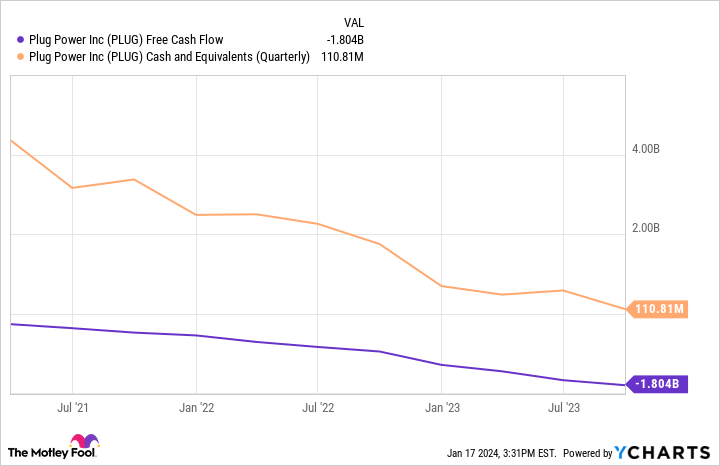

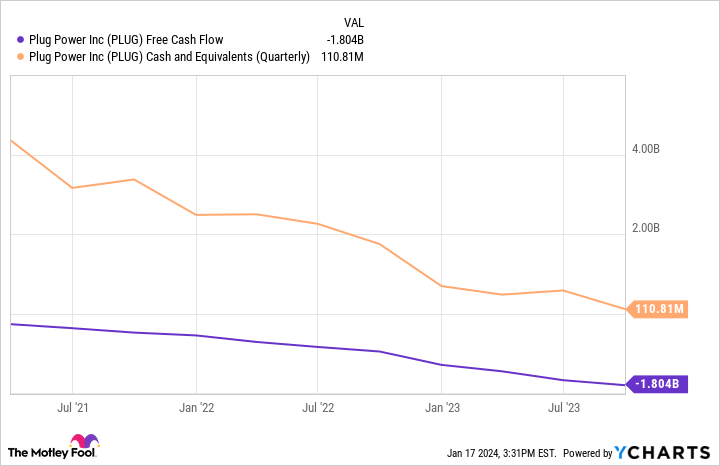

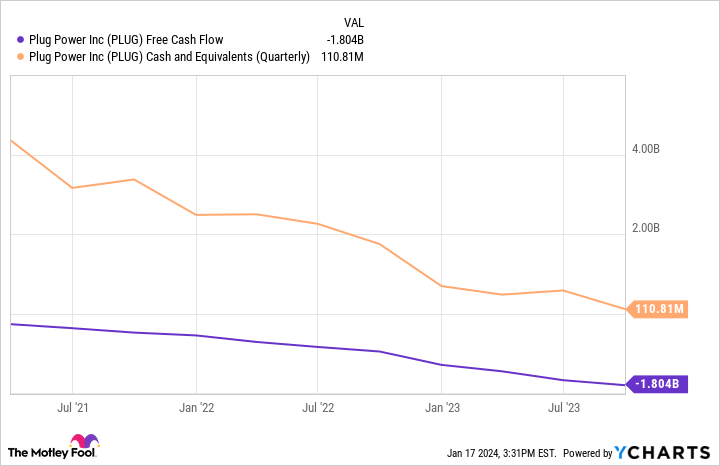

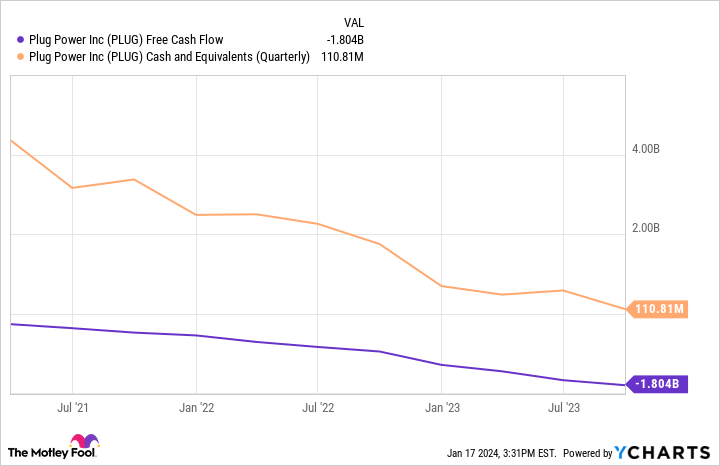

It was once any other tough day for Plug Energy (NASDAQ: PLUG) on Wednesday because the marketplace grew to become south and buyers bought off each higher-risk belongings and effort shares. Stocks fell up to 13.5% and had been down 13.2% at 3:30 p.m. ET.Plug Energy is unravelingPlug Energy is down 84% up to now 12 months, and there is not any result in sight to the drop. Now not most effective are losses piling up, money may be dwindling and there is not any expected bailout.This has turn into a downward spiral for Plug Energy that won’t prevent. You’ll be able to see within the chart beneath that money ranges are shedding because the industry’ money burn selections up. Control has up to now used the corporate’s inventory to fill the money hollow by means of promoting stocks, however because the inventory value drops that choice is probably not to be had.

PLUG Unfastened Money Drift ChartThere are billions of greenbacks in bookings and attainable orders, however the ones would possibly take years to materialize, and the monetary problem is a lot more fast for Plug Energy. The corporate has even warned it is probably not a “going fear,” which means it won’t be capable to fund the industry by itself.A freefall that won’t stopPlug Energy has long past thru tough occasions prior to, however the problem now could be that it has $200 million in debt and a industry that is consuming more money than ever. With out the power to boost extra debt or promote inventory, which will get tougher the decrease the inventory value is going, this inventory would possibly most effective head decrease. That turns out like a explanation why to desert the inventory these days, if you have not already.Must you make investments $1,000 in Plug Energy at this time?Before you purchase inventory in Plug Energy, imagine this:The Motley Idiot Inventory Marketing consultant analyst staff simply known what they imagine are the ten perfect shares for buyers to shop for now… and Plug Energy wasn’t certainly one of them. The ten shares that made the lower may produce monster returns within the coming years.Inventory Marketing consultant supplies buyers with an easy-to-follow blueprint for luck, together with steerage on construction a portfolio, common updates from analysts, and two new inventory selections every month. The Inventory Marketing consultant provider has greater than tripled the go back of S&P 500 since 2002*.Tale continuesSee the ten shares *Inventory Marketing consultant returns as of January 16, 2024 Travis Hoium has no place in any of the shares discussed. The Motley Idiot has no place in any of the shares discussed. The Motley Idiot has a disclosure coverage.Why Plug Energy Inventory Fell Every other 13.5% Nowadays was once initially revealed by means of The Motley Idiot

PLUG Unfastened Money Drift ChartThere are billions of greenbacks in bookings and attainable orders, however the ones would possibly take years to materialize, and the monetary problem is a lot more fast for Plug Energy. The corporate has even warned it is probably not a “going fear,” which means it won’t be capable to fund the industry by itself.A freefall that won’t stopPlug Energy has long past thru tough occasions prior to, however the problem now could be that it has $200 million in debt and a industry that is consuming more money than ever. With out the power to boost extra debt or promote inventory, which will get tougher the decrease the inventory value is going, this inventory would possibly most effective head decrease. That turns out like a explanation why to desert the inventory these days, if you have not already.Must you make investments $1,000 in Plug Energy at this time?Before you purchase inventory in Plug Energy, imagine this:The Motley Idiot Inventory Marketing consultant analyst staff simply known what they imagine are the ten perfect shares for buyers to shop for now… and Plug Energy wasn’t certainly one of them. The ten shares that made the lower may produce monster returns within the coming years.Inventory Marketing consultant supplies buyers with an easy-to-follow blueprint for luck, together with steerage on construction a portfolio, common updates from analysts, and two new inventory selections every month. The Inventory Marketing consultant provider has greater than tripled the go back of S&P 500 since 2002*.Tale continuesSee the ten shares *Inventory Marketing consultant returns as of January 16, 2024 Travis Hoium has no place in any of the shares discussed. The Motley Idiot has no place in any of the shares discussed. The Motley Idiot has a disclosure coverage.Why Plug Energy Inventory Fell Every other 13.5% Nowadays was once initially revealed by means of The Motley Idiot

:max_bytes(150000):strip_icc()/GettyImages-2209066207-ff8a6b8aadb943c896b0bb5c3262c9a4.jpg)