Just one% of Polygon traders have been in benefit.

Metrics urged that purchasing force used to be emerging.

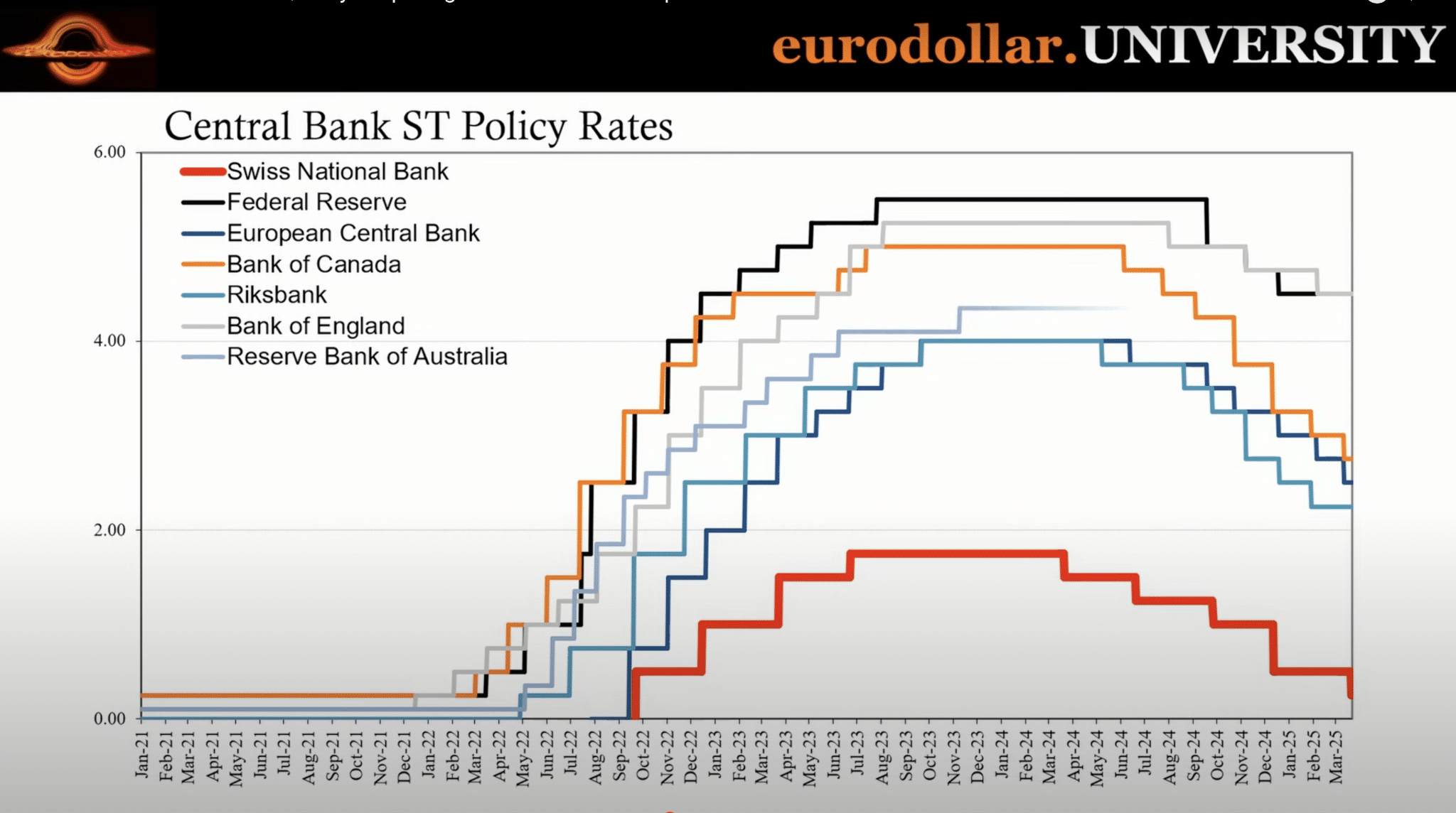

Since its transfer from MATIC to POL, Polygon has been going through troubles in relation to value. On the other hand, issues would possibly glance up quickly.

Significantly, a bullish development has seemed on POL’s chart, which might lead to large enlargement.

A bull development on Polygon’s chart

Polygon has been witnessing main value corrections in recent times. In keeping with CoinMarketCap, POL’s value dropped by way of over 3% closing week. The bearish development endured within the closing 24 hours as its worth declined by way of 1%.

On the time of writing, the token used to be buying and selling at $0.3682 with a marketplace capitalization of over $2.8 billion, making it the thirty first biggest crypto.

As a result of the ongoing value declines, the bulk traders have been driven out of benefit. To be exact, most effective 10.3k POL addresses have been in benefit, which accounted for simply over 1% of the overall traders.

![Why Polygon [POL] bulls were eyeing alt= Why Polygon [POL] bulls were eyeing alt=](https://ambcrypto.com/wp-content/uploads/2024/10/Screenshot-2024-10-13-at-4.24.19 PM.png) Supply: IntoTheBlock

Supply: IntoTheBlock

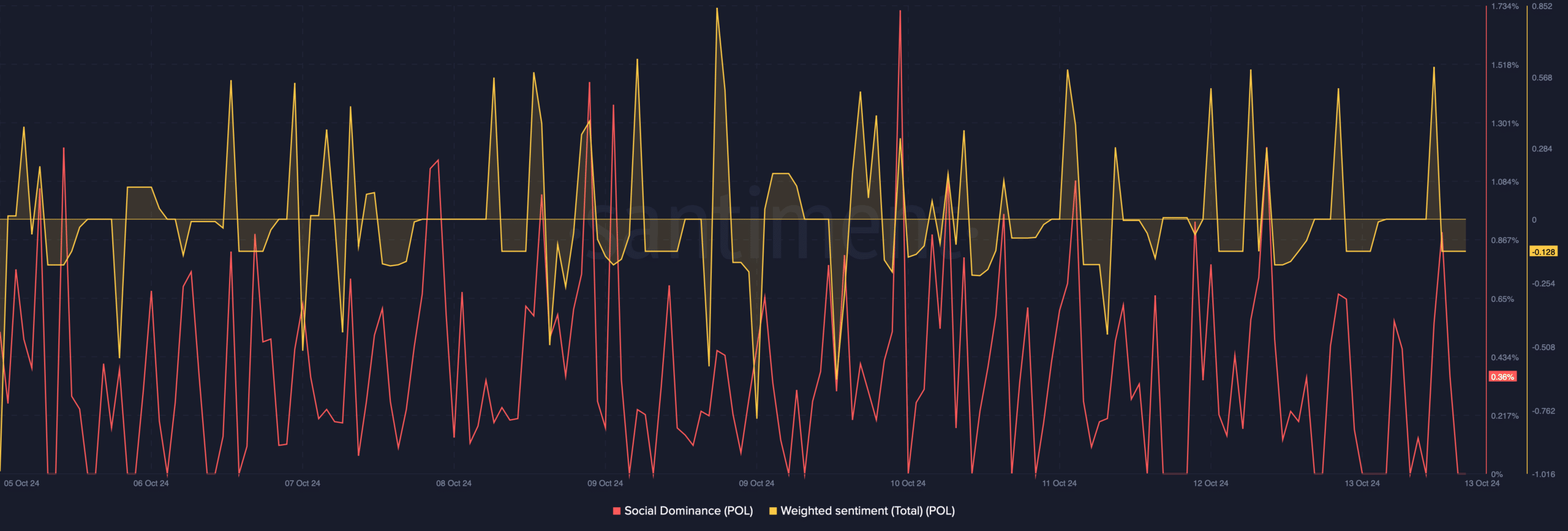

This additionally had a adverse affect at the token’s social metrics. As an example, the token’s Social Dominance fell closing week, reflecting a decline in its reputation.

The Weighted Sentiment additionally went into the adverse zone. This supposed that bearish sentiment round POL used to be dominant out there.

Supply: Santiment

Supply: Santiment

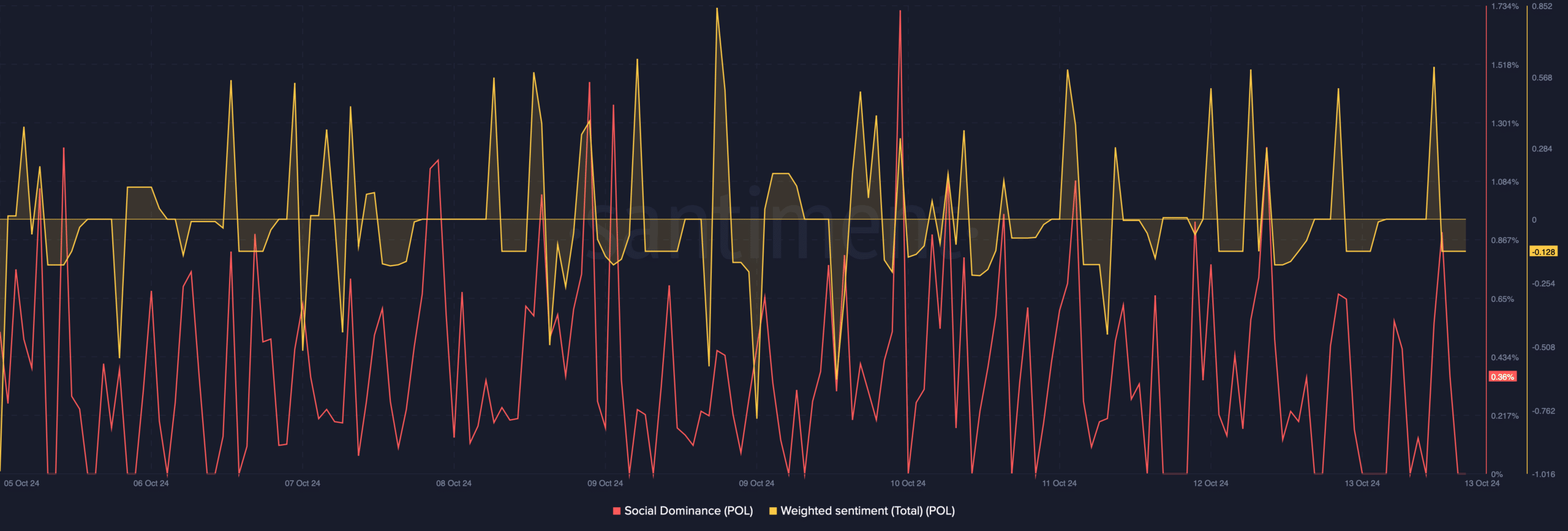

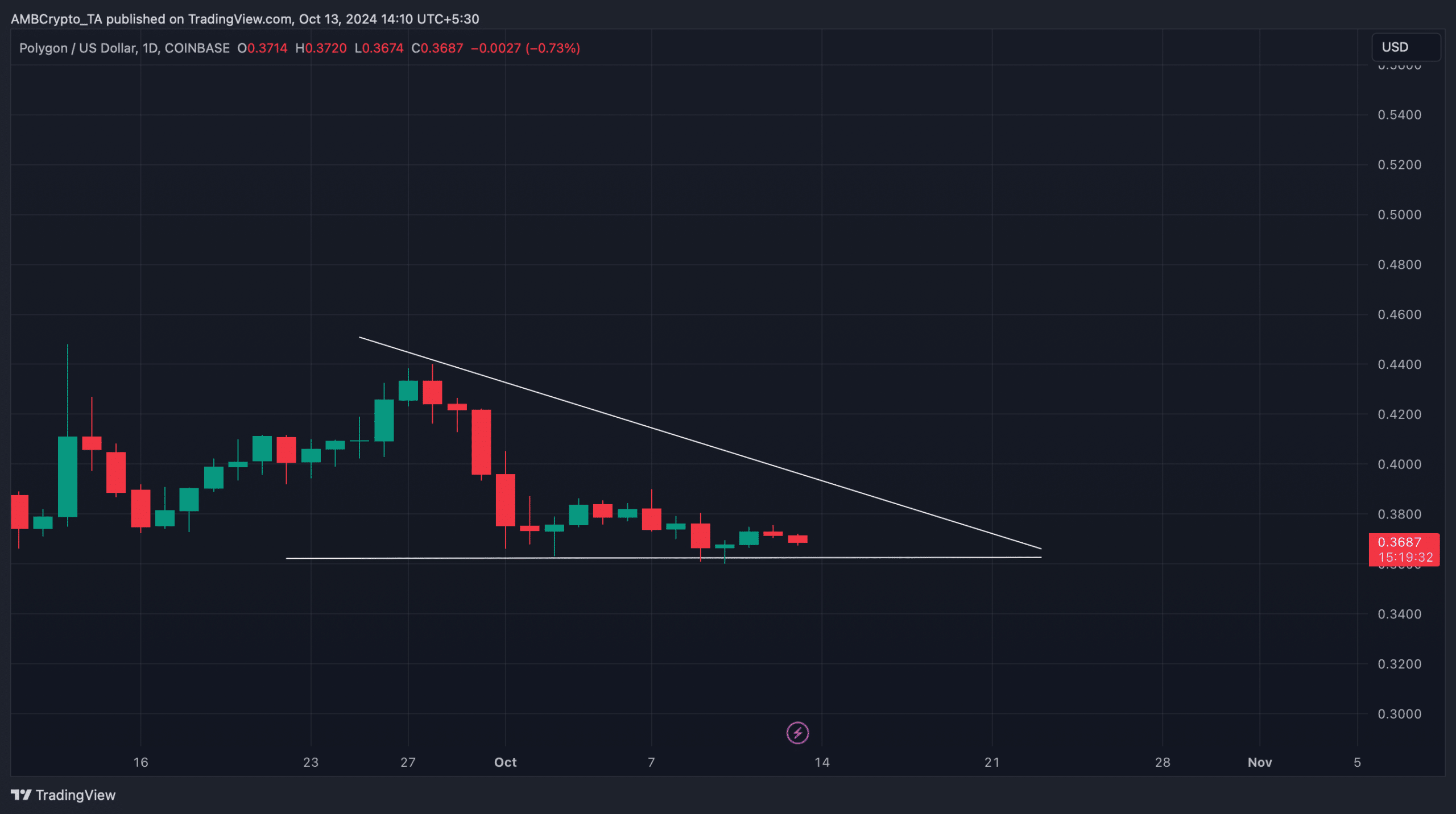

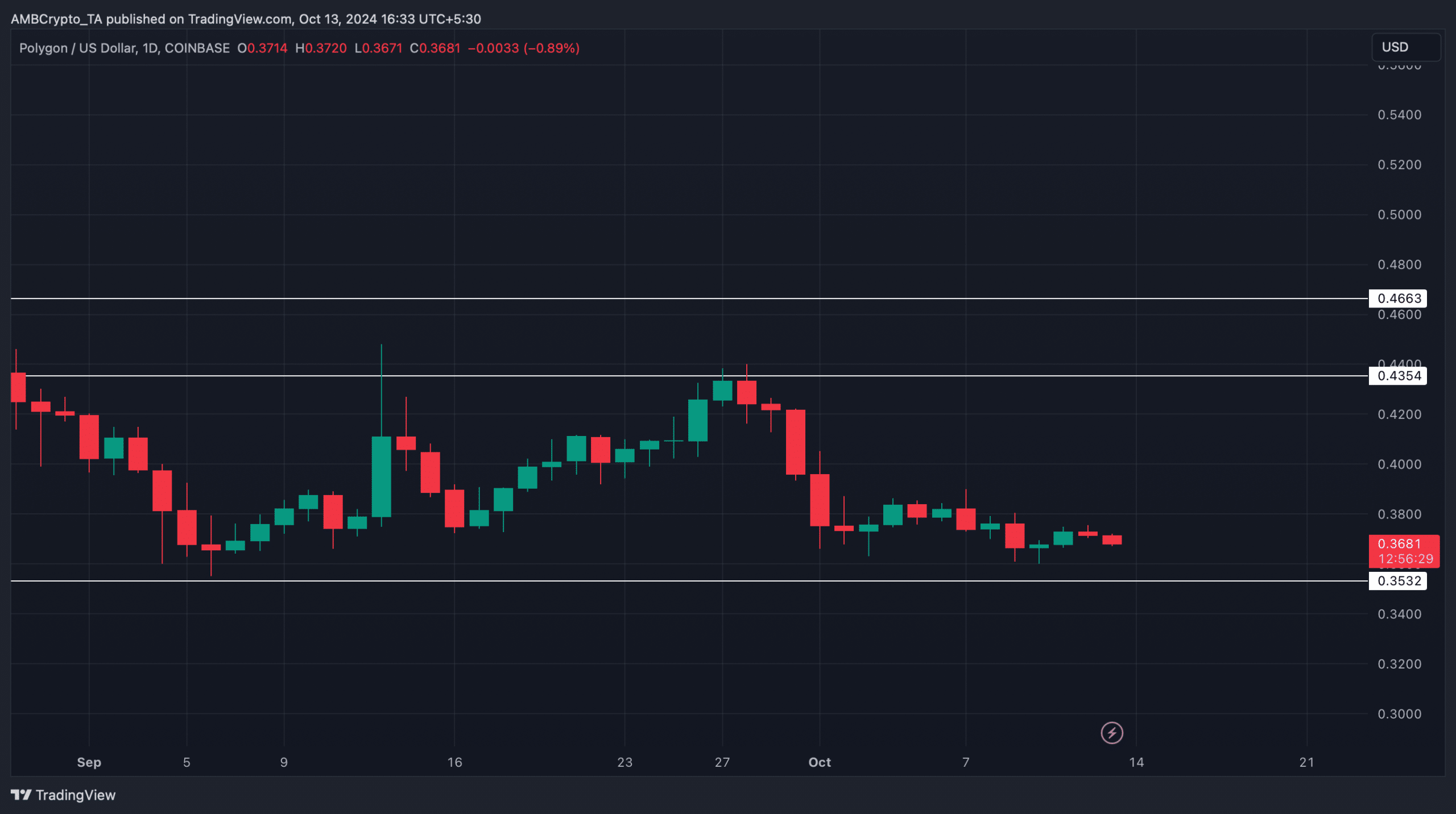

However the development would possibly exchange quickly, as a bullish development seemed at the token’s chart. AMBCrypto’s research printed {that a} bullish descending triangle development emerged on Polygon’s value chart.

It seemed in September, and because then, the token’s value has been consolidating.

On the time of writing, POL used to be trying out its strengthen. A a success take a look at may push the token up against the higher resistance of the development within the coming days.

Supply: TradingView

Supply: TradingView

What’s in retailer for POL?

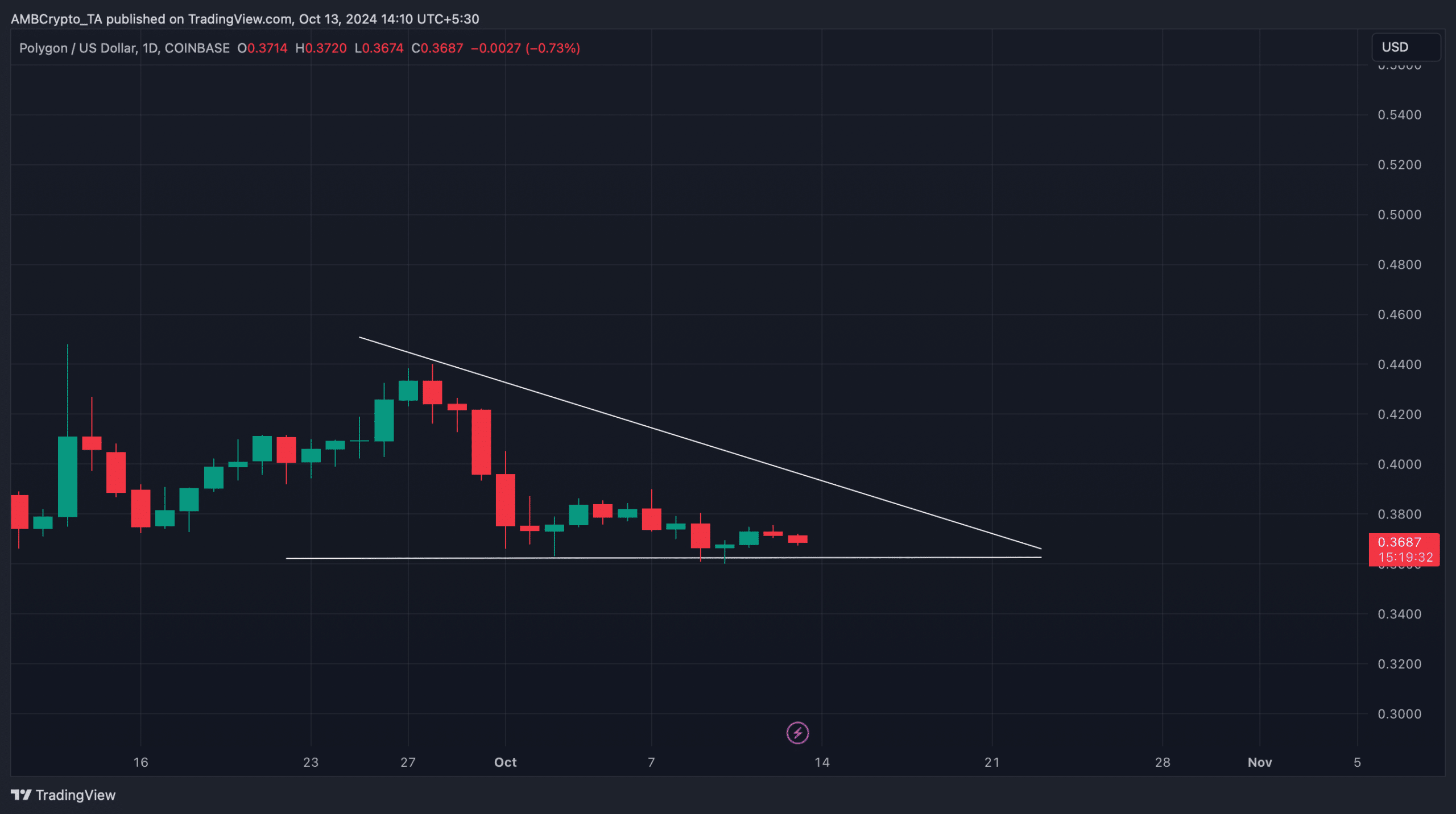

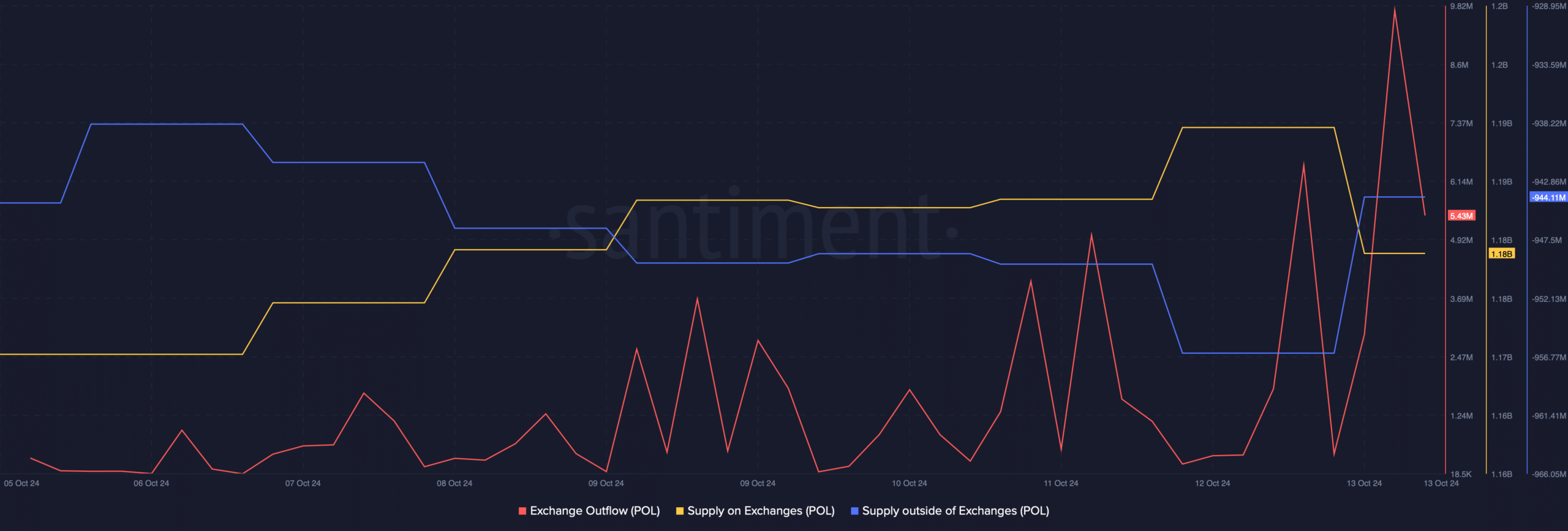

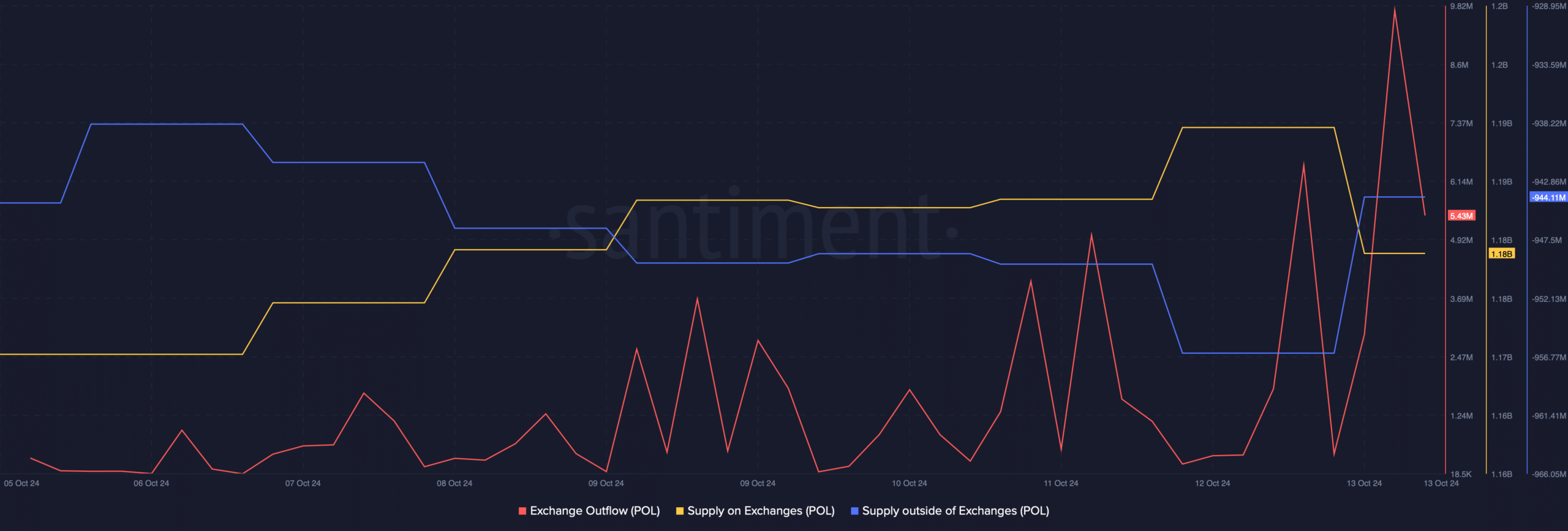

AMBCrypto then checked the token’s different datasets to determine the likeness of POL effectively trying out the strengthen. As in step with our research, POL’s change outflow higher.

Polygon’s provide on exchanges dropped, whilst its provide outdoor of exchanges higher. All 3 of those metrics indicated that purchasing force used to be prime.

On every occasion that occurs, it hints at a imaginable value upward push within the coming days.

Supply: Santiment

Supply: Santiment

Is your portfolio inexperienced? Take a look at the POL Benefit Calculator

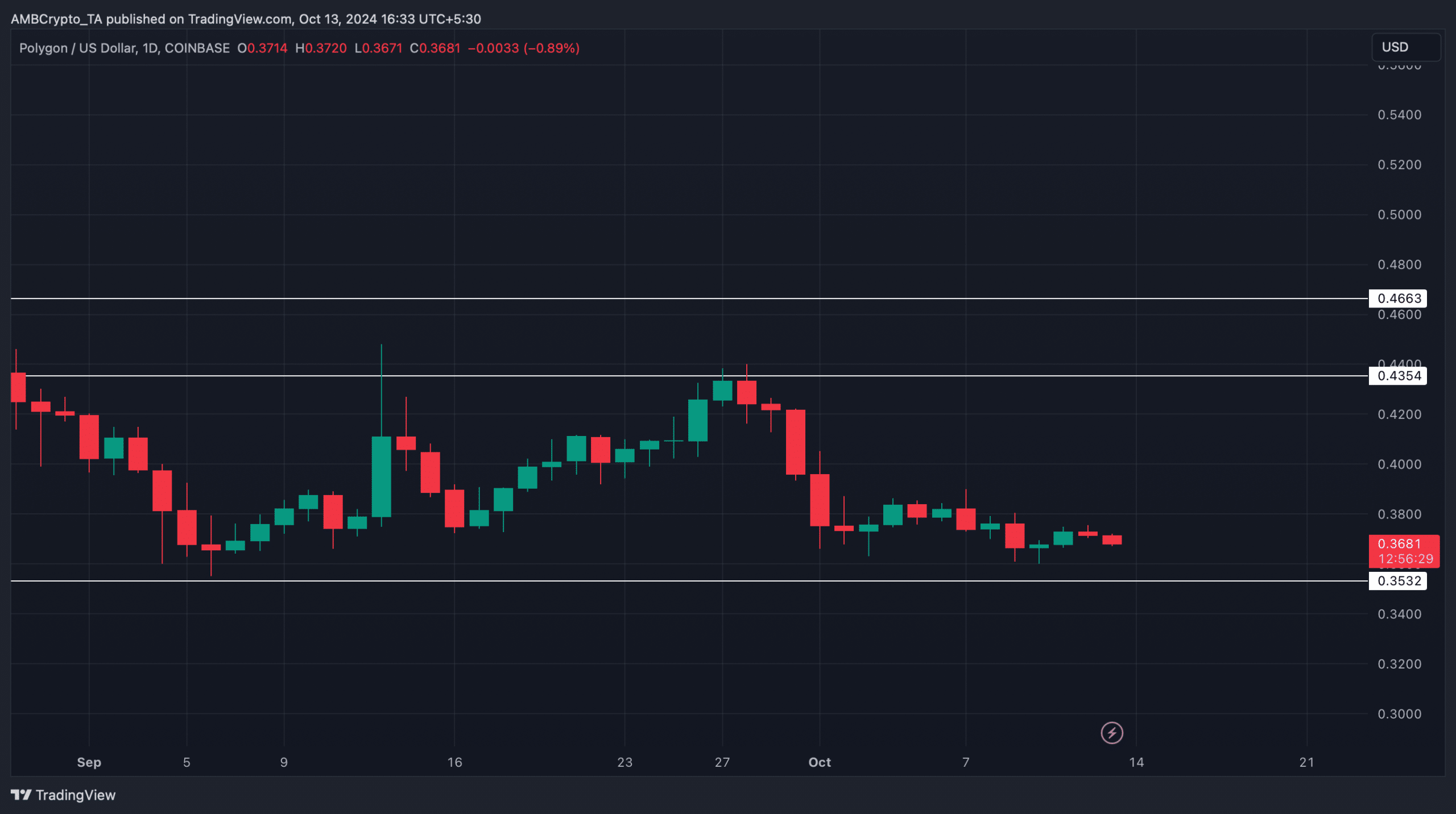

We then checked Polygon’s day-to-day chart to determine upcoming goals. If the purchasing force ends up in a worth hike, then it gained’t be unexpected to peer the token transferring against $0.43 once more.

A leap above that would push the token additional as much as $0.46. On the other hand, if the bearish development persists, Polygon would possibly drop to $0.35.

Supply: TradingView

Supply: TradingView

Subsequent: Amid plans to start out a ‘Bitcoin financial institution,’ MSTR inventory soars to ATH