SAND’s Open Passion jumped via 5.6% previously 24 hours following a bullish breakout.

The foremost liquidation ranges had been at $0.255 and $0.27, with buyers over-leveraged at those ranges.

The full cryptocurrency marketplace is experiencing a notable restoration.

Amid this, the digital gaming platform The Sandbox [SAND] has damaged out of a powerful bullish development and shifted the sentiment from a downtrend to an uptrend.

SAND technical research and key ranges

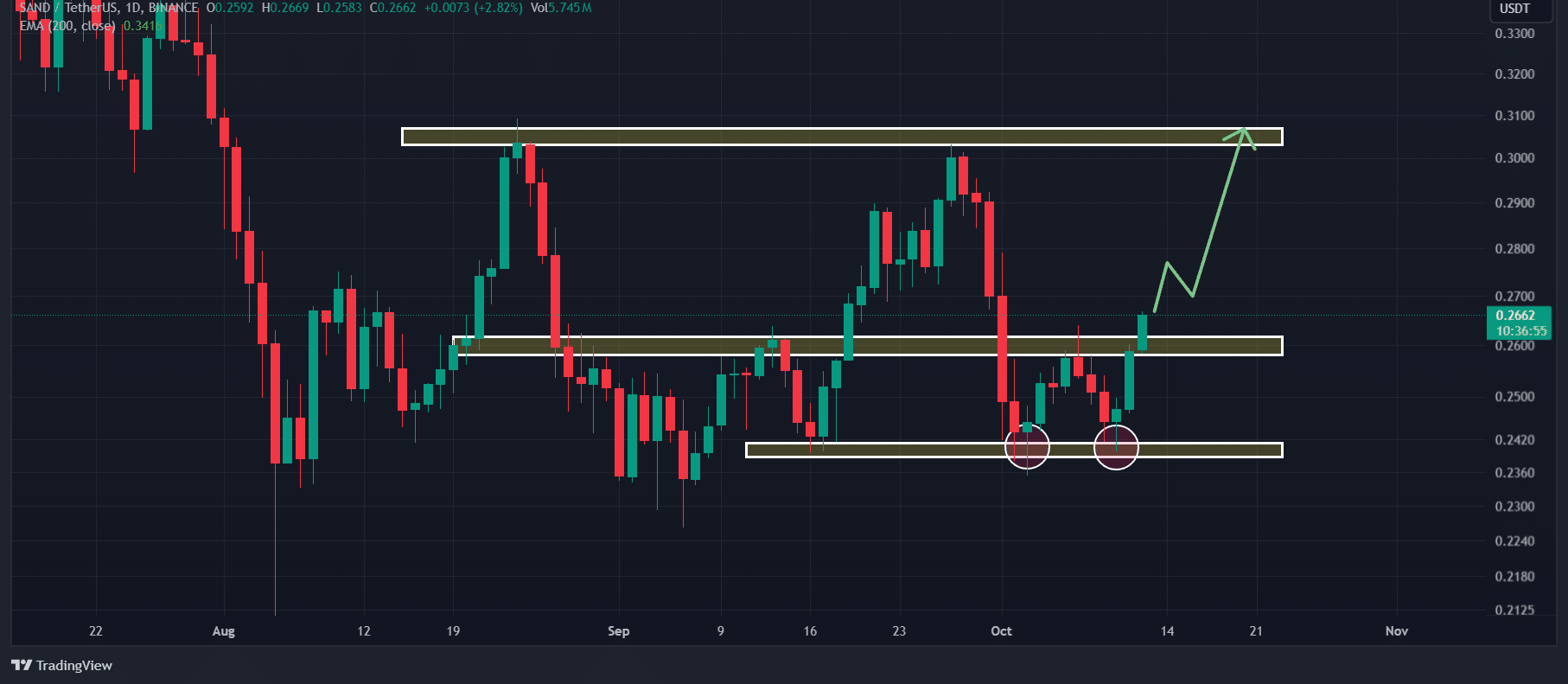

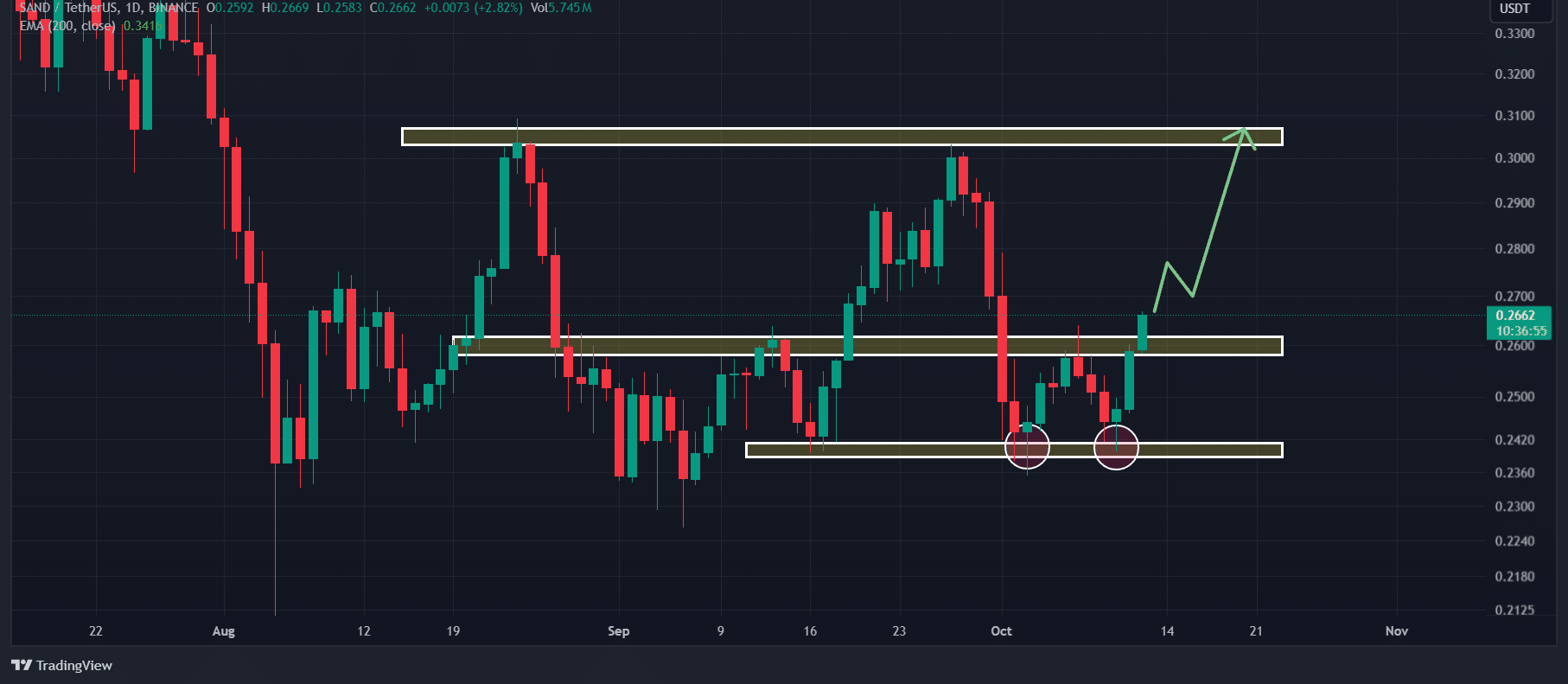

Consistent with AMBCrypto’s technical research, SAND seemed bullish at press time because it broke out of a double-bottom value motion development. The breakout was once showed via the day-to-day candle last above the neckline.

Supply: TradingView

Supply: TradingView

In response to the hot value efficiency, if SAND closes a day-to-day candle above $0.264, there’s a robust risk it might jump via 15% to achieve the $0.305 degree within the coming days.

Moreover, SAND’s Relative Energy Index (RSI) stood at 52.30 at press time, hinting at a possible upside rally forward.

In spite of SAND’s bullish outlooks, the 200 Exponential Shifting Reasonable (EMA) indicated a downtrend. When an asset trades under the 200 EMA, buyers and traders typically believe it to be in a downtrend, and vice versa.

SAND’s bullish on-chain metrics

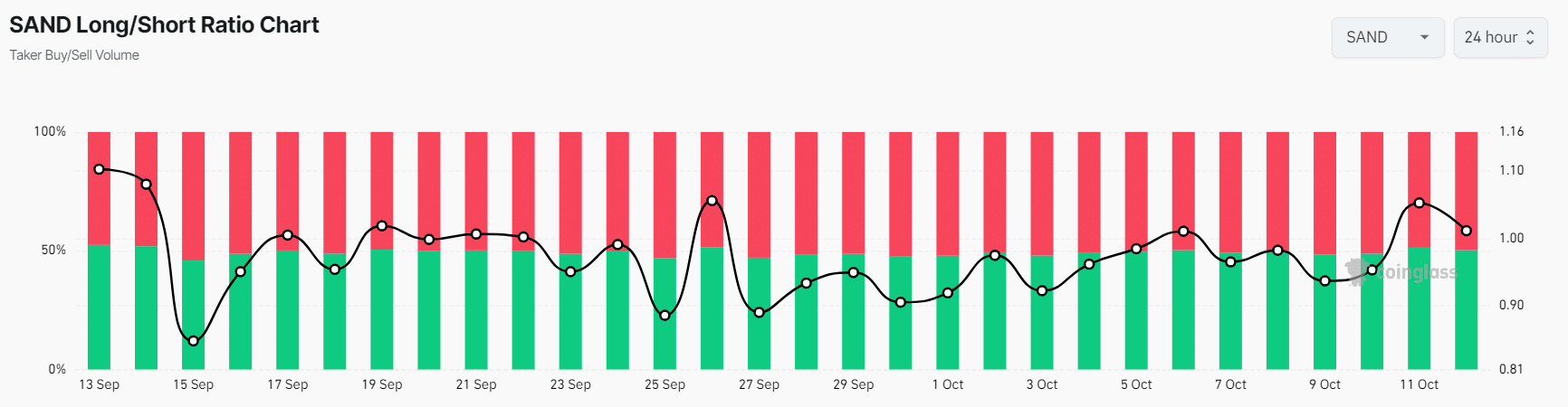

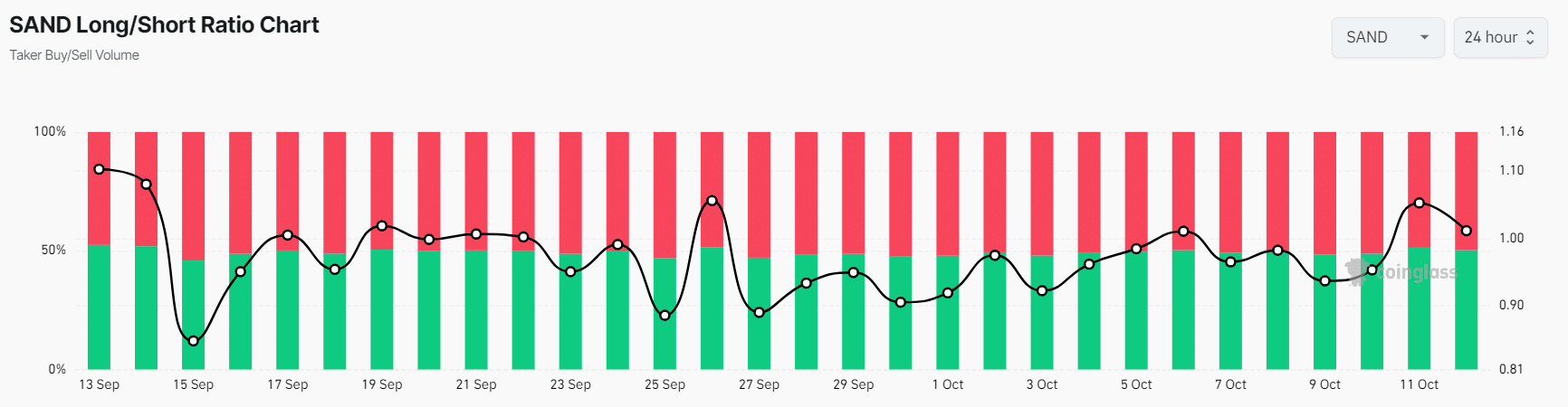

SAND’s bullish outlook is additional supported via on-chain metrics. Consistent with the on-chain analytics company Coinglass, SAND’s Lengthy/Quick Ratio was once 1.03 at press time, indicating bullish marketplace sentiment.

Supply: Coinglass

Supply: Coinglass

Moreover, its Futures Open Passion jumped via 5.6% previously 24 hours and three.91% over the last 4 hours.

This urged rising buyers’ pastime within the SAND token following the breakout of the double-bottom value motion development.

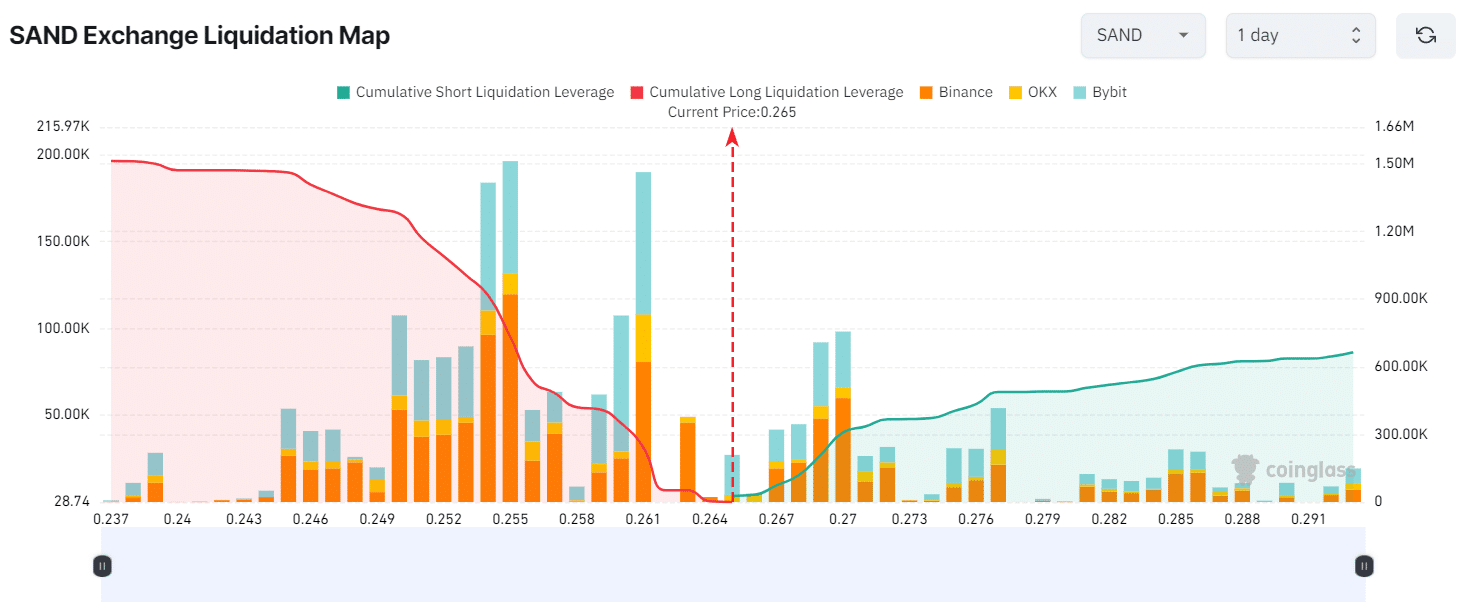

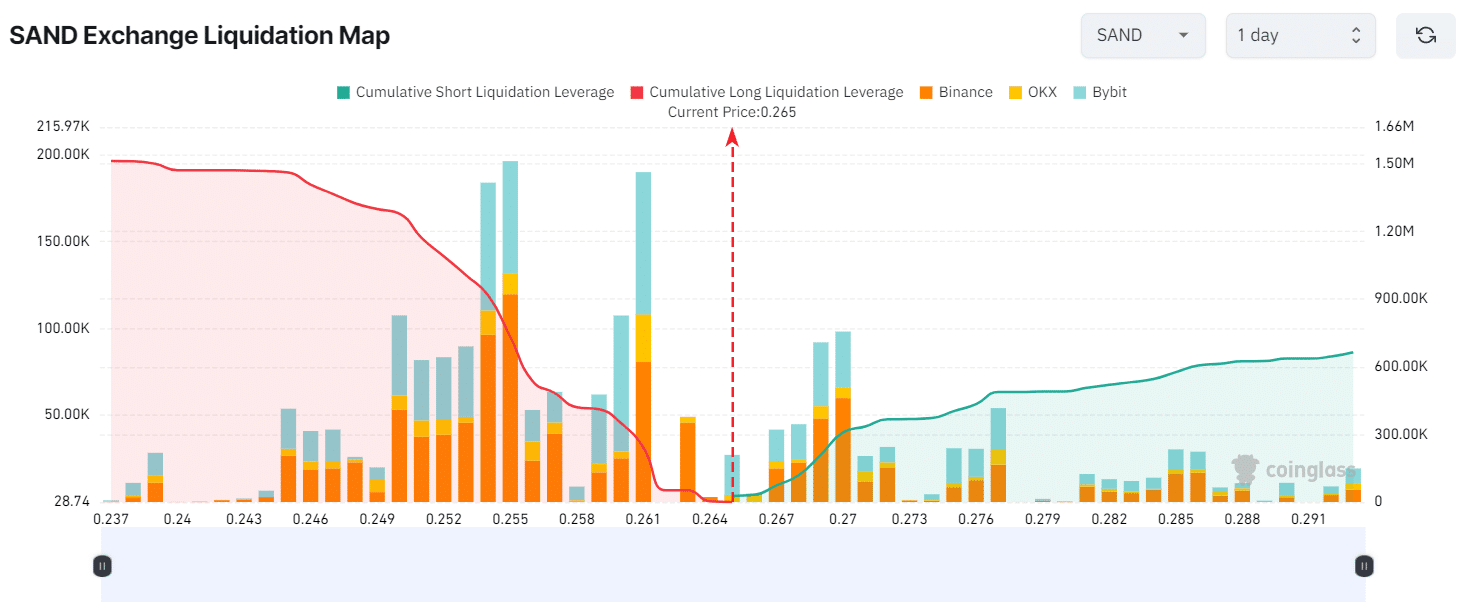

Main liquidation ranges

As of now, the most important liquidation ranges are at $0.255 at the decrease aspect and $0.27 at the higher aspect, with buyers over-leveraged at those ranges, in keeping with Coinglass.

Supply: Coinglass

Supply: Coinglass

If the marketplace sentiment stays unchanged and the cost rises to the $0.27 degree, just about $308,620 price of quick positions might be liquidated.

Conversely, if the sentiment shifts and the cost falls to the $0.255 degree, roughly $732,960 price of lengthy positions might be liquidated.

This liquidation knowledge displays, that bulls’ lengthy positions are greater than double of bears’ quick positions.

Combining these types of on-chain metrics with technical research, it seems that that bulls are lately dominating the asset and feature the possible to enhance SAND within the imminent upside rally.

Learn The Sandbox’s [SAND] Worth Prediction 2024–2025

Present value momentum

At press time, SAND is buying and selling close to $0.266 and has skilled a value surge of over 5.2% previously 24 hours.

All over the similar duration, its buying and selling quantity declined via 6%, indicating decrease participation from buyers and traders.

Subsequent: CARV crypto surges 65% since release – What’s the reason why?