Arbitrum’s new proposal may just assist strengthen transaction ordering at the community.

Regardless of possible for enhancements, total process at the community fell.

Arbitrum [ARB] has been probably the most common Layer-2 protocols within the DeFi area, having controlled to retain its dominance regardless of more than one new entrants getting into the marketplace.

New trends on the upward push

One such construction is the proposed adoption of “Timeboost,” a transaction ordering coverage. Underneath the present device, Arbitrum transactions adhere to a first-come, first-served manner.

Timeboost, on the other hand, would introduce a bidding device for transaction inclusion and site.

Customers would have the ability to publish bids for his or her transactions, with the perfect bidders securing sooner processing and a extra favorable place throughout the block.

Supply: Arbitrum

Supply: Arbitrum

Against this to the present device, transactions that win the Timeboost public sale could be integrated in an “categorical lane,” experiencing no delays.

Transactions that don’t take part within the public sale would proceed to be processed as same old. On the other hand, there will likely be a slight prolong of roughly 200 milliseconds.

This mechanism bears similarities to the concern charge device hired on OP Mainnet, the place customers pays further charges to expedite their transactions.

Very similar to Optimism [OP], the proceeds from the Timeboost public sale could be directed against the Arbitrum DAO treasury, doubtlessly producing an important earnings circulation.

Having the ability to prioritize transactions, customers achieve extra keep watch over over their enjoy at the Arbitrum community.

Time-sensitive transactions, like arbitrage alternatives or vital DeFi movements, will also be expedited via using Timeboost. This may end up in a extra responsive and user-friendly platform, attracting a much wider vary of customers.

State of Arbitrum

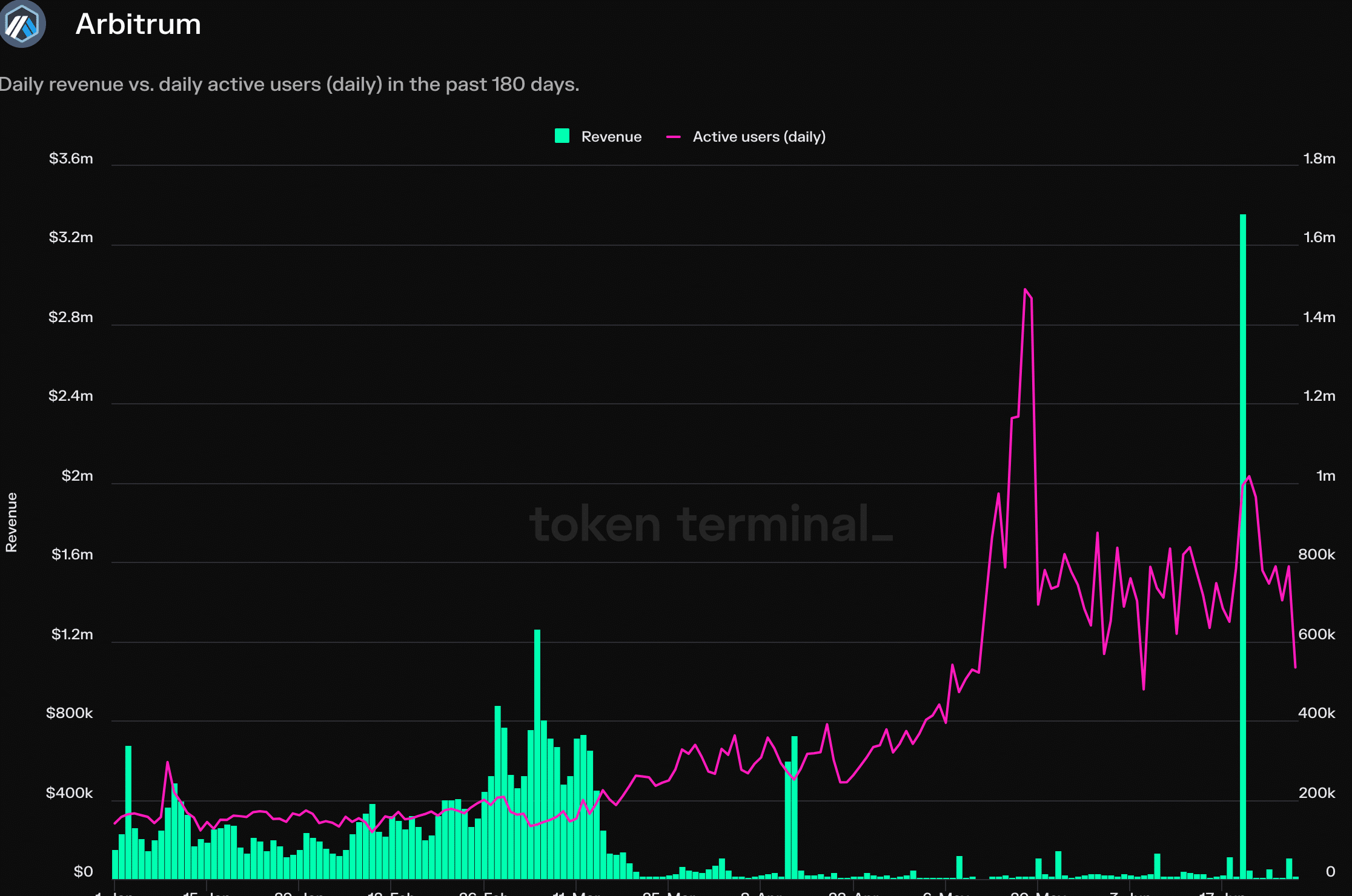

On the time of writing, Arbitrum used to be having hassle attracting and conserving customers.

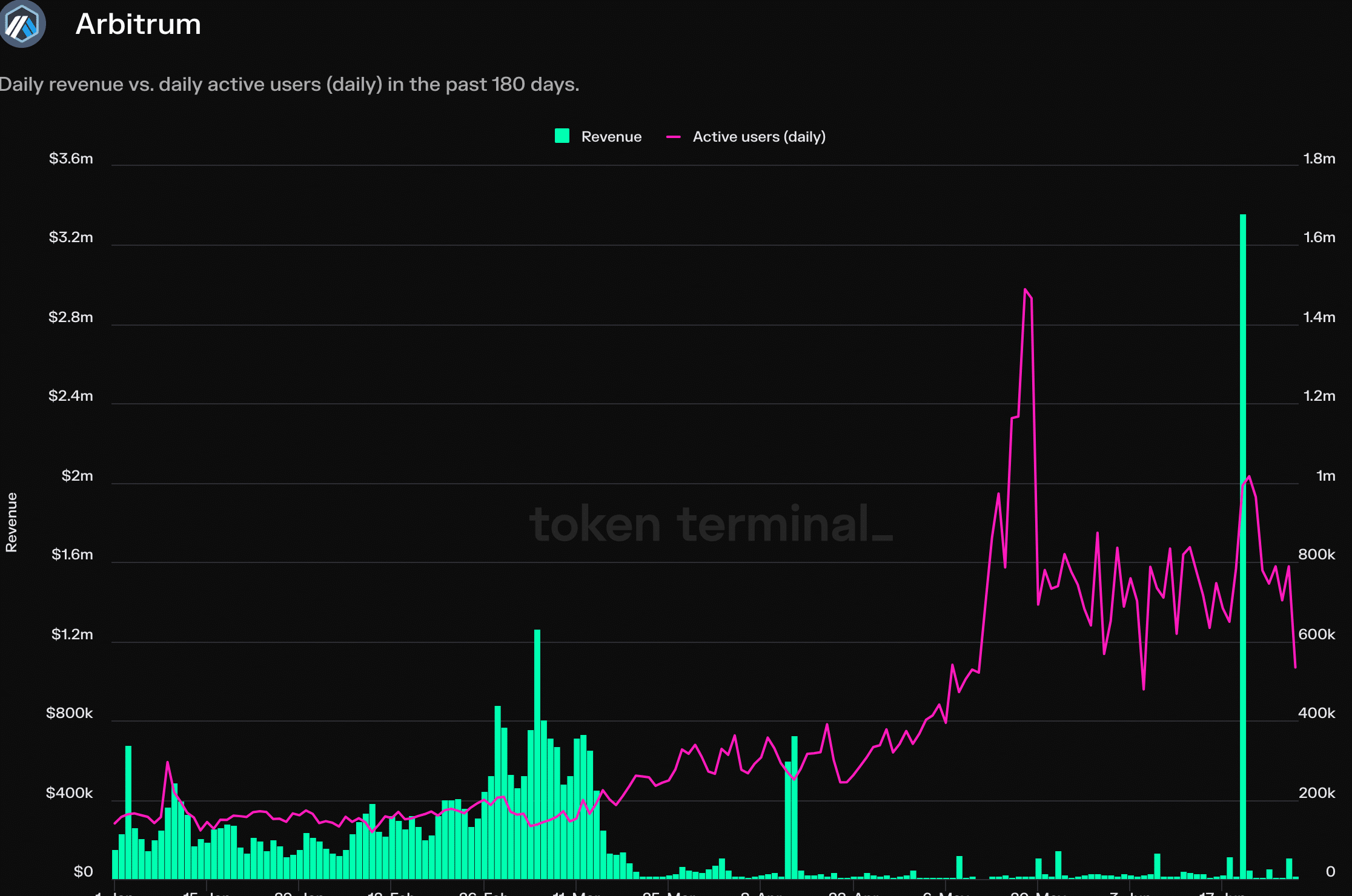

AMBCrypto’s research of Token Terminal’s information indicated that the selection of lively addresses at the Arbitrum community had fallen through 38% during the last month.

On the other hand, the earnings generated through Arbitrum remained prime.

Supply: Token Terminal

Supply: Token Terminal

Real looking or no longer, right here’s ARB’s marketplace cap in MATIC’s phrases

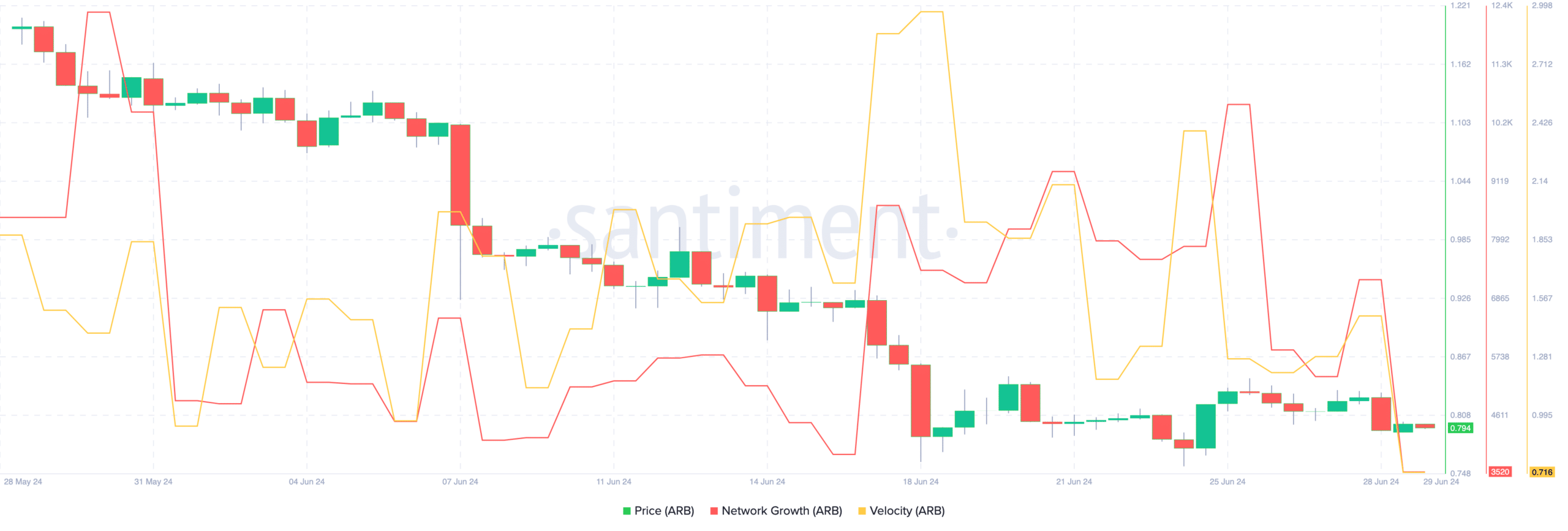

At press time, ARB used to be buying and selling at $0.7946 and its value had declined through 3.26% within the final 24 hours. Over the last month, ARB showcased the indicators of a bearish development.

It used to be indicated through decrease lows and decrease highs exhibited through the fee. The community enlargement across the token additionally fell considerably, implying that new addresses had been getting bored within the token.

Supply: Santiment

Supply: Santiment

Subsequent: Bitcoin ETF traders are ‘20% worse off’: Peter Schiff – Is that this true?

![Local weather startup develops era that would disrupt the concrete trade: ‘No person on the earth has [done this]’ Local weather startup develops era that would disrupt the concrete trade: ‘No person on the earth has [done this]’](https://www.thecooldown.com/wp-content/themes/tcd/assets/images/divider-icon-earth.svg)