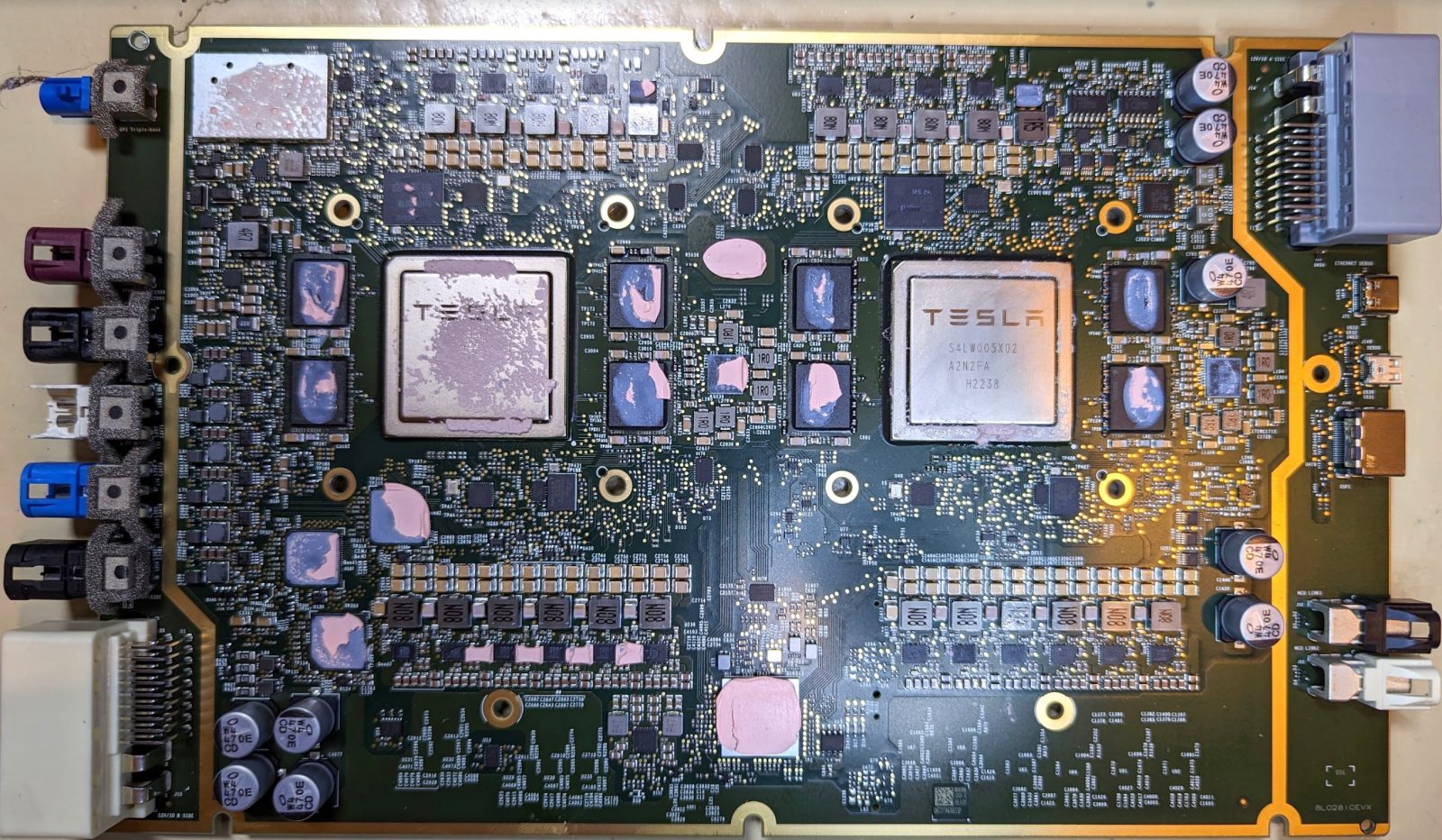

Tesla CEO Elon Musk has confronted complaint from analysts for the automakers lackluster effects. Beata Zawrzel—NurPhoto by way of Getty Photographs

Tesla’s no just right, very dangerous yr were given even worse on Friday following experiences that Elon Musk’s EV powerhouse was once reducing again manufacturing at its China plant.

Tesla trimmed the output at its plant in Shanghai (which produces for each home and global markets) beginning previous this month and has requested workers to paintings fewer days, Bloomberg reported, mentioning folks conversant in the subject.

The corporate’s inventory is already down greater than 31% for the reason that get started of the yr and fell up to 4% in intraday buying and selling at the China reporting, ahead of rebounding fairly. Stocks had been down just below 2% as of Friday afternoon. 12 months-to-date, the S&P 500 is up about 10%.

A number of setbacks over the last few months have taken a just about $250 billion chunk out of the corporate’s marketplace cap.

View the Tesla Inventory Plummets Extra Than 30% 12 months-to-date chart

Past due final yr, Warren Buffett-backed BYD toppled Tesla as the arena’s main electrical carmaker through gross sales. The Chinese language EV corporate delivered 526,409 automobiles within the fourth quarter, about 8% greater than the 484,507 delivered through Tesla.

Chinese language carmakers are increasingly more making their mark at the EV marketplace, and the automobile marketplace basically, with low value automobiles that experience left even legacy carmakers like Honda and Nissan scrambling. Musk has himself lauded China’s carmakers, announcing they’re “essentially the most aggressive automobile corporations on this planet.”

Partly to compete with Chinese language automakers, Tesla has minimize costs a number of occasions over the last yr. Partly because of Tesla’s fee cuts, Hertz CEO Stephen Scherr instructed Bloomberg in January that the corporate deliberate to dump 20,000 electrical automobiles, nearly all of that are Tesla’s.

Tesla’s fourth quarter revenue noticed its earnings fall in need of analyst expectancies and its source of revenue from operations fall 47% from a yr prior. The corporate additionally cautioned buyers that “quantity enlargement might be decrease” within the coming yr because it specializes in a “subsequent technology,” automobile that might be geared toward budget-strapped customers.

Amid the lackluster effects, some professionals have urged that it can be time for the Tesla board to power Musk out of the C-suite. Musk, even though a visionary entrepreneur, has rubbed some the flawed means at Tesla for his blunt demeanor and reportedly difficult nature towards employees.

In January, Musk demanded 25% vote casting keep an eye on of Tesla ahead of he endured with the corporate’s construction of robotics and AI. The ultimatum was once salient for the reason that Tesla’s monstrous valuation is a minimum of in part in response to hopes that Musk would ultimately transfer the corporate past vehicles to make it right into a generation juggernaut.

That promise hasn’t fairly panned out but, and nonetheless Tesla has one of the most easiest ahead price-to-earnings multiples of the Magnificent Seven shares. Force at the corporate is mounting—one best analyst final week sharply described Tesla as a “enlargement corporate without a enlargement.”

Tesla didn’t reply to a request for remark.

:max_bytes(150000):strip_icc()/GettyImages-1466481927-22c36921cd7e4c3f8767f389463f807c.jpg)