Arbitrum’s descending channel might quickly finish, with analysts predicting a 2x rally if the breakout is showed.

94% of ARB holders are within the purple, however a possible breakout may sign a big turnaround.

Arbitrum [ARB] has proven minor fluctuations up to now 24 hours, buying and selling inside a slender vary between $0.59 and $0.61. As of press time, ARB used to be buying and selling at $0.5977, representing a zero.85% building up during the last day and an 11.23% upward thrust over the last week.

With a circulating provide of three.5 billion ARB tokens, the present marketplace capitalization stands at $2.09 billion, supported via a buying and selling quantity of $182.4 million up to now 24 hours.

Marketplace analyst Captain Faibik famous,

“$ARB is lately shifting inside a Descending Channel. It now seems to have Bottomed out and is at the verge of a Breakout. If it Effectively breaks out, lets see a 2x Bullish Rally in 2-3 months.”

This attainable breakout is being carefully monitored via buyers, as it would mark an important shift in ARB’s value trajectory.

ARB has been buying and selling inside a descending channel since March 2024, characterised via decrease highs and decrease lows. The cost has persistently adhered to the channel limitations, appearing a transparent downtrend.

On the other hand, fresh actions recommend that ARB could also be making an attempt to damage out of this trend.

Supply: X

Bollinger bands tighten: Breakout coming near near?

ARB/USDT chart unearths that the cost is lately buying and selling close to the center Bollinger Band, indicating consolidation following a contemporary downtrend.

The narrowing of the Bollinger Bands issues to decreased volatility, which might sign an imminent breakout as the cost nears the higher band round $0.62.

Additional supporting this outlook, the MACD has proven a bullish crossover, with the MACD line shifting above the sign line.

This means attainable upward momentum; then again, the small certain bars within the histogram point out that the energy of this momentum continues to be susceptible and calls for additional affirmation.

Supply: TradingView

In the meantime, the RSI (Relative Energy Index) hovers round 50, reflecting marketplace indecision. A transfer above 60 may point out a shift in opposition to bullish momentum, whilst a drop beneath 40 would possibly recommend renewed promoting power.

ARB holders endure as breakout looms forward

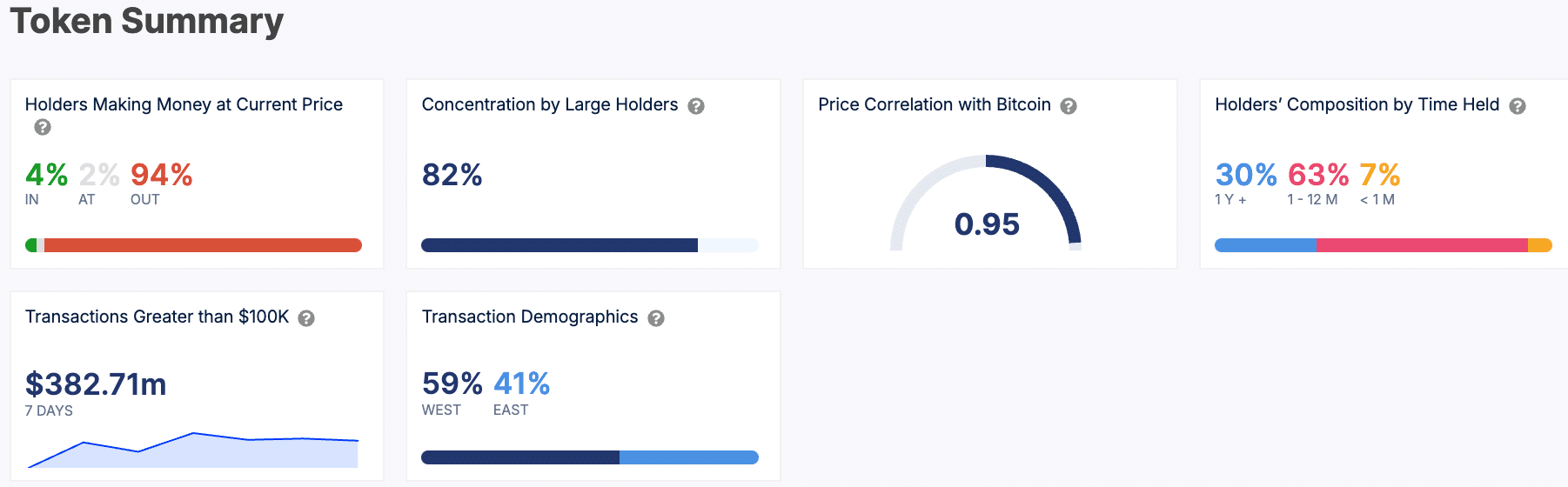

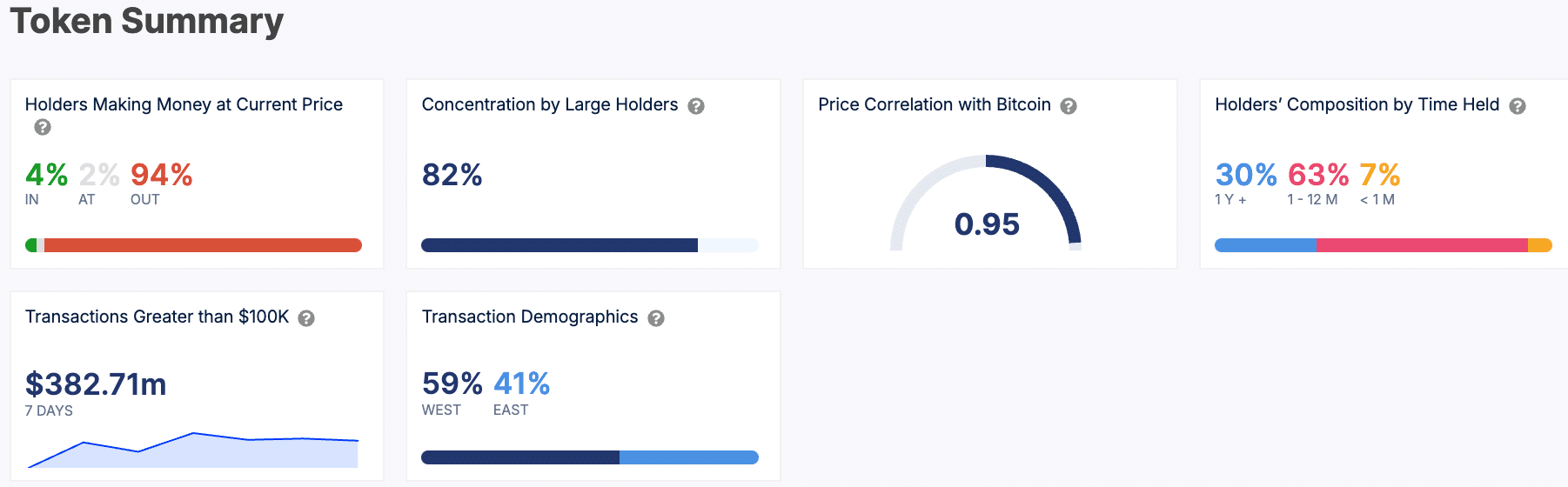

Regardless of those technical signs, broader marketplace sentiment seems wary. In keeping with knowledge from IntoTheBlock, 94% of ARB holders are lately at a loss, with most effective 4% profiting on the present value.

Huge holders, who keep watch over 82% of the overall provide, dominate the marketplace, which might affect value actions.

The token additionally presentations a powerful correlation with Bitcoin, with a correlation coefficient of 0.95, suggesting that ARB’s value might proceed to practice Bitcoin’s developments carefully.

Supply: IntoTheBlock

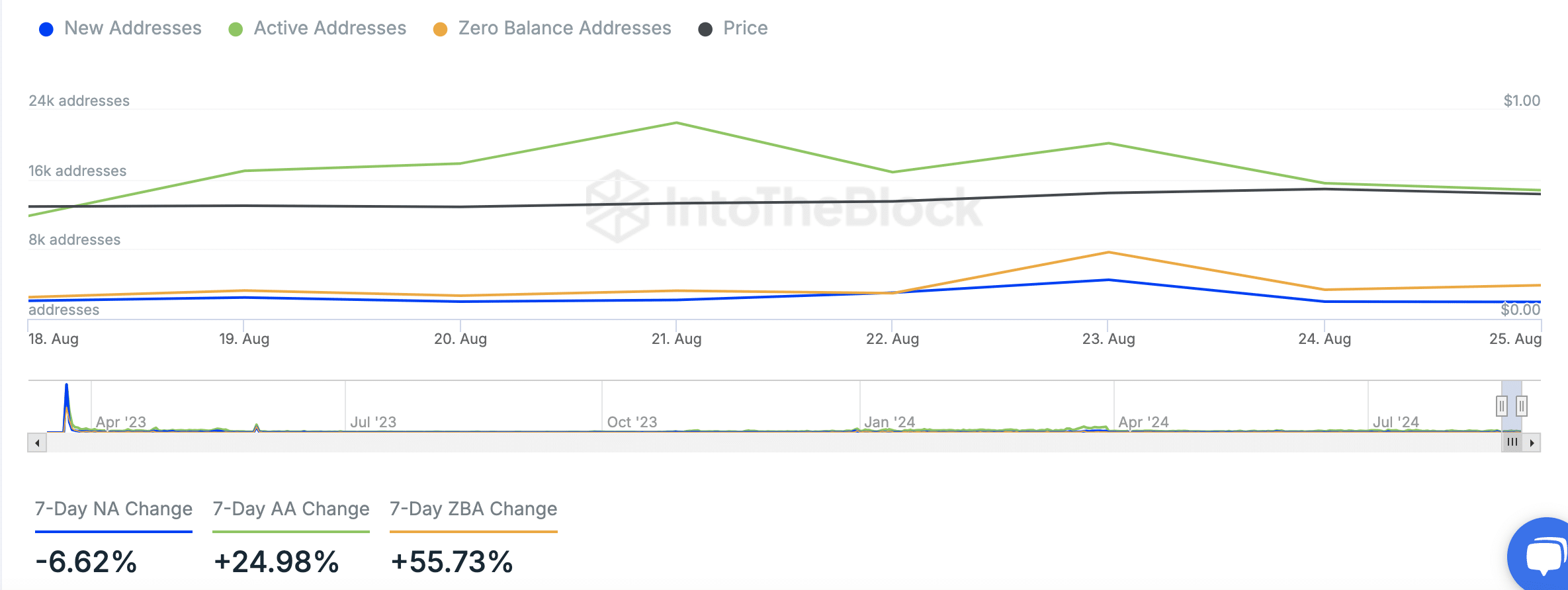

During the last week, the selection of new addresses has diminished via 6.62%, whilst lively addresses have risen via 24.98%, indicating rising consumer engagement.

On the other hand, the selection of zero-balance addresses has surged via 55.73%, which might level to an building up in inactive or deserted accounts.

Supply: IntoTheBlock

As ARB trades at $0.5977, marketplace contributors are keenly looking at for indicators of a breakout from the descending channel.

Subsequent: Solana: Analyst predicts SOL to $200 following a strategic $4.5M stake