It appears that the sentiment towards Intel (NASDAQ:INTC) has taken a turn for the worse. In a market where opinions can change drastically, it’s important to take a step back and look at the bigger picture. My belief is that, in due time, the market will regain its appreciation for Intel. I remain bullish on INTC stock for the long term. Unlike many of its competitors, Intel is a chipmaker that actually produces its own microchips. This aspect sets Intel apart, although it also comes with its own set of risks. The current decline in INTC stock price perfectly exemplifies how quickly investor sentiment can change. In just one year, Intel has gone from being out of favor to being a favorite and back again. It’s important not to become disheartened by the market’s volatile behavior, as irrationality creates opportunities for investors.

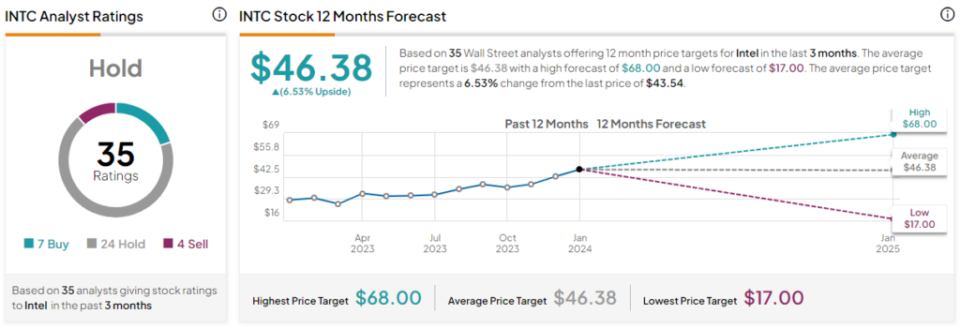

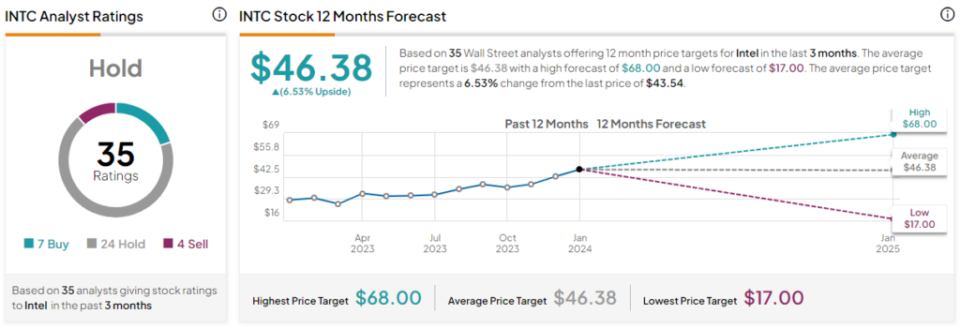

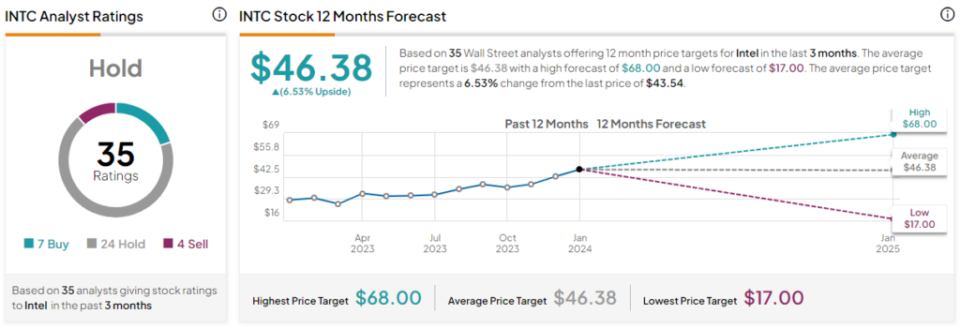

The Positive Developments Being OverlookedAbout Intel’s performance, there are many positive aspects being overshadowed by today’s 12% drop in INTC stock. The market is currently fixated on Intel’s quarterly report and forward guidance to such an extent that it’s overlooking some significant developments. Notably, Intel recently opened its factory in Rio Rancho, New Mexico. Keyvan Esfarjani, Intel’s executive vice president and chief global operations officer, highlighted this as the “opening of Intel’s first high-volume semiconductor operations and the only U.S. factory producing the world’s most advanced packaging solutions at scale.” In addition, Intel announced a collaboration with Taiwan-based United Microelectronics Corporation (NYSE:UMC) to develop a “12-nanometer semiconductor process platform targeting high-growth markets such as mobile, communication infrastructure, and networking.” The partnership with a Taiwanese foundry business like United Microelectronics Corporation raises questions about whether Intel and UMC could be positioned to capture significant market share from Taiwan Semiconductor (NYSE:TSM). Despite its potential impact, this aspect is largely being overlooked by investors at present.Story continuesThe Market’s Unreasonable DemandsThe market’s current expectations are such that it no longer tolerates anything less than a significant beat-and-raise. Even when a company does achieve this, the earnings beat and/or guidance raise might not be substantial enough to impress investors. It’s a curious trend, but once again, irrationality presents opportunities. In its results for the fourth quarter of Fiscal Year 2023, Intel met the “beat” aspect of the beat-and-raise formula. Intel CEO Pat Gelsinger had reason to be proud, stating, “We delivered strong Q4 results, surpassing expectations for the fourth consecutive quarter with revenue at the higher end of our guidance.” Here are the highlights: Intel’s quarterly revenue increased by 10% year-over-year to $15.4 billion, beating analysts’ consensus expectations by $230 million. Additionally, while Wall Street predicted Fiscal Q4-2023 earnings of $0.45 per share, Intel actually earned $0.54 per share. Given that INTC stock had doubled from around $24 to $50, one might have expected Intel’s stock price to rise following the solid quarterly results. However, Intel failed to meet the “raise” part of the expected beat-and-raise combination that investors demand nowadays. Intel provided a revenue guidance range of $12.2 billion to $13.2 billion for the current quarter, falling short of analysts’ consensus forecast of $14.2 billion. Furthermore, while Wall Street had forecast adjusted Fiscal Q1-2024 earnings of $0.32 per share, Intel’s management only guided for $0.13 per share. These factors have led several analysts, including Bernstein’s Stacy Rasgon and Stifel Nicolaus’s Ruben Roy, to adopt Hold/Neutral ratings on Intel shares. Moreover, Rasgon’s $42 price target and Roy’s $45 price target are less than optimistic. Essentially, for Intel stock to reach those price targets in the next 12 months, it would have to make almost no progress. Nevertheless, Intel’s performance suggests that the company is capable of exceeding Wall Street’s financial estimates. With current-quarter expectations being quite low, it wouldn’t be surprising to see another earnings beat in the offing — albeit without any guarantees of a beat-and-raise, a demand that seems prevalent at present.Recommendations by AnalystsOn TipRanks, INTC is rated as a Hold, based on seven Buy ratings, 24 Holds, and four Sell ratings from analysts in the past three months. The average price target for Intel stock is $46.38, indicating a potential upside of 6.5%.

The Positive Developments Being OverlookedAbout Intel’s performance, there are many positive aspects being overshadowed by today’s 12% drop in INTC stock. The market is currently fixated on Intel’s quarterly report and forward guidance to such an extent that it’s overlooking some significant developments. Notably, Intel recently opened its factory in Rio Rancho, New Mexico. Keyvan Esfarjani, Intel’s executive vice president and chief global operations officer, highlighted this as the “opening of Intel’s first high-volume semiconductor operations and the only U.S. factory producing the world’s most advanced packaging solutions at scale.” In addition, Intel announced a collaboration with Taiwan-based United Microelectronics Corporation (NYSE:UMC) to develop a “12-nanometer semiconductor process platform targeting high-growth markets such as mobile, communication infrastructure, and networking.” The partnership with a Taiwanese foundry business like United Microelectronics Corporation raises questions about whether Intel and UMC could be positioned to capture significant market share from Taiwan Semiconductor (NYSE:TSM). Despite its potential impact, this aspect is largely being overlooked by investors at present.Story continuesThe Market’s Unreasonable DemandsThe market’s current expectations are such that it no longer tolerates anything less than a significant beat-and-raise. Even when a company does achieve this, the earnings beat and/or guidance raise might not be substantial enough to impress investors. It’s a curious trend, but once again, irrationality presents opportunities. In its results for the fourth quarter of Fiscal Year 2023, Intel met the “beat” aspect of the beat-and-raise formula. Intel CEO Pat Gelsinger had reason to be proud, stating, “We delivered strong Q4 results, surpassing expectations for the fourth consecutive quarter with revenue at the higher end of our guidance.” Here are the highlights: Intel’s quarterly revenue increased by 10% year-over-year to $15.4 billion, beating analysts’ consensus expectations by $230 million. Additionally, while Wall Street predicted Fiscal Q4-2023 earnings of $0.45 per share, Intel actually earned $0.54 per share. Given that INTC stock had doubled from around $24 to $50, one might have expected Intel’s stock price to rise following the solid quarterly results. However, Intel failed to meet the “raise” part of the expected beat-and-raise combination that investors demand nowadays. Intel provided a revenue guidance range of $12.2 billion to $13.2 billion for the current quarter, falling short of analysts’ consensus forecast of $14.2 billion. Furthermore, while Wall Street had forecast adjusted Fiscal Q1-2024 earnings of $0.32 per share, Intel’s management only guided for $0.13 per share. These factors have led several analysts, including Bernstein’s Stacy Rasgon and Stifel Nicolaus’s Ruben Roy, to adopt Hold/Neutral ratings on Intel shares. Moreover, Rasgon’s $42 price target and Roy’s $45 price target are less than optimistic. Essentially, for Intel stock to reach those price targets in the next 12 months, it would have to make almost no progress. Nevertheless, Intel’s performance suggests that the company is capable of exceeding Wall Street’s financial estimates. With current-quarter expectations being quite low, it wouldn’t be surprising to see another earnings beat in the offing — albeit without any guarantees of a beat-and-raise, a demand that seems prevalent at present.Recommendations by AnalystsOn TipRanks, INTC is rated as a Hold, based on seven Buy ratings, 24 Holds, and four Sell ratings from analysts in the past three months. The average price target for Intel stock is $46.38, indicating a potential upside of 6.5%.

In Conclusion – Is Intel Stock Worth Considering?Intel has set modest goals for the current quarter. Investor response has been negative, but this creates opportunities. This may set the stage for another earnings beat and more optimistic guidance in the coming months. In a market where sentiment toward Intel is overwhelmingly pessimistic, it’s challenging to imagine a positive outcome. However, remember that just a few days ago, investors were favoring Intel. I believe they will regain their appreciation for Intel, so it may be wise to consider INTC stock while it is trading at a reduced price.Disclosure

In Conclusion – Is Intel Stock Worth Considering?Intel has set modest goals for the current quarter. Investor response has been negative, but this creates opportunities. This may set the stage for another earnings beat and more optimistic guidance in the coming months. In a market where sentiment toward Intel is overwhelmingly pessimistic, it’s challenging to imagine a positive outcome. However, remember that just a few days ago, investors were favoring Intel. I believe they will regain their appreciation for Intel, so it may be wise to consider INTC stock while it is trading at a reduced price.Disclosure

/Palantir%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock.jpg)