AAVE may rally to the following resistance at $165 as purchasing power grows.

Declining change reserves and emerging DeFi task might be the catalysts in the back of the following rally.

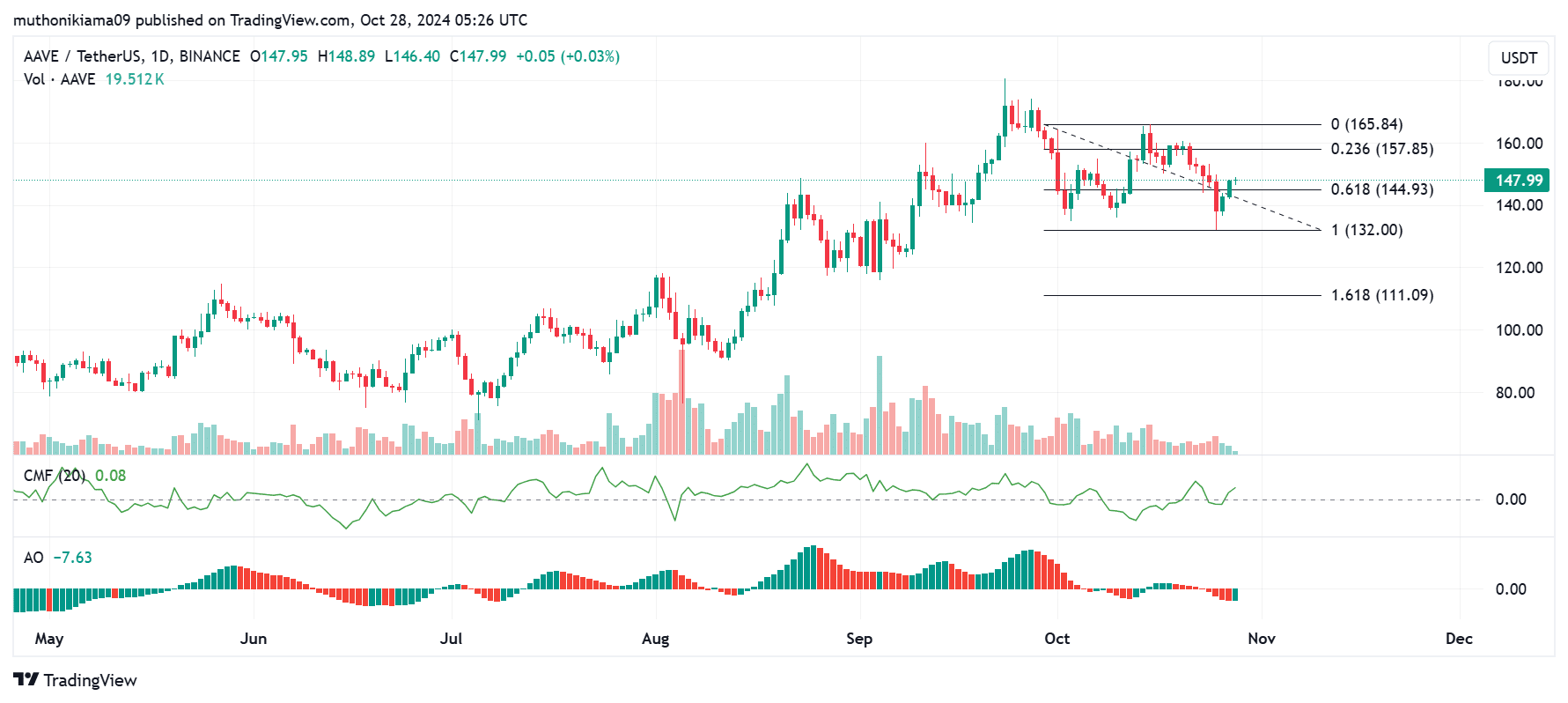

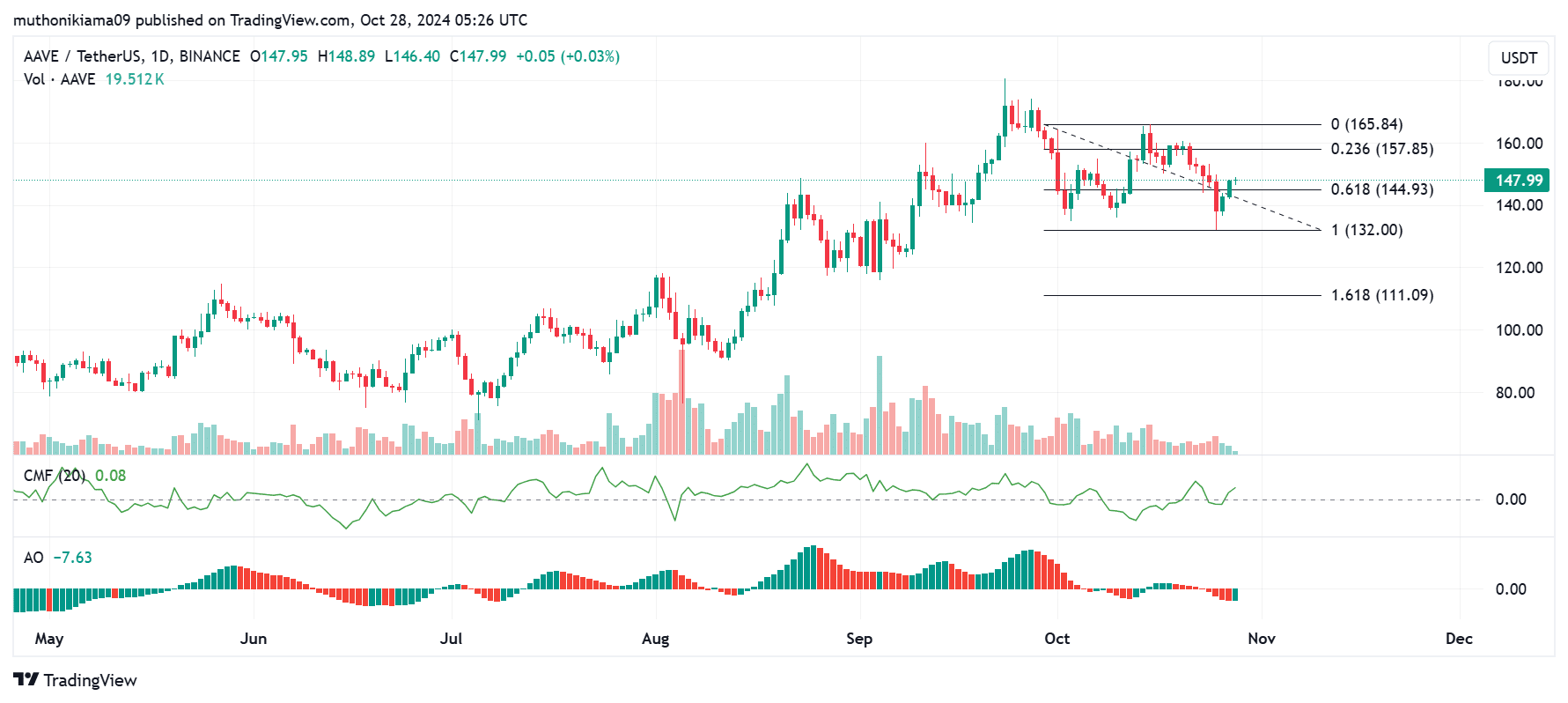

Aave [AAVE]has been beneath bearish power amid a 6% worth decline within the final seven days. Then again, the altcoin is now appearing indicators of a rebound after bouncing by means of 2.3% in 24 hours to business at $147 at press time.

At the day by day chart, the bearish tendencies looked as if it would weaken. This was once after the Superior Oscillator (AO) flipped inexperienced. The AO continues to be unfavourable, which presentations that bears are nonetheless in keep an eye on however a development reversal might be at the horizon.

The Chaikin Cash Go with the flow (CMF) helps the bullish thesis after trending upwards and flipping to sure. This indicator presentations that purchasing power is now outweighing promoting power, which might precede a rally.

Supply: Tradingview

Supply: Tradingview

If AAVE’s uptrend strengthens following those bullish indicators, the following resistance degree would be the 0.236 Fibonacci degree ($157). Breaking this degree will pave the way in which for any other rally against $165.

But even so the technical signs, on-chain metrics additionally display that an uptrend is imaginable.

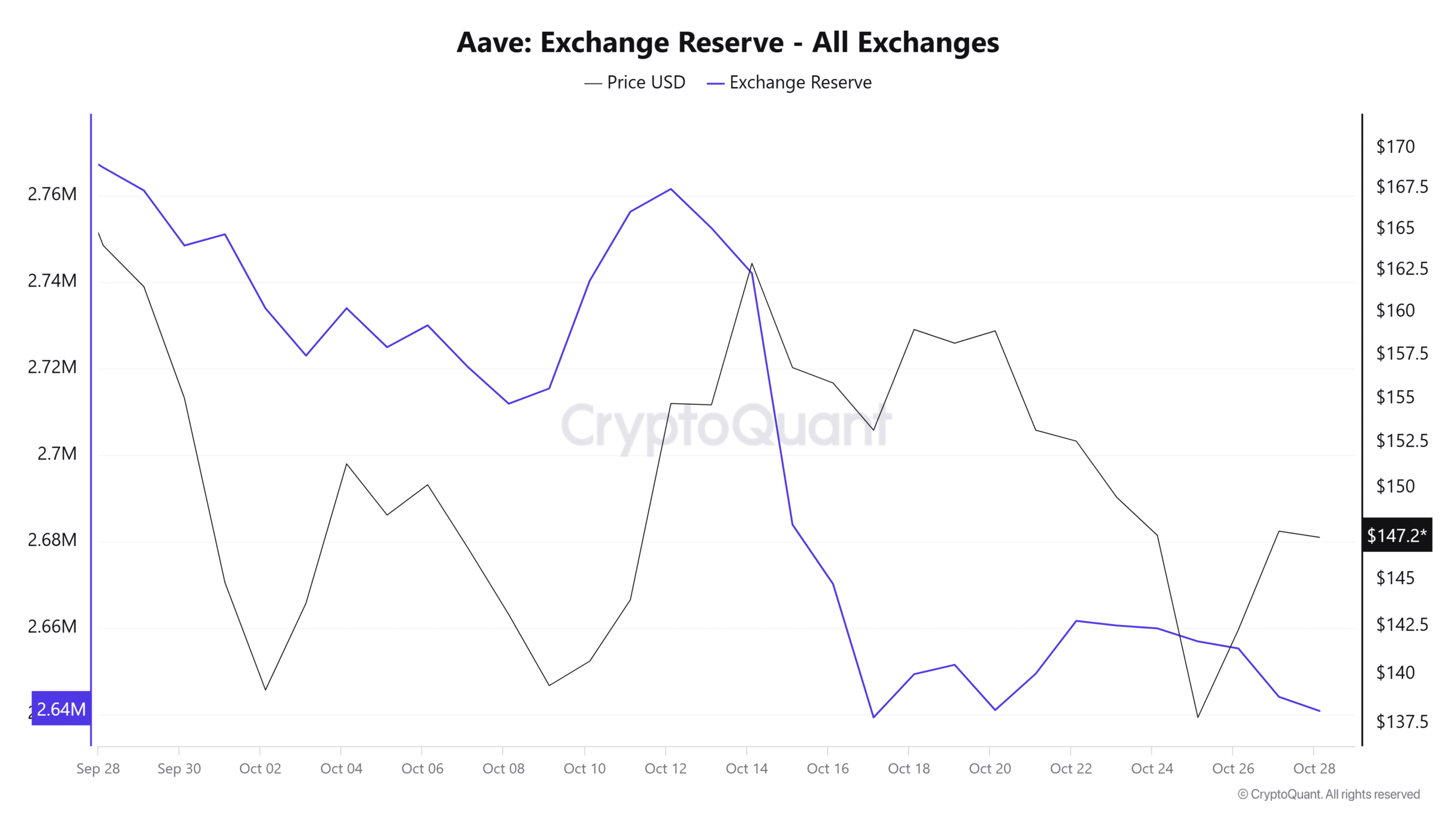

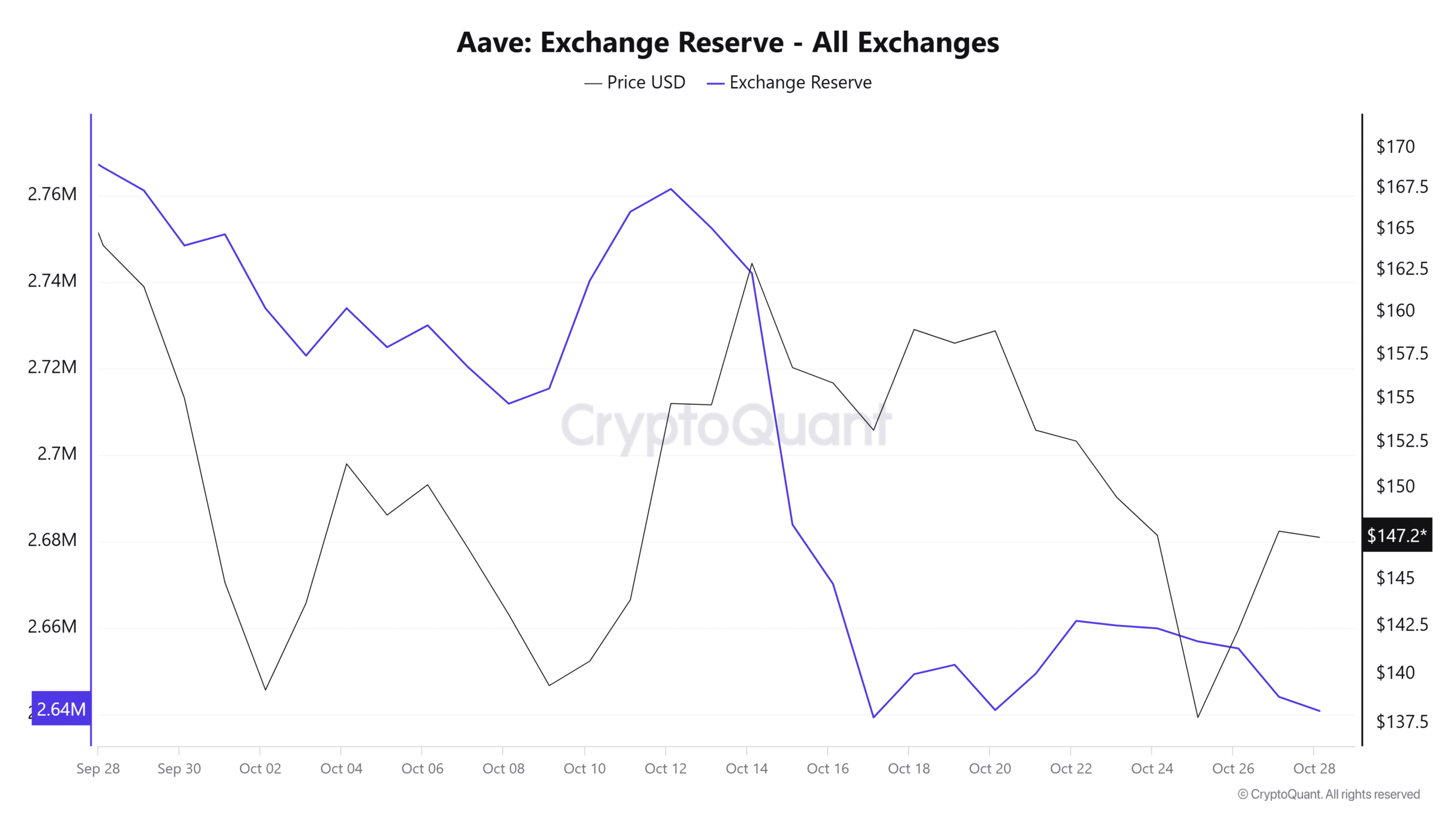

Change reserves plummet

AAVE change reserves have dropped to file lows suggesting that the promoting power is easing.

Knowledge from CryptoQuant confirmed that since mid-October, change reserves had been losing often in spite of the slight bounces in worth.

Supply: CryptoQuant

Supply: CryptoQuant

Few change reserves display that there’s much less AAVE to be had on exchanges to promote. This provides room for a value restoration. Additionally, if there’s a unexpected surge in call for whilst provide on exchanges stays low, the altcoin may make a forged jump.

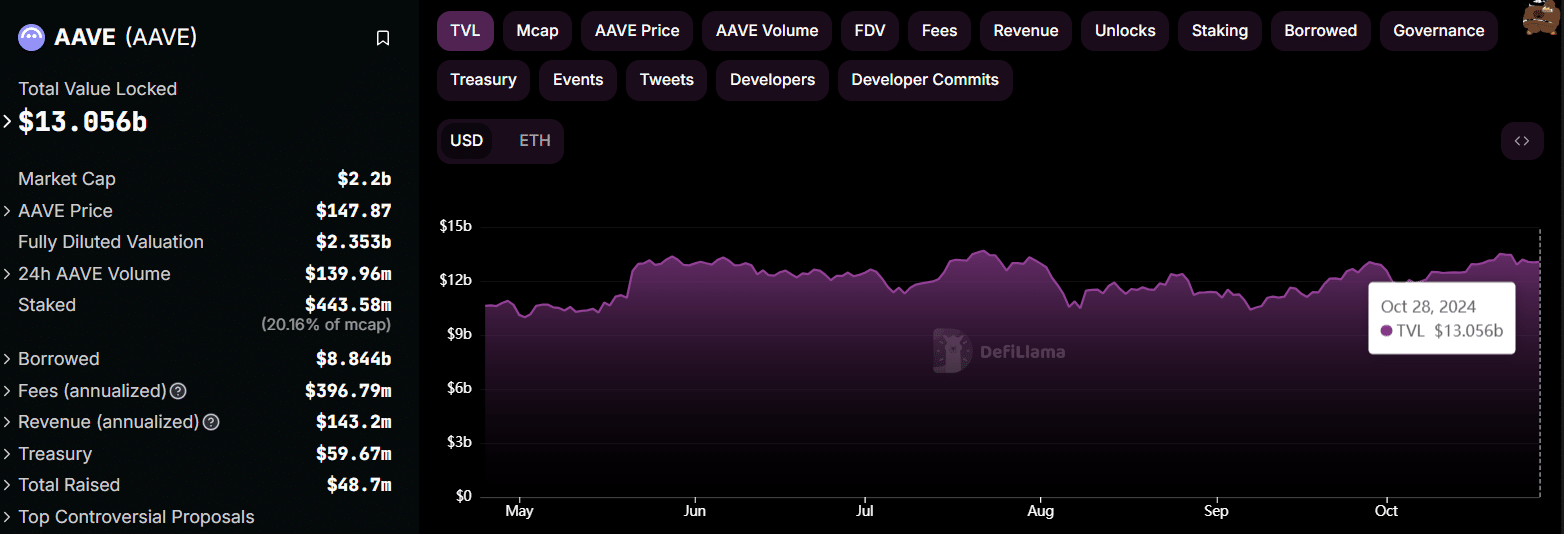

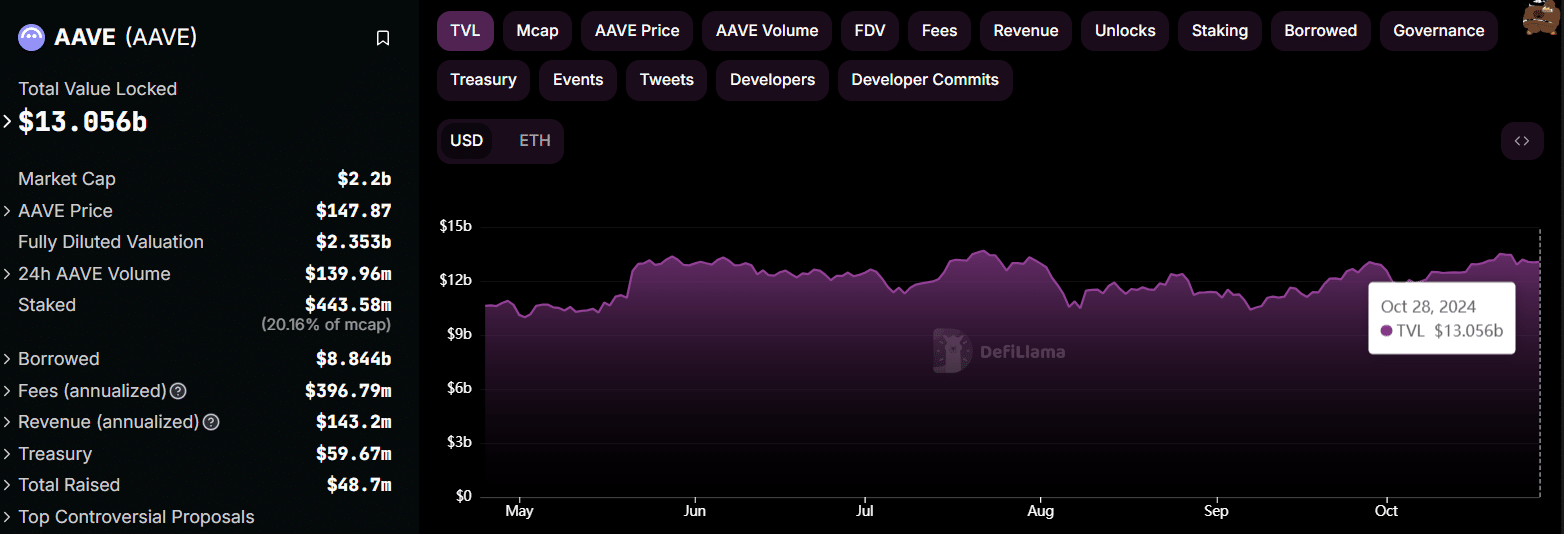

AAVE DeFi TVL will increase

AAVE may be poised for a forged worth restoration on account of the stable enlargement of its decentralized finance (DeFi) General Worth Locked (TVL).

AAVE is the second-largest DeFi protocol. Its TVL stood at $13.05 billion at press time in keeping with DeFiLlama and has greater by means of just about $500 million for the reason that get started of the month.

Supply: DeFiLlama

Supply: DeFiLlama

A surge in DeFi task is generally a catalyst for worth good points as AAVE is the local token used to strengthen transactions at the protocol.

Learn Aave’s [AAVE] Value Prediction 2024–2025

Finally, AAVE’s token holders may additionally affect the rally. At press time, 57% of holders had been in income in keeping with IntoTheBlock. Moreover, just about 18,000 addresses purchased the token above $155.

Subsequently, if AAVE continues the uptrend, it’s sure to stand resistance at $155 if those holders make a decision to ebook income.

Earlier: Aerodrome crypto soars 1200% in a 12 months: What’s fueling the surge?

Subsequent: Tether’s $5.58B Bitcoin reserves: A transfer to beef up USDT?