Bitcoin’s worth declined by means of greater than 4% within the closing 24 hours.

Maximum marketplace signs and metrics hinted at an additional worth drop.

Bitcoin [BTC] has struggled to show bullish over the past couple of days as its worth persisted to business beneath $67k.

Then again, all of the development would possibly exchange quickly as a key indicator hinted at a imaginable worth build up that would permit the king of cryptos to the touch $86k within the coming weeks or months.

Bitcoin’s street to $86k

The bears ruled the closing week, inflicting maximum cryptos’ costs to drop, and BTC used to be no longer an exception. In line with CoinMarketCap, BTC witnessed a significant worth correction at the sixth of June.

The coin’s worth had dropped by means of over 4% within the closing seven days. On the time of writing, BTC used to be buying and selling at $66,344 with a marketplace capitalization of over $1.3 trillion.

Then again, Ali, a well-liked crypto analyst, not too long ago posted a tweet highlighting a proven fact that gave hope for a worth build up. As in keeping with the tweet, BTC’s mining value used to be $86,668.

If ancient traits are to be thought to be, then BTC’s would possibly start a bull rally quickly, because it has all the time surged above its reasonable mining value.

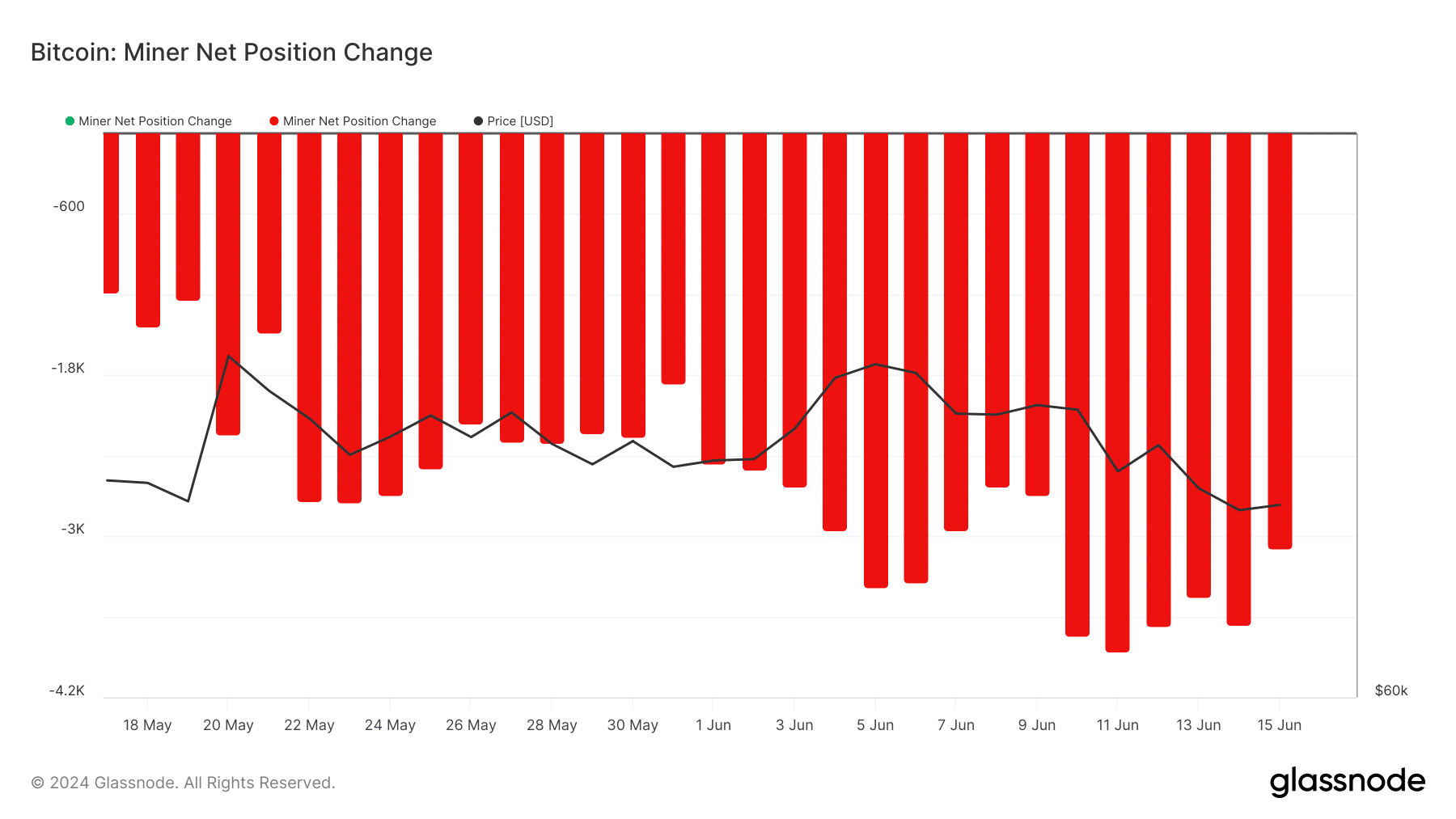

AMBCrypto then analyzed Glassnode’s knowledge to learn the way miners had been behaving whilst BTC’s mining value touched $86k. We discovered that they have got intent to promote.

This used to be obtrusive from the large dip in its miners’ internet place exchange, appearing that miners weren’t assured in BTC and therefore selected to promote their holdings.

Miners’ steadiness additionally registered a decline over the last few weeks.

Supply: Glassnode

Supply: Glassnode

Will BTC stay bearish?

Since miners had been exerting promoting power on BTC, AMBCrypto deliberate to try different datasets to search out whether or not BTC would stay bearish.

AMBCrypto’s research of CryptoQuant’s knowledge printed that BTC’s internet deposit on exchanges used to be prime in comparison to the closing seven days’ reasonable.

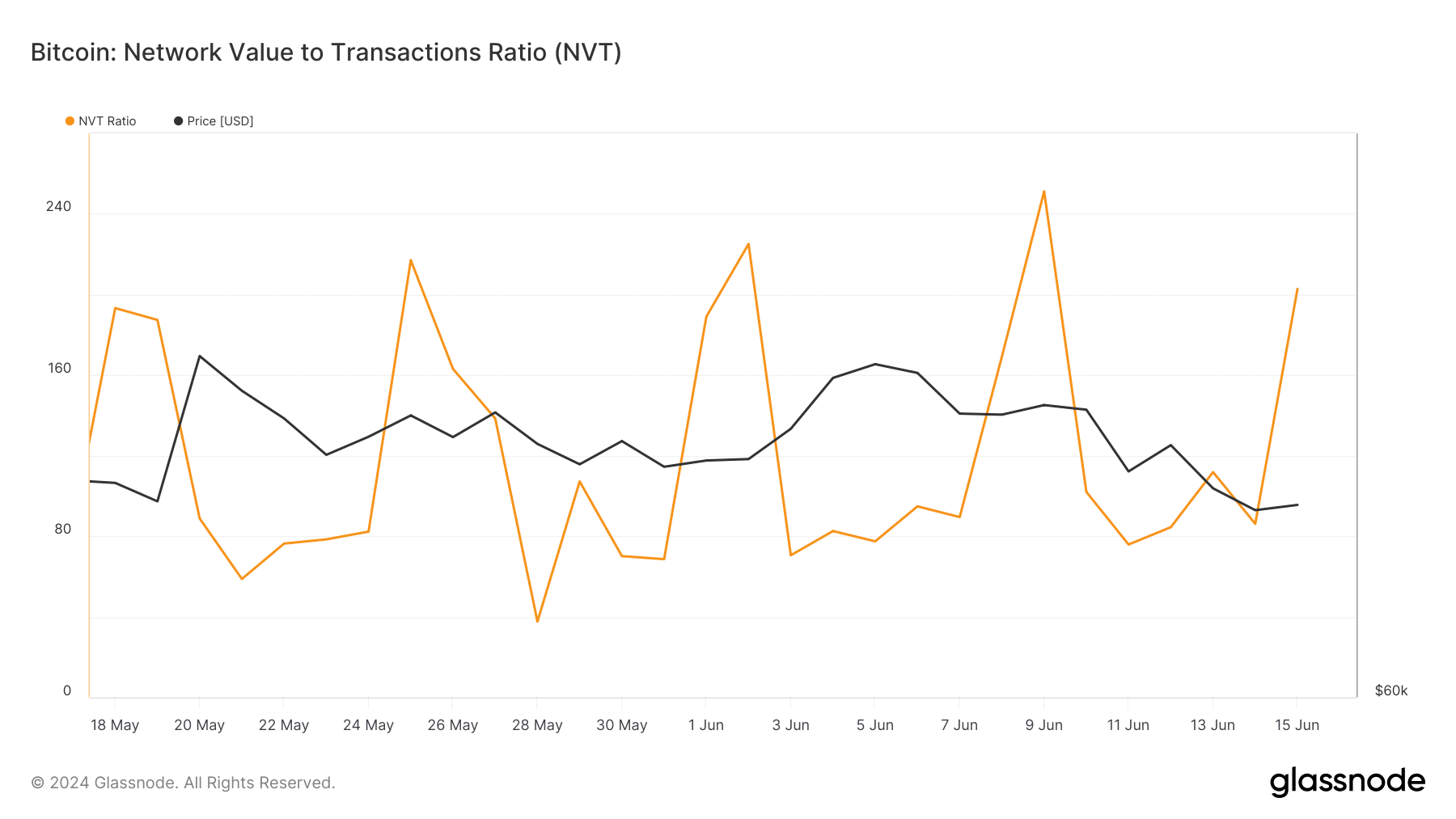

The king of cryptos’ Coinbase Top rate used to be additionally purple, which means that promoting sentiment used to be dominant amongst US buyers. On most sensible of that, Bitcoin’s NVT ratio registered a pointy uptick at the fifteenth of June.

A upward push within the metric signifies that an asset is hyped up, which signifies a imaginable worth correction.

Supply: Glassnode

Supply: Glassnode

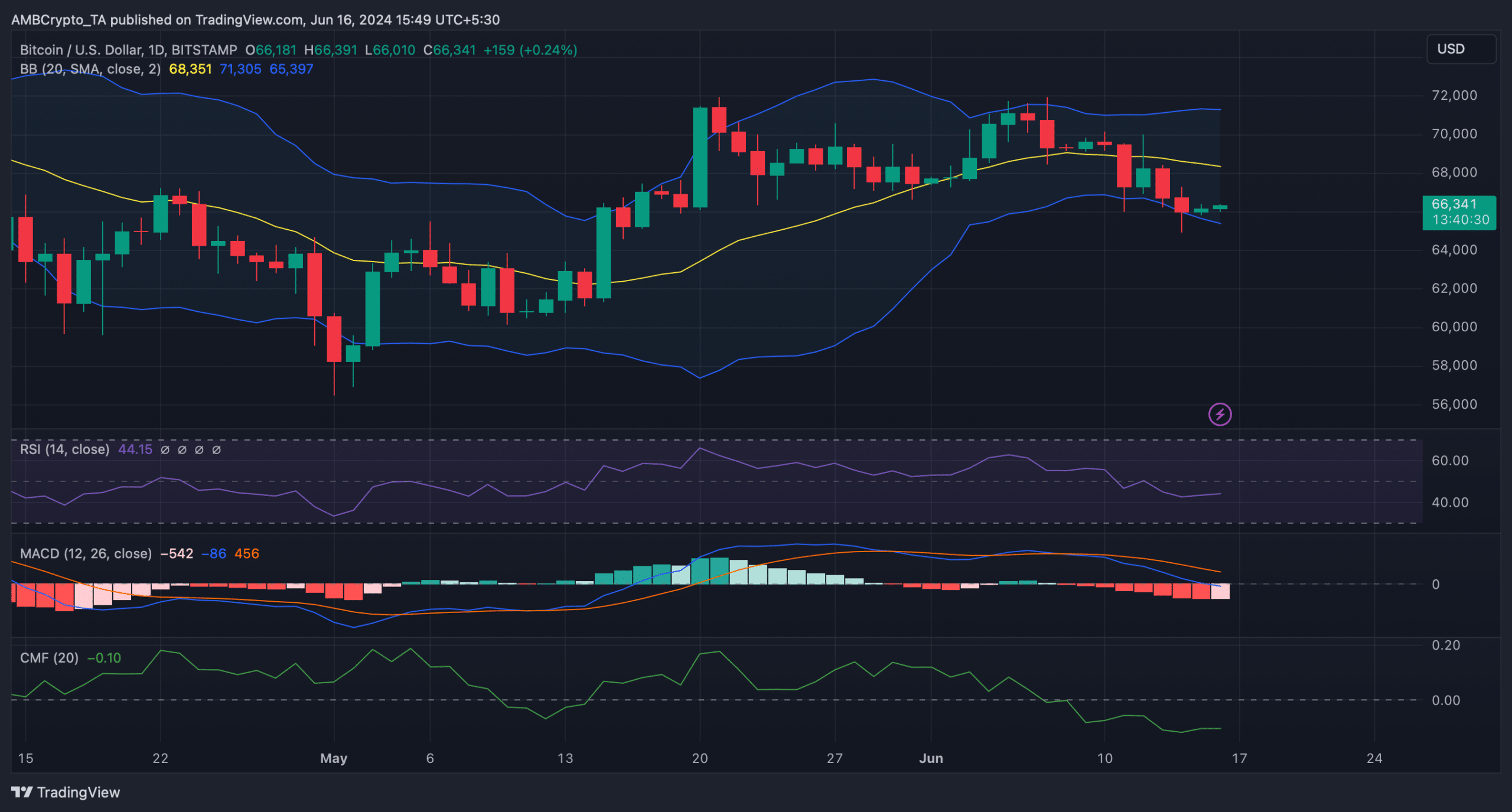

Issues seemed even worse, as maximum marketplace signs seemed bearish. As an example, the MACD displayed a bearish benefit out there.

The Chaikin Cash Go with the flow (CMF) registered a decline and used to be resting neatly beneath the impartial mark. BTC’s Relative Energy Index (RSI) used to be additionally beneath the impartial mark.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Those signs steered an additional worth decline.

However, BTC’s worth had touched the decrease restrict of the Bollinger Bands. On every occasion that occurs, it hints at a northward worth restoration within the coming days.

Supply: TradingView

Supply: TradingView