Wormhole displays promise with its top building task.

The cost motion chart printed a momentary downtrend.

A Santiment put up on X (previously Twitter) printed that Wormhole [W] had the very best building task among Solana [SOL] ecosystem tasks previously month.

It conveniently surpassed the advance task of Solana and Jupiter [JUP].

Solana has skilled its proportion of ache previously few days. The transaction failure price reached 75% at the sixth and seventh of April, bringing the community to its knees.

The surge in on-chain site visitors over the last month, in part fueled via the call for for meme cash, additionally noticed a drop within the day-to-day lively consumer rely.

Wormhole’s top building task was once an encouraging building. It additionally noticed a upward push in call for within the spot markets.

Evaluating Wormhole in opposition to Solana and Jupiter

Supply: Santiment on X

Supply: Santiment on X

The 30-day building task of Wormhole stood at 189. In the meantime, Solana was once at 108.2 and Jupiter at 83.07.

In a Medium put up, Santiment defined why monitoring occasions offers a greater working out of building task than simply GitHub commits.

The time period match encompasses the collection of code pushes, pull request interactions, GitHub wiki edits, and extra. The upshot is that larger task usually equals larger trust within the eventual luck of the undertaking.

This is a metric that is going an extended strategy to guarantee traders that the undertaking will likely be pushing out extra options and decreases the likelihood that the undertaking is a rip-off.

Technical research highlights two key ranges, however there’s a catch

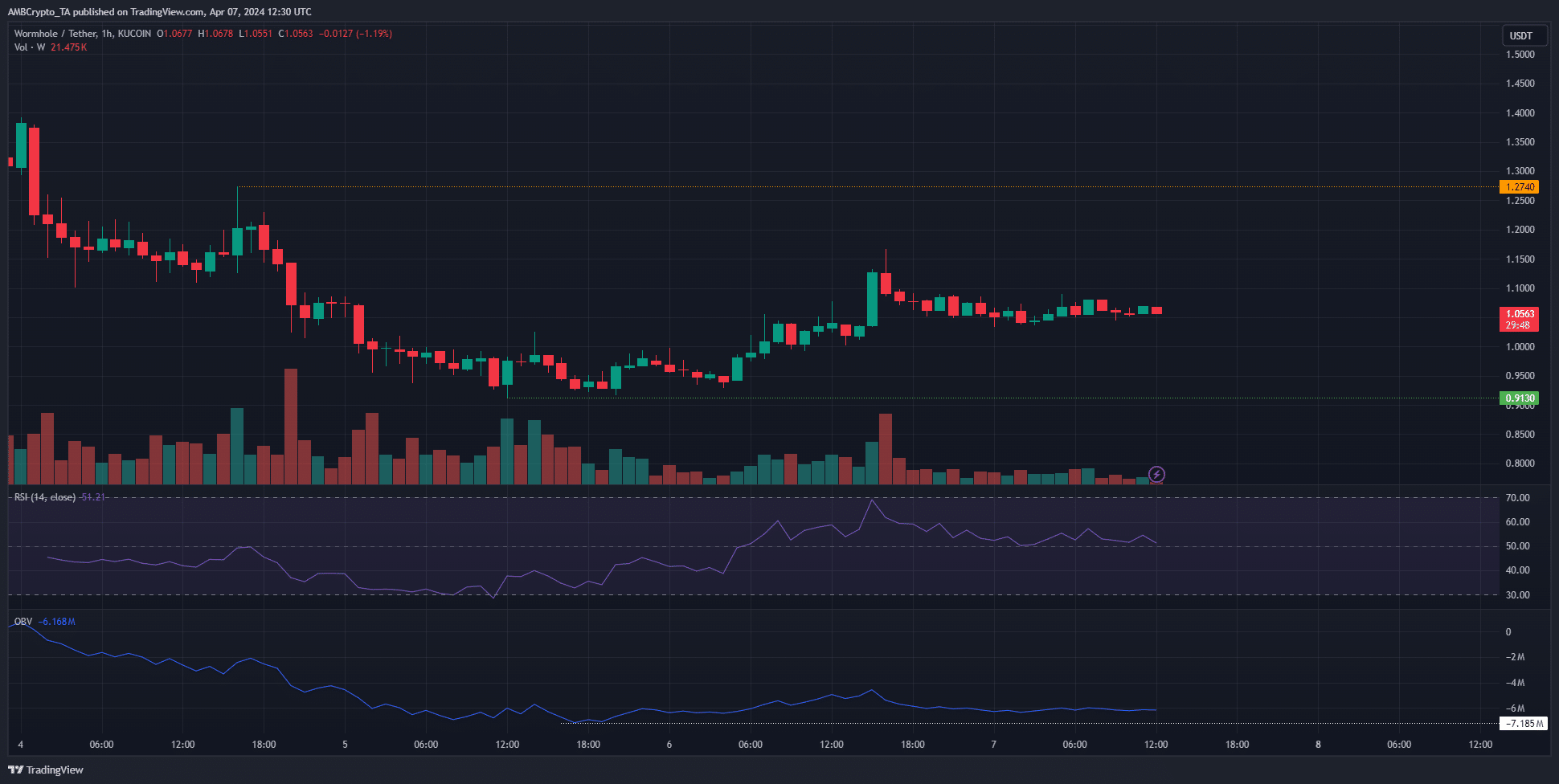

Supply: W/USDT on TradingView

Supply: W/USDT on TradingView

The 1-hour chart of W printed a bearish marketplace construction. The $0.913 swing low, if breached, would sign a bearish continuation and extra losses for the token.

The cost noticed a jump from $0.913 to $1.05 previously two days. Along, the OBV additionally climbed moderately upper. But, the buying and selling quantity has trended downward for the reason that fifth of March.

The H1 chart’s RSI was once at 51, appearing neither bulls nor bears had the higher hand within the quick time period.

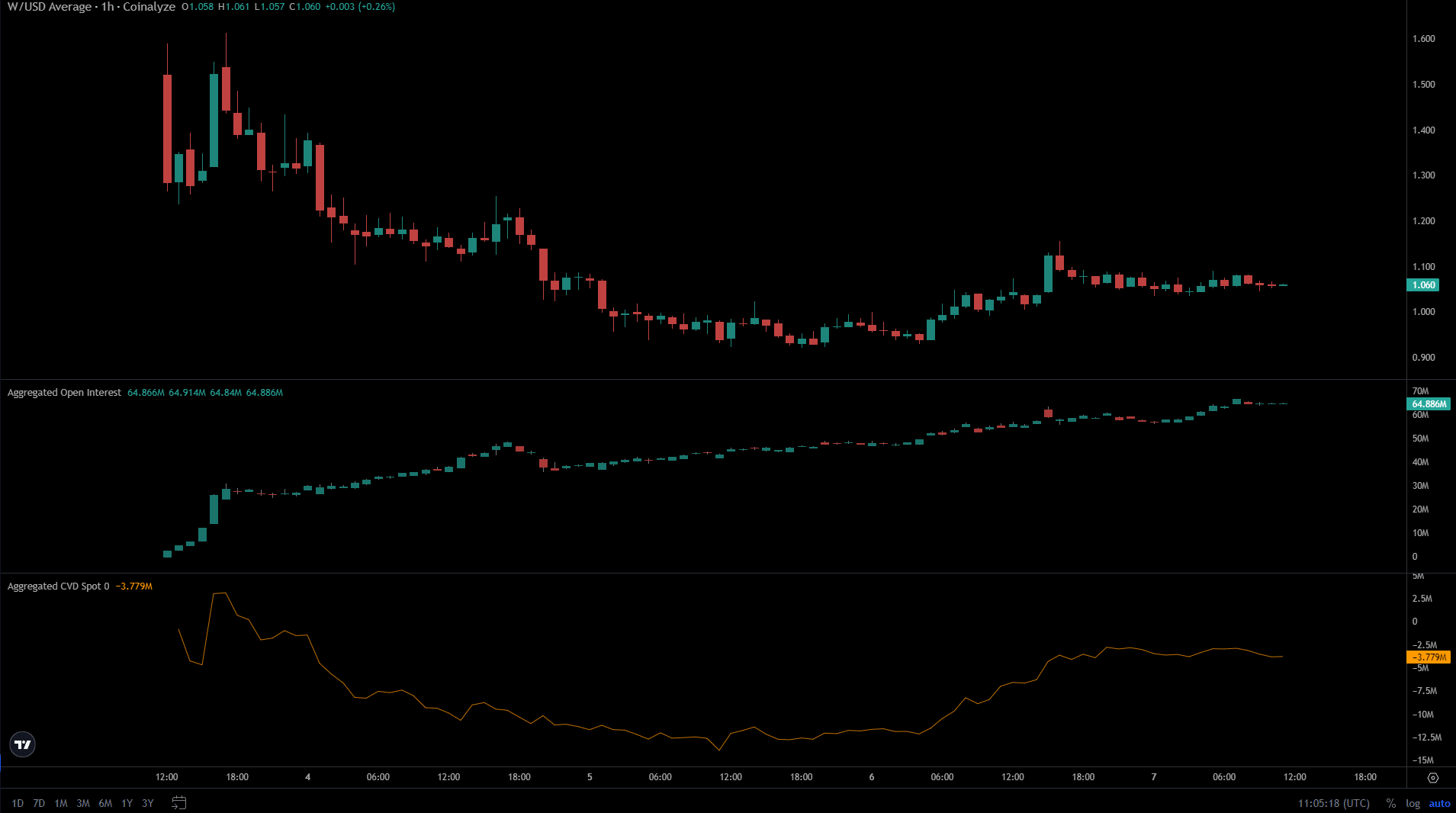

Supply: Coinalyze

Supply: Coinalyze

Conversely, the spot CVD of W noticed a sizeable uptick previously 24 hours. This pointed towards rising call for within the spot markets.

The Open Hobby was once additionally trending upward, at the same time as costs struggled to arrest their decline.

Is your portfolio inexperienced? Take a look at the W Benefit Calculator

The catch here’s that the cost motion could be very younger. With only some days’ value of buying and selling information to be had, it’s arduous to map out the place W may transfer subsequent.

As issues stand, the $1.27 stage, if damaged, may see a rally ensue for Wormhole.