On Friday, Nike (NYSE:NKE) confronted a tricky day as its stocks took a vital hit. The corporate’s iconic swoosh would possibly as smartly were changed with an “ooof” because the inventory skilled its greatest ever one-day drop, plummeting 20% after disappointing fiscal fourth quarter (Would possibly quarter) effects.

Whilst the earnings and benefit figures had been blended, the true let down got here from the corporate’s outlook. Macro headwinds and ongoing weak point in China had been in the back of a discounted gross sales forecast for FY25. The sports clothing massive now expects a high-single-digit earnings decline for the primary part of fiscal 2025, in comparison to the prior to now expected low-single-digit drop. Wall Boulevard had predicted a 2.3% decline. Moreover, Nike’s steering for the primary quarter of fiscal 2025 (finishing in August) forecasts a earnings decline of round 10%, considerably beneath analysts’ expectancies of a 2.8% lower.

It used to be now not way back that Oppenheimer’s Brian Nagel, an analyst ranked within the most sensible 1% of Wall Boulevard inventory professionals, upgraded his score on NKE. He cited a “traditionally discounted percentage valuation,” it appears pessimistic investor sentiment, and the intermediate to long-term potentialities for a elementary restoration, in response to control’s really extensive “strategic repositioning efforts,” as causes for his optimism.

Has the most recent readout modified the 5-star analyst’s view? No longer truly. Whilst Nagel concedes the effects and up to date FY25 steering proved “even weaker than our downbeat and beneath Boulevard forecasts,” he nonetheless sees the readout and observation as “most probably a ‘ultimate dangerous’ quarter and ‘wholesome clearing tournament for NKE.”

“NKE is operating to aggressively reposition the corporate’s international endeavor amid an increasingly more comfortable call for backdrop in america and in markets around the globe,” Nagel went on to mention. “We proceed to very a lot be expecting NKE efforts to lend a hand to gas a good more potent restoration on the corporate, as cyclical pressures ease.”

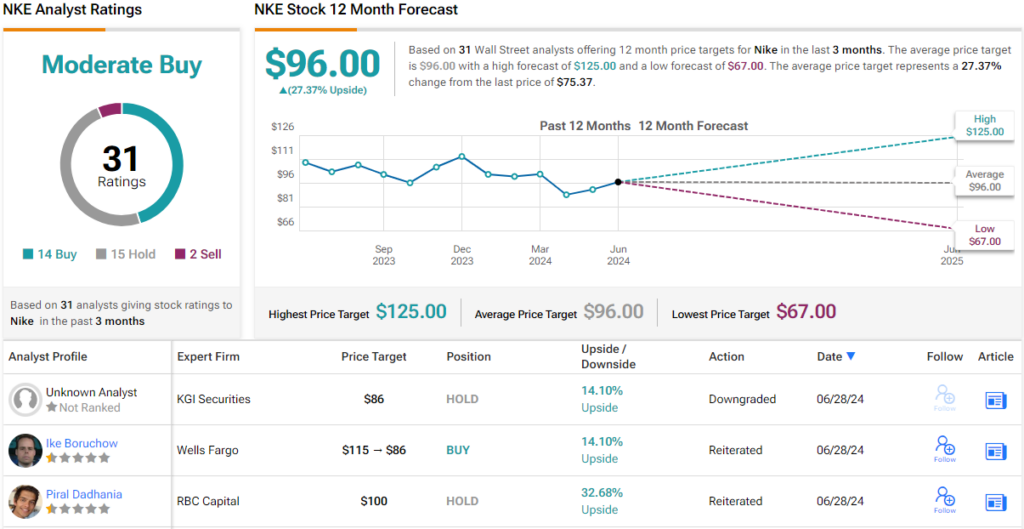

All informed, Nagel charges Nike stocks an Outperform (i.e., Purchase), with a $120 value goal, suggesting the stocks will rebound 59% over the approaching yr. (To observe Nagel’s monitor report, click on right here)

Maximum of Nagel’s colleagues are virtually flippantly break up between bulls and skeptics. With an extra 13 Purchase suggestions, 15 Holds, plus 2 Sells, the inventory claims a Reasonable Purchase consensus score. At $96, the common value goal elements in one-year returns of ~27%. (See Nike inventory forecast)

To seek out just right concepts for shares buying and selling at sexy valuations, discuss with TipRanks’ Perfect Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The reviews expressed on this article are only the ones of the featured analyst. The content material is meant for use for informational functions most effective. You will need to to do your individual research ahead of making any funding.