![]()

Journalist

Posted: December 31, 2024

Solana’s buying and selling quantity dipped sharply within the final seven days.

A key technical indicator hinted at a worth drop quickly.

Solana [SOL] has witnessed a slight correction within the final 24 hours, like all different cryptos. On the other hand, a up to date research published that it’s the most important for the token to hover inside a selected vary with a purpose to dangle its value.

Will SOL be in a position to take action, or the finishing of 2024 may witness SOL shedding marketplace capitalization?

Solana’s the most important degree!

After a just about 5% weekly value hike, the token’s worth dropped within the final 24 hours. On the time of writing, SOL was once buying and selling at $193 with a marketplace capitalization of over $92 billion.

Ali Martinez, a well-liked crypto analyst, posted a tweet revealing a fascinating building. Martinez discussed that it is important for the token to maintain its value with the $190-$180 vary.

In case of a plummet beneath that degree, the token may witness an additional value down, which is able to push many buyers in loss.

AMBCrypto then checked Solana’s on-chain information to determine whether or not SOL falling beneath this vary is conceivable within the near-term.

What’s occurring with SOL?

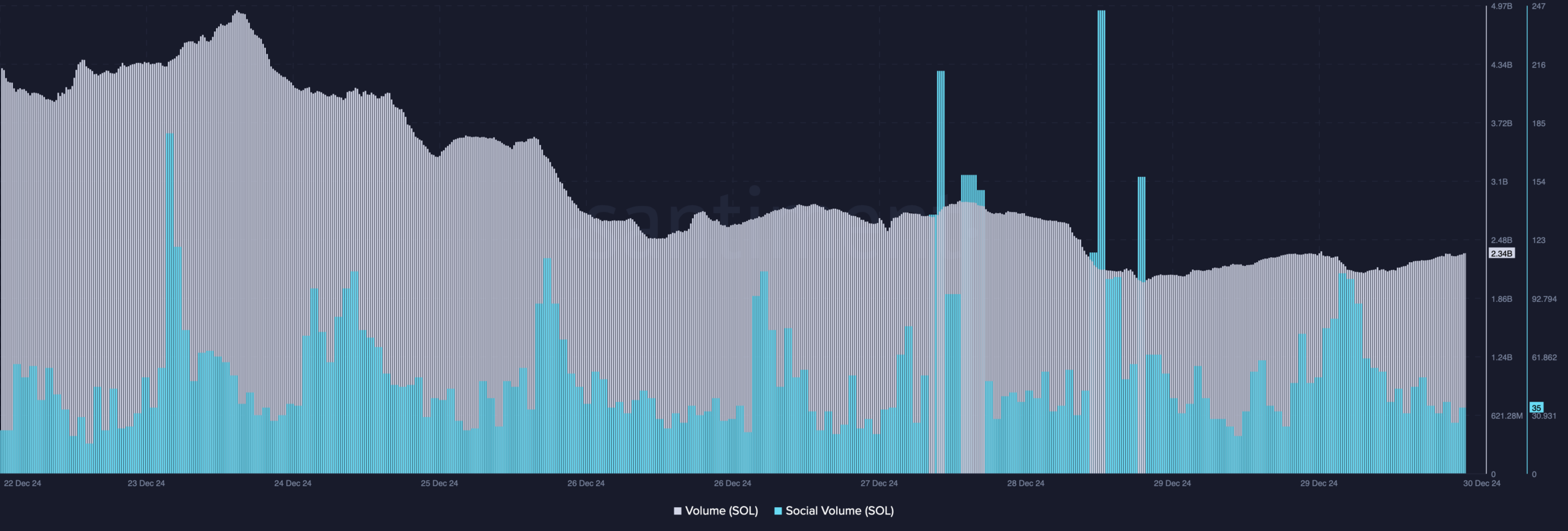

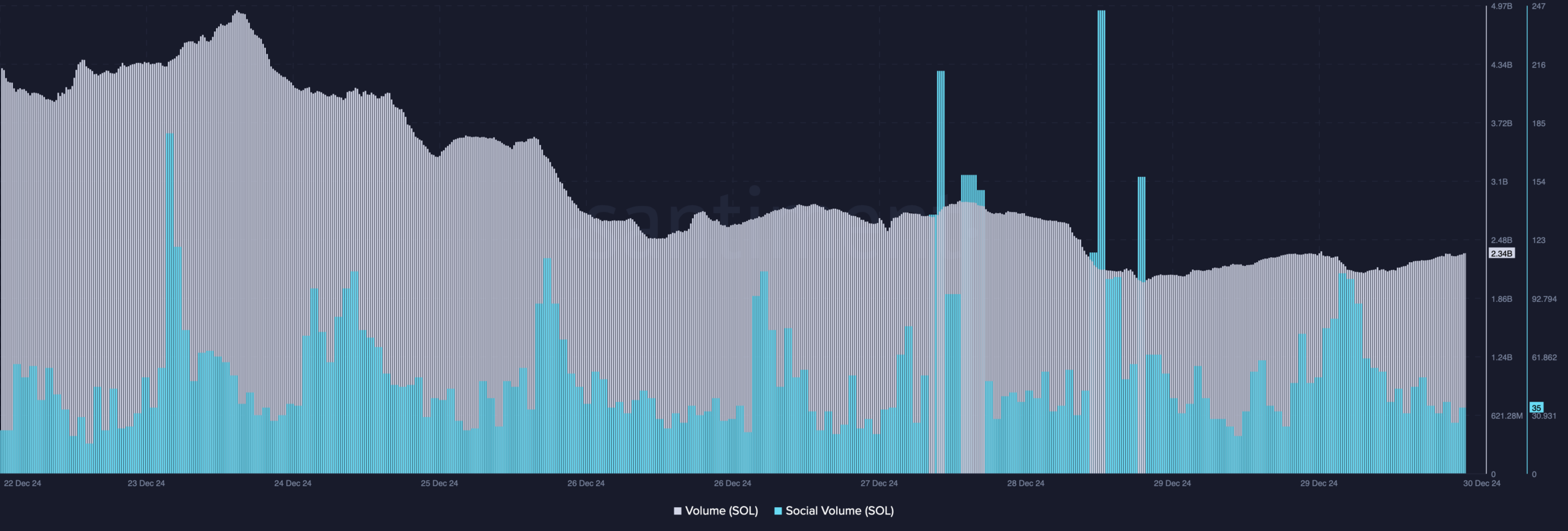

As in step with our research of Santiment’s information, SOL’s value may proceed to drop as its buying and selling quantity declined during the last week. A drop within the metric hints at a persisted bearish development.

However, Solana’s Social Quantity remained top, which mirrored the token’s recognition within the crypto marketplace.

Supply: Santiment

Supply: Santiment

Regardless of the declining quantity, SOL’s Lengthy/Brief Ratio registered an uptick. This intended that there have been extra lengthy positions out there than brief ones, which can also be regarded as a bullish replace.

AMBCrypto’s research of Hyblock Capital’s information published but every other bullish metric, which urged that Solana may now cross beneath the important buying and selling vary.

The token’s purchase quantity touched 86 at the twenty ninth of December. A worth nearer to 100 signifies that purchasing power is top, which has a favorable have an effect on on an asset’s value.

Supply: Hyblock Capital

Supply: Hyblock Capital

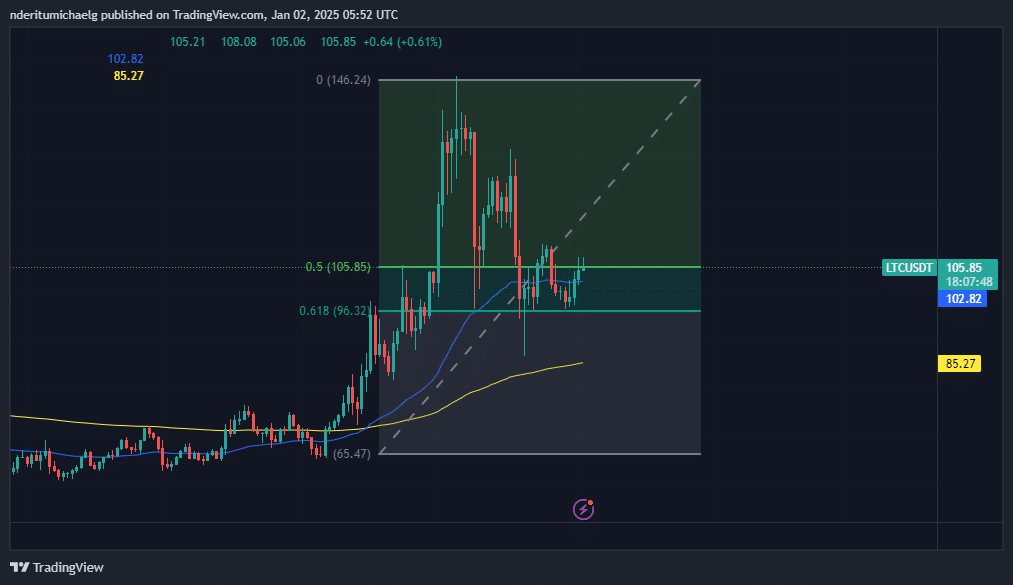

The truth that purchasing power on Solana was once emerging was once additional confirmed by way of a technical indicator. The token’s Relative Power Index (RSI) registered a slight uptick, suggesting a hike in purchasing task.

On the other hand, the Chaikin Cash Float (CMF) dipped within the contemporary previous — a sign of a decline in purchasing task.

Learn Solana’s [SOL] Value Prediction 2025–2026

Whether or not this may increasingly purpose Solana’s value to drop beneath $180 within the coming days, is a query simplest time to respond to.

Supply: TradingView

Supply: TradingView

Subsequent: Solana leads weekly stablecoin expansion: Surges above $5 Billion