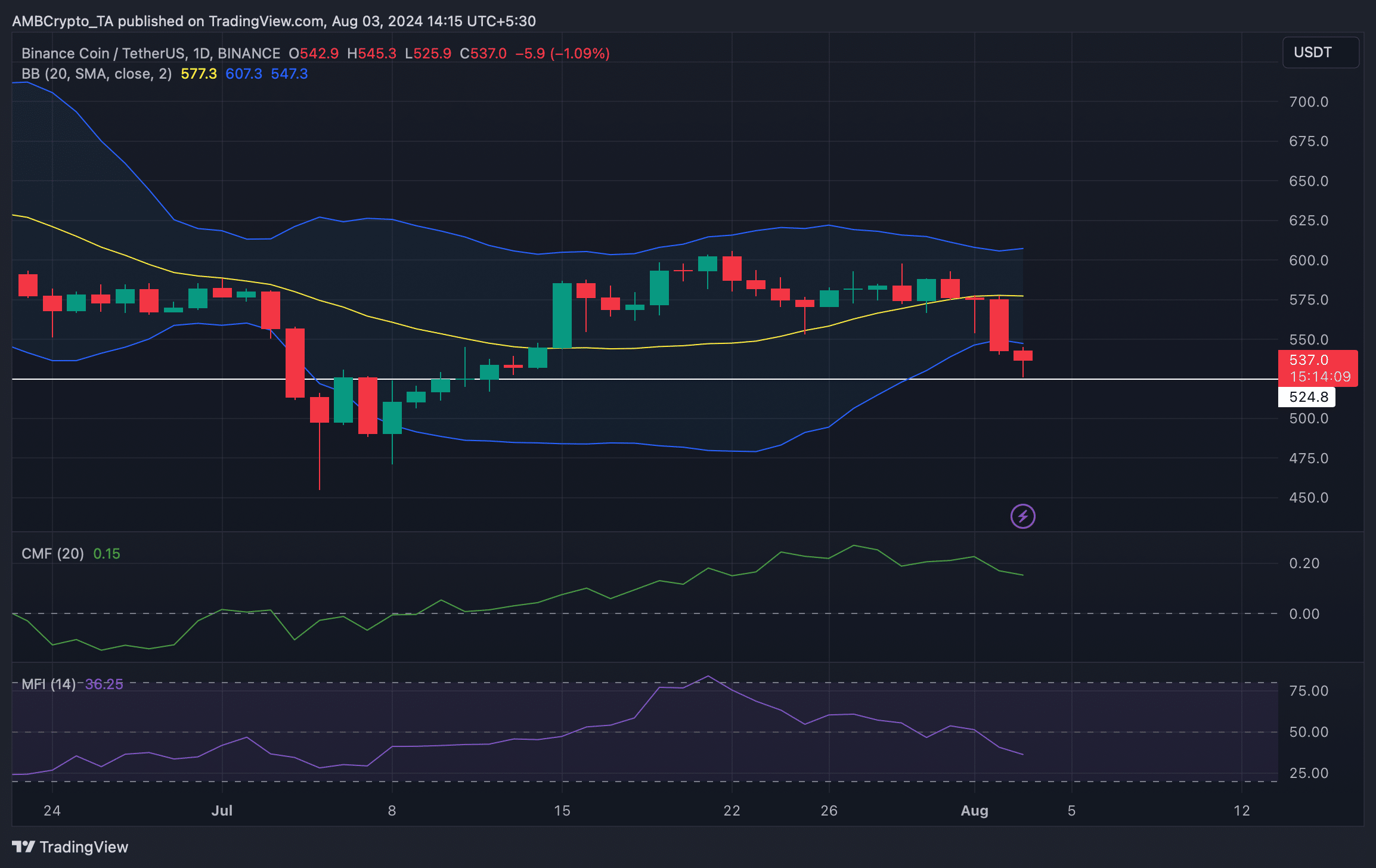

In any case, we checked the coin’s day-to-day chart to look whether or not there have been any adjustments of a pattern reversal within the non permanent. As in keeping with our research, BNB’s value went below the decrease restrict of the Bollinger bands, indicating an extra value drop.

Moreover, each its Cash Glide Index (MF) and Chaikin Cash Glide (CMF) registered downticks.

Learn Binance Coin’s [BNB] Value Prediction 2024-25

At press time, BNB was once checking out a the most important fortify degree, and a fall below it may well be disastrous. Alternatively, this may be a possibility for the marketplace’s bulls to shield their place and begin a rally.

Supply: TradingView

Supply: TradingView

Subsequent: Why Solana-based WIF whale’s $24M sell off may spur 15% value drop