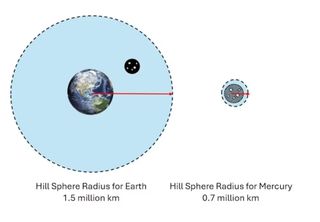

The Iranian flag above the brand new Segment 3 facility on the Persian Gulf Superstar fuel condensate refinery in Bandar Abbas, Iran, in 2019.Ali Mohammadi | Bloomberg | Getty ImagesIn truth, U.S. oil futures closed Friday at $83.14 a barrel which used to be the bottom agreement value since overdue March, days ahead of the present spiral of escalation started with Israel’s strike on an Iranian diplomatic compound in Damascus, Syria on April 1.Futures fell for 3 days following Iran’s missile and drone barrage in opposition to Israel ultimate weekend, and costs settled most effective reasonably upper after Israel struck again on Friday.Buyers appear to consider that Israel’s restricted retaliatory strike, which doesn’t seem to have brought about any important injury or casualties, supplied Iran with an off ramp to chorus from counterattacking.The marketplace has necessarily erased the chance top rate related to the Iran-Israel tensions after investors bid up costs ultimate week on struggle fears.”Investors don’t seem to be purchasing that both Israel or Iran is in fact taken with escalating the tensions and are simply engaged in in large part symbolic, face-saving workouts,” stated Manish Raj, managing director at Velandara Power Companions. “Those skirmishes didn’t provoke the oil markets, which consider that no disruption to grease flows will happen.”Oil markets have been maximum anxious about Israel putting one in every of Iran’s nuclear amenities, which might have required Tehran to hit again, in accordance John Kilduff, founding spouse at Once more Capital. World power on Israel to show restraint seems to have paid off. The World Atomic Power Company showed Friday there used to be no injury to Iran’s nuclear websites.”We’re due to this fact able to cautiously conclude that the cycle of escalation between Israel and Iran is over, no less than so far as direct assaults in opposition to every different are concerned,” Marko Papic, leader strategist on the Clocktower Staff, instructed shoppers in a Friday word. Papic stated a sustained struggle between Israel and Iran is tricky to believe and will even be nearly unimaginable.See Chart…WTI and Brent costs during the last month”The 2 international locations are separated by way of substantial distances given the ability projection functions in their militaries,” Papic instructed shoppers. “As such, Israel’s restricted reaction to Iran is probably not simply a diplomatic selection because of U.S. power. As an alternative, it can be a serve as of subject matter constraints as smartly.” Kilduff instructed CNBC’s “Squawk Field” on Friday that the bar may be very prime within the Heart East for all-out struggle to wreck out, choking off oil provides. “Over time – in point of fact the many years now – those assaults come, they’re handled, they’re treated diplomatically and we do not lose any barrels of oil,” Kilduff stated.However the oil marketplace and the arena at massive will have merely had excellent good fortune this week. Israel and its U.S.-led allies controlled to shoot down just about all the greater than 300 missiles and drones introduced by way of Iran, which most likely decreased power at the Netanyahu executive to strike again with dramatic power.However Iran meant for the missiles and drones to do important injury, stated Tom Donilon, who served as former President Barack Obama’s nationwide safety advisory. The Islamic Republic merely didn’t look forward to that the coalition’s air defenses would end up so efficient at shielding Israel, Donilon stated.”There is not any make sure that you get a 99% good fortune charge on this type of issues each time that it occurs,” Donilon cautioned on the Columbia World Power Summit in New York Town on Tuesday. Even though the location hasn’t escalated within the quick time period, the Iranian assault has modified the area, he stated.”Lengthy-term this can be a structural building up within the chance profile within the area,” Donilon stated.Focal point stays at the the Strait of Hormuz, the slender frame of water by which 19 million barrels of oil cross day-to-day from the Persian Gulf to the worldwide marketplace. The cost of international benchmark Brent crude oil may surge to $130 a barrel if there is a main disruption within the strait, in step with Rapidan Power Staff.”When you are speaking about Iran, everyone’s specializing in the Strait of Hormuz, rightly so, although it is exhausting to peer Iran affecting that as a result of they depend on it such a lot” themselves to export oil, Kilduff stated.Blocking off the strait is off the desk for the Iranians, Kilduff stated, but when they began seizing vessels the oil marketplace would take realize.”The oil marketplace would center of attention like a laser beam on that as a result of to the level tankers then begin to steer clear of the area, forestall transporting oil to steer clear of any roughly direct war or interplay with the Iranian naval forces, then sure, we are again within the soup,” Kilduff stated.

Why the oil marketplace shrugged as Iran and Israel seemed on the point of struggle this week