Cardano is prone to fall towards $0.3 within the close to time period to assemble liquidity.

The downtrend of the MDIA is usually a tough sign for bulls to re-enter.

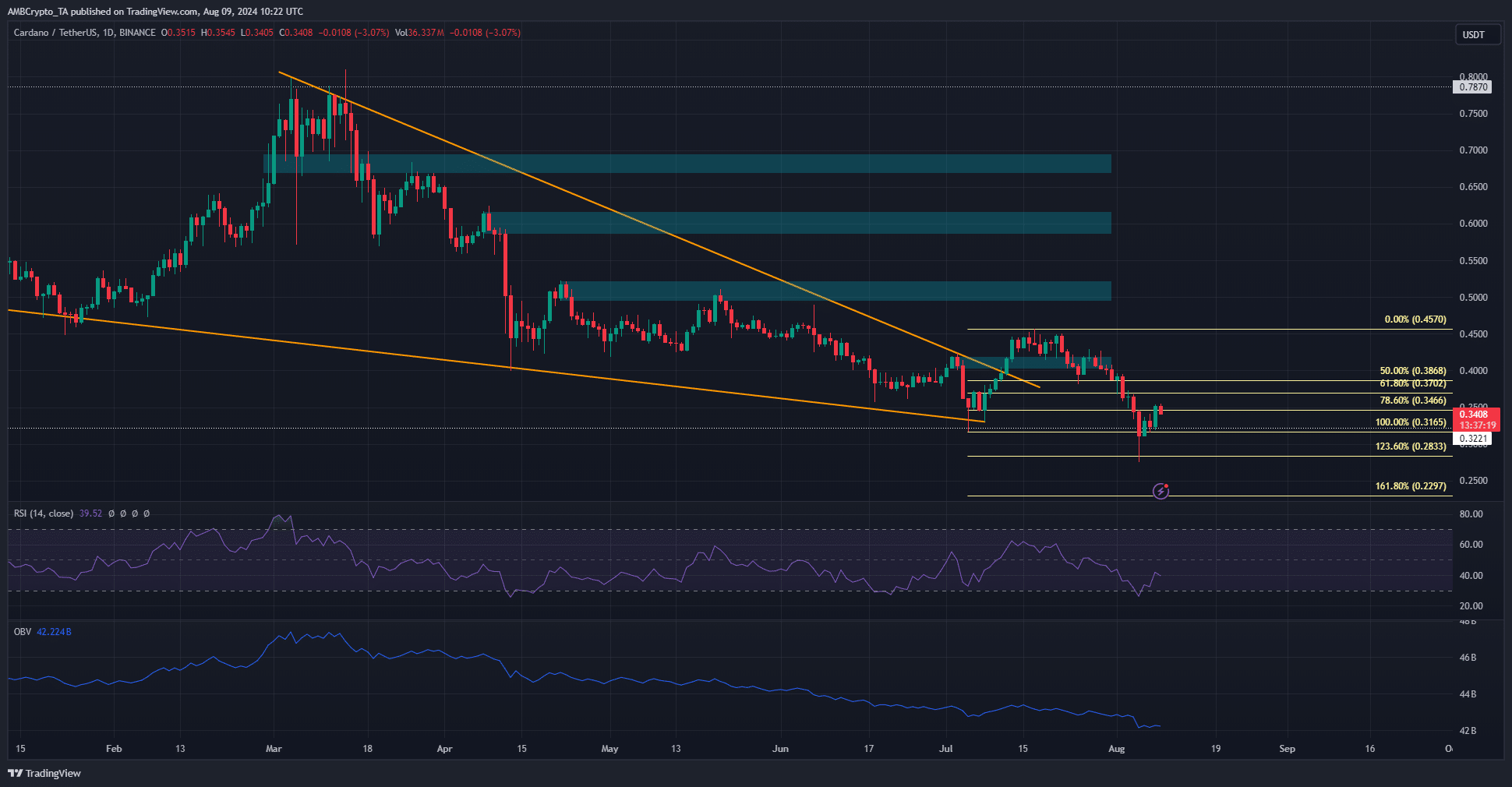

Cardano [ADA] noticed a breakout previous the descending wedge formation in mid-July, however its development used to be halted sooner than the uptrend used to be correctly.

If that wasn’t discouraging sufficient, the Bitcoin [BTC] sell-off and market-wide panic previous this week noticed ADA droop to $0.275.

Supply: ADA/USDT on TradingView

Supply: ADA/USDT on TradingView

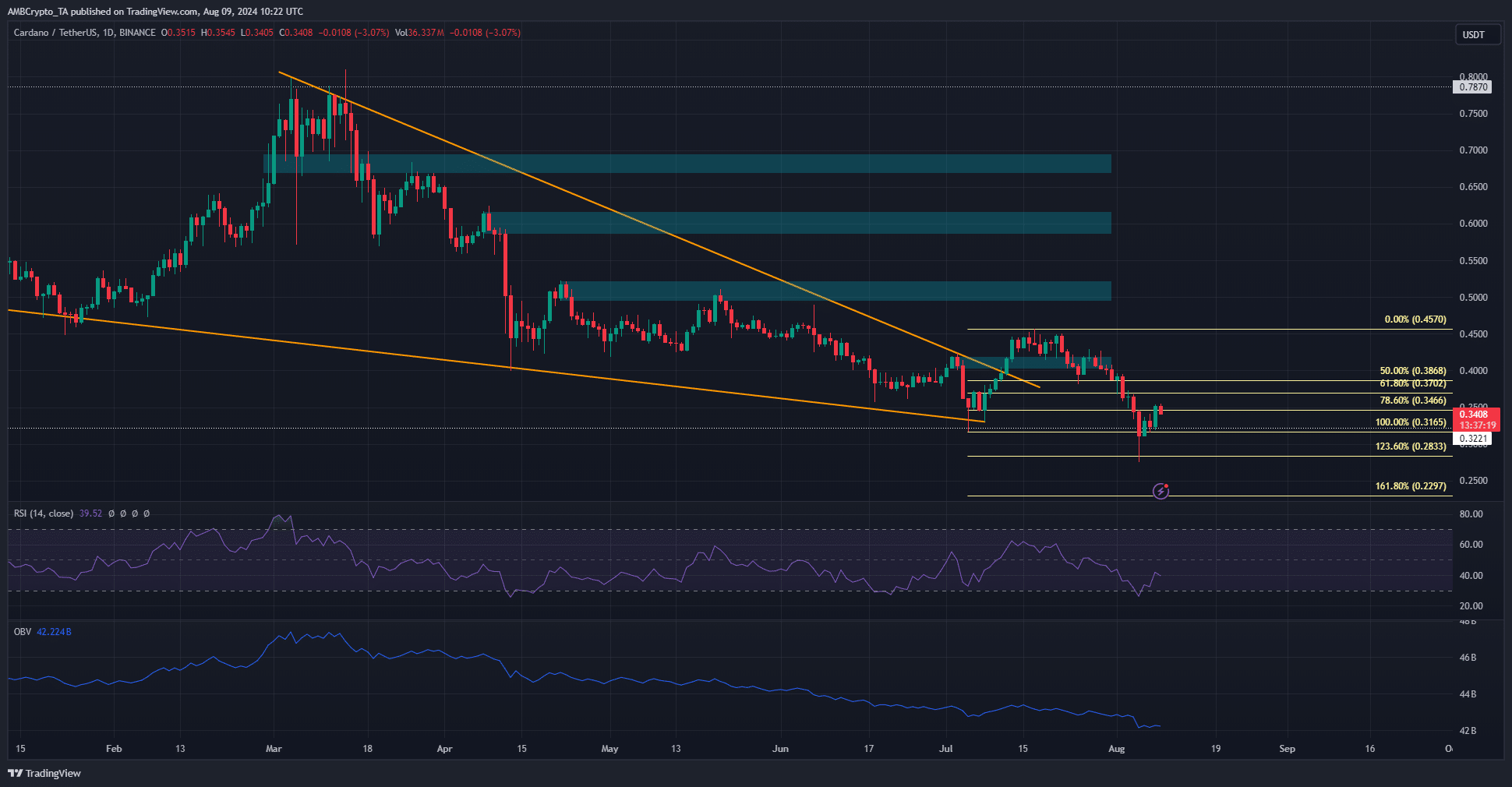

Information confirmed that the asset has been somewhat risky in fresh weeks. The opposite metrics have been combined however preferred the bears greater than the bulls. In spite of the associated fee drop, social media sentiment remained robust.

Is ADA a just right funding?

Supply: IntoTheBlock

Supply: IntoTheBlock

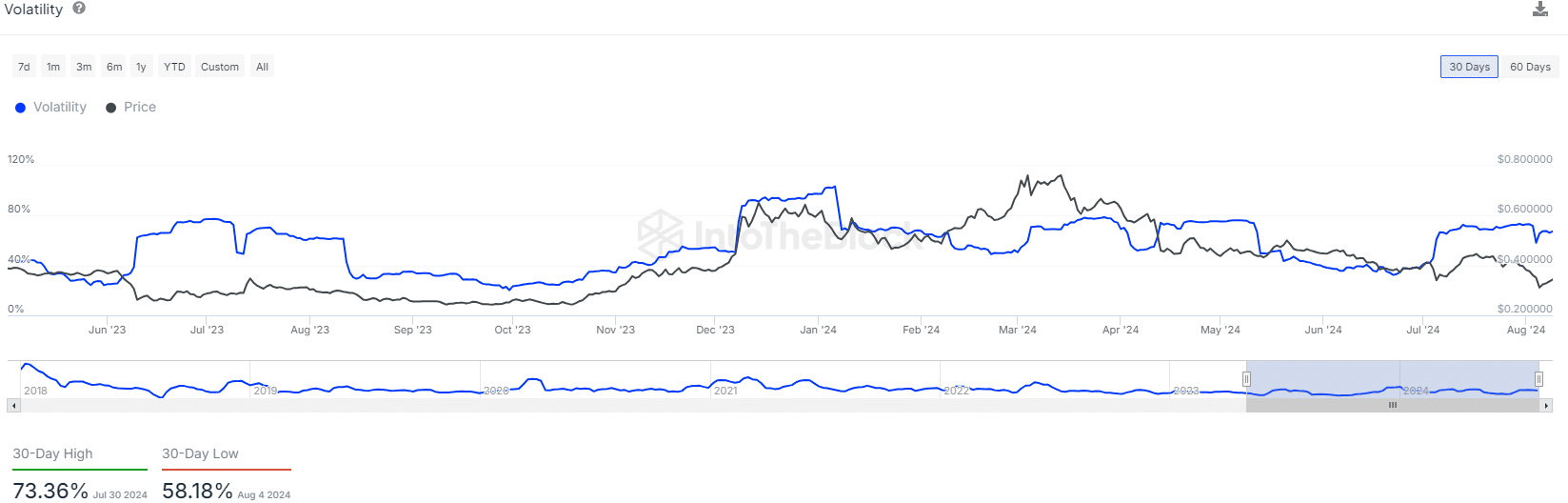

The 30-day diversifications within the Cardano volatility confirmed top worth swings in July. The continual worth drop within the first week of August noticed this metric drop to a low of 58.18%.

Preferably, long-term traders wish to see low volatility for a protracted duration to signify stable, continual accumulation.

AMBCrypto checked out any other metric, the Beta coefficient, evaluating Cardano’s volatility to Bitcoin’s. It confirmed a worth of 0.86 at press time, that means its worth strikes are much less risky.

It additionally confirmed that ADA is most likely most popular by means of extra conservative traders.

Extra competitive ones would most likely goal upper returns, and be prepared to abdomen the selected asset’s better volatility relative to BTC.

Supply: IntoTheBlock

Supply: IntoTheBlock

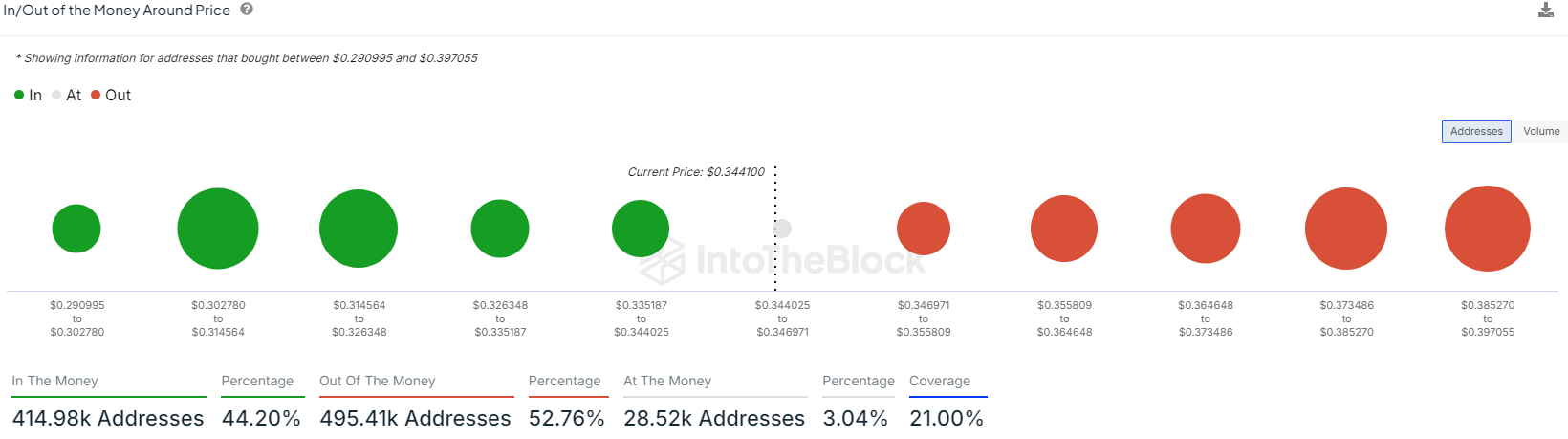

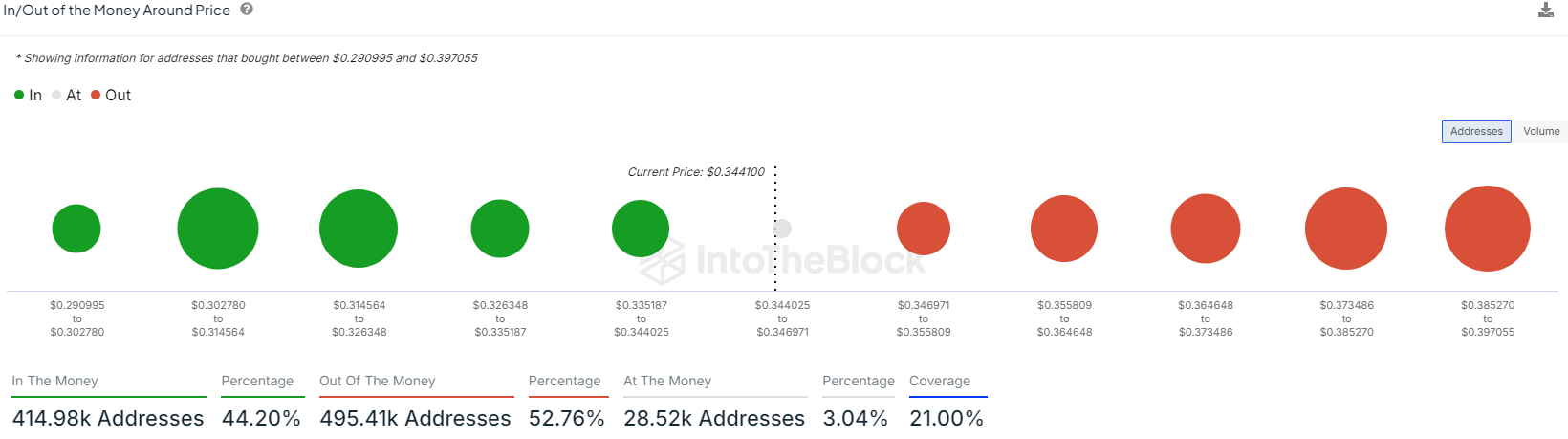

The $0.3-$0.326 used to be highlighted as the largest beef up zone round the associated fee. This area had confluence with the July lows however used to be breached on Monday.

Accumulating extra clues for the following worth pattern

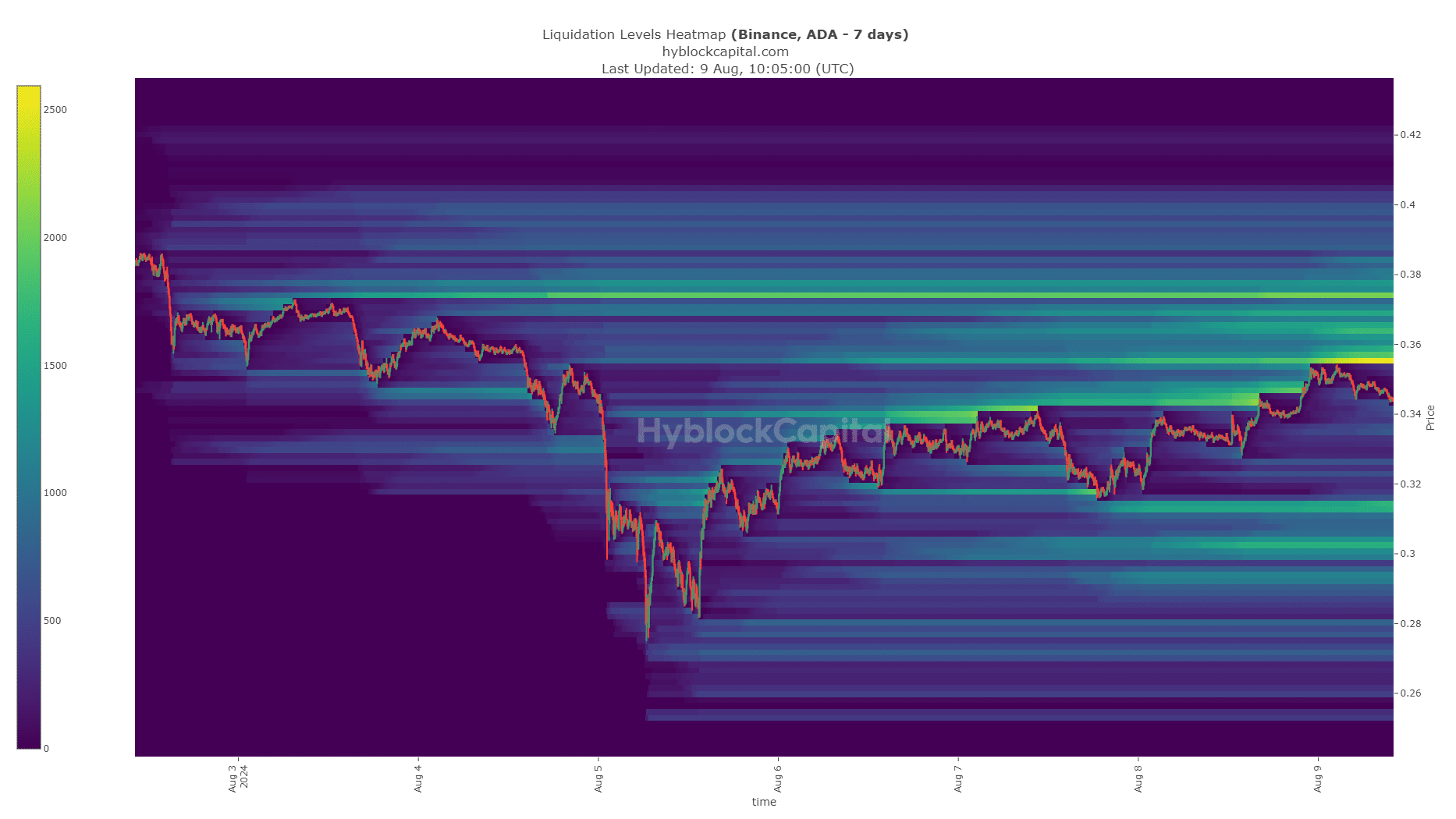

Supply: Hyblock

Supply: Hyblock

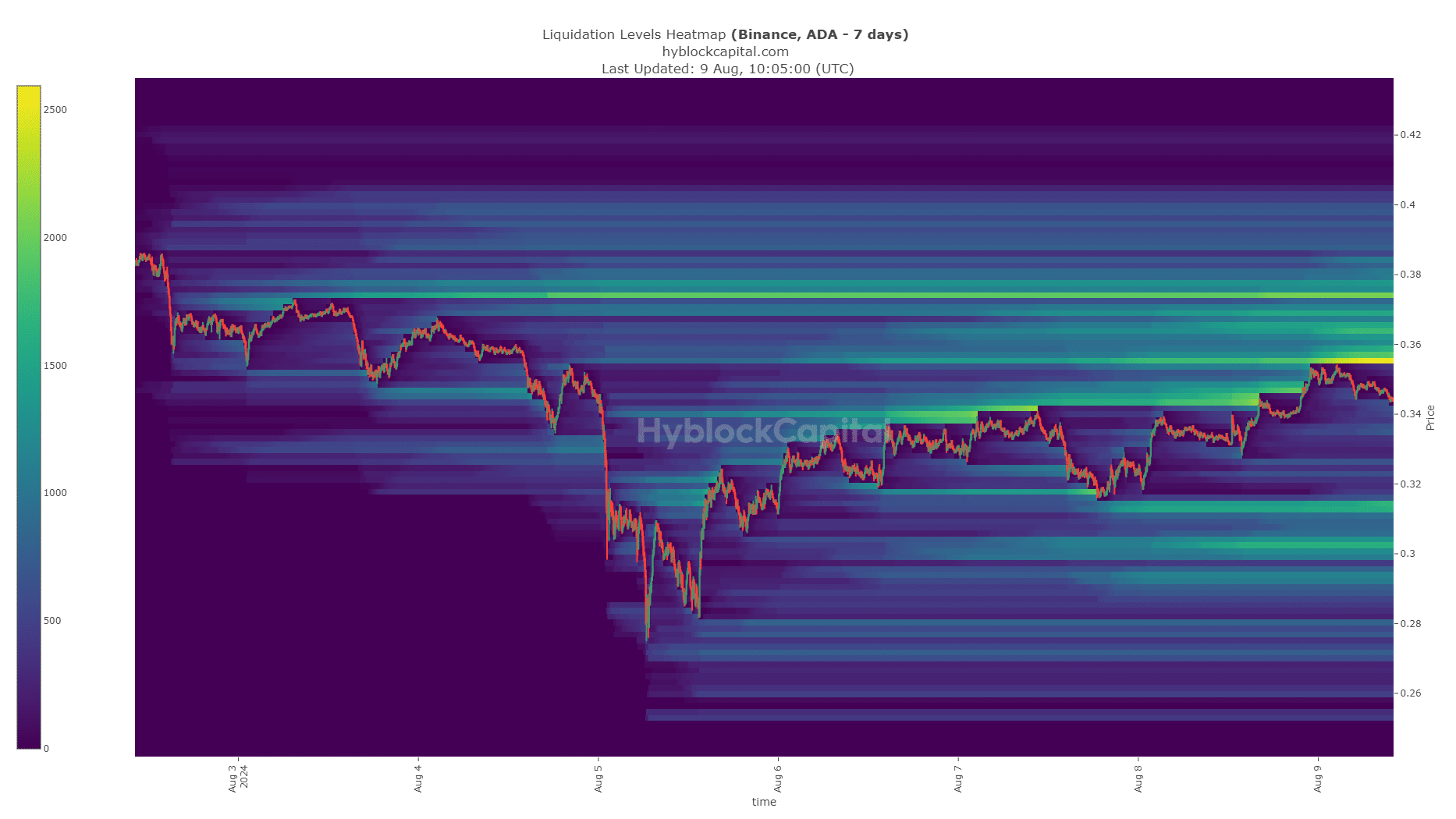

The 7-day lookback duration confirmed that the $0.3-$0.314 zone had a cluster of liquidation ranges that might have an effect on a reversal.

On the other hand, because of the new crash, there used to be now not sufficient time for a big swathe of liquidity to be constructed up, which might be an obtrusive upper time frame goal.

It helps the technical findings and the in/out of the cash information.

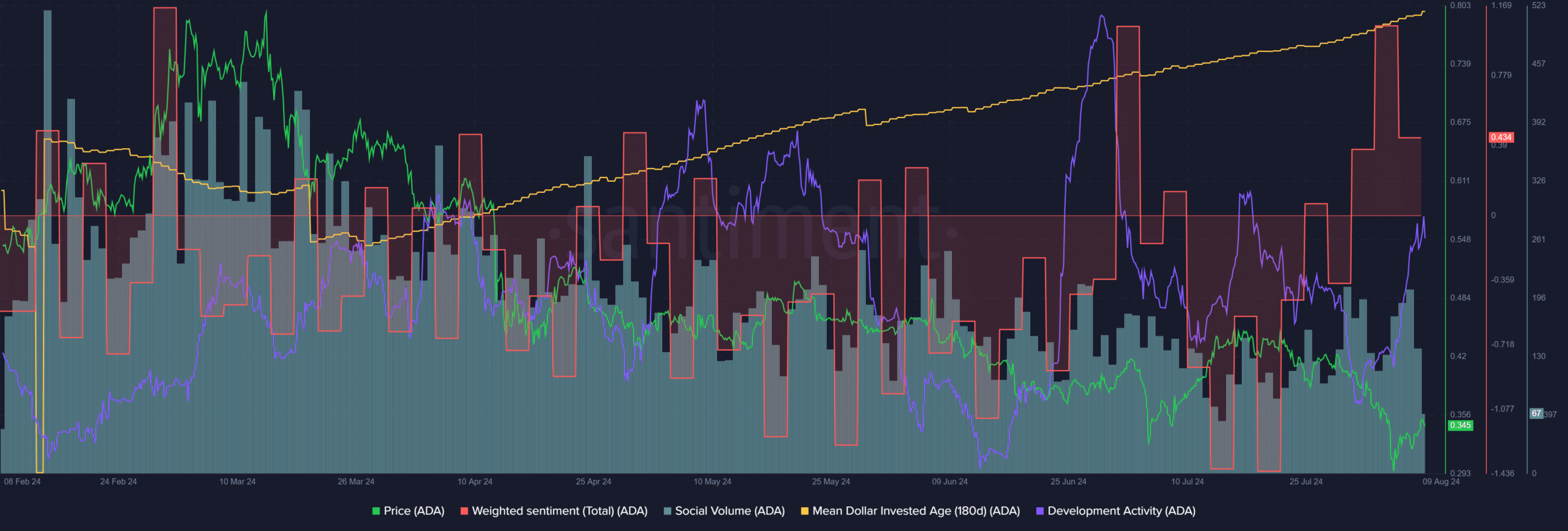

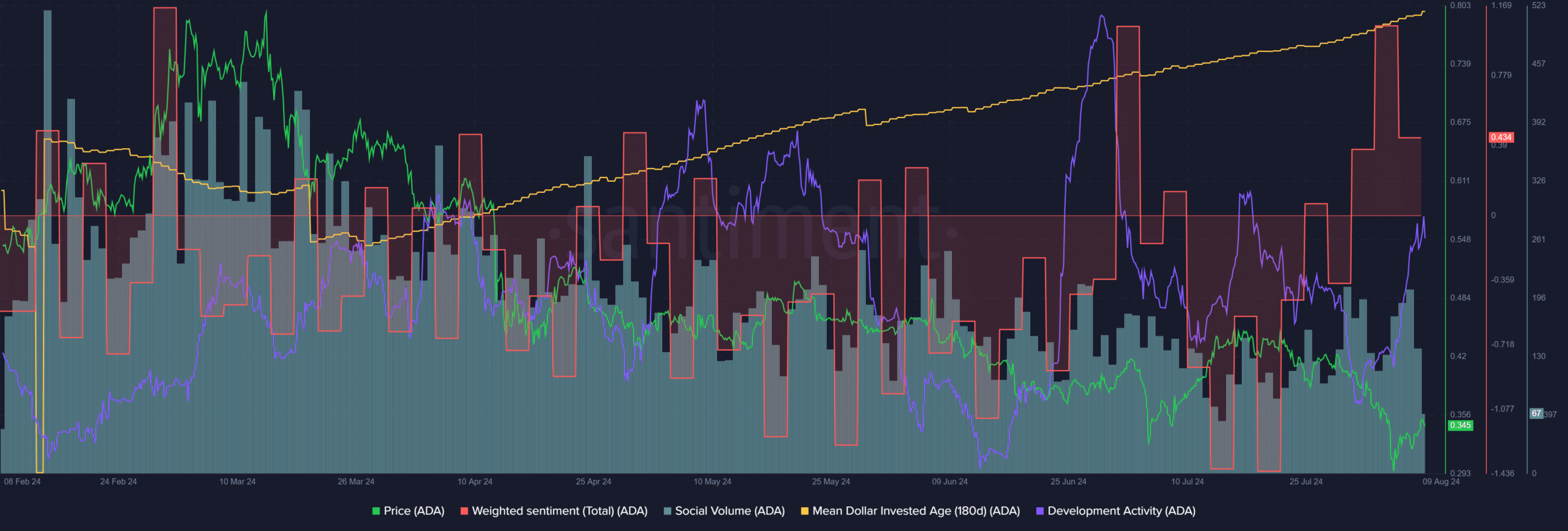

Supply: Santiment

Supply: Santiment

The Weighted Sentiment used to be certain, a stunning building after the associated fee crash underneath $0.3. It instructed panic has now not seized traders.

The improvement task used to be on par with previous months, any other inspiring sight for long-term holders.

Learn Cardano’s [ADA] Value Prediction 2024-25

But, the imply buck invested age persisted to pattern upper. The 180-day MDIA has climbed upper since March and is just about on the October 2023 ranges. It indicated stagnancy and a loss of new capital flowing in.

If the metric starts to pattern downward, it could be a powerful signal that ADA is in a position for a sustained rally.

Earlier: It’s Bitcoin’s victory as Russia, U.S. combat for crypto dominance!

Subsequent: Solana vs Ethereum – Why Brandt sees SOL gaining by means of 100% over ETH