Solana’s income failed to pick out up in spite of low congestion at the community

Volatility round SOL diminished, indicating {that a} breakout used to be now not shut.

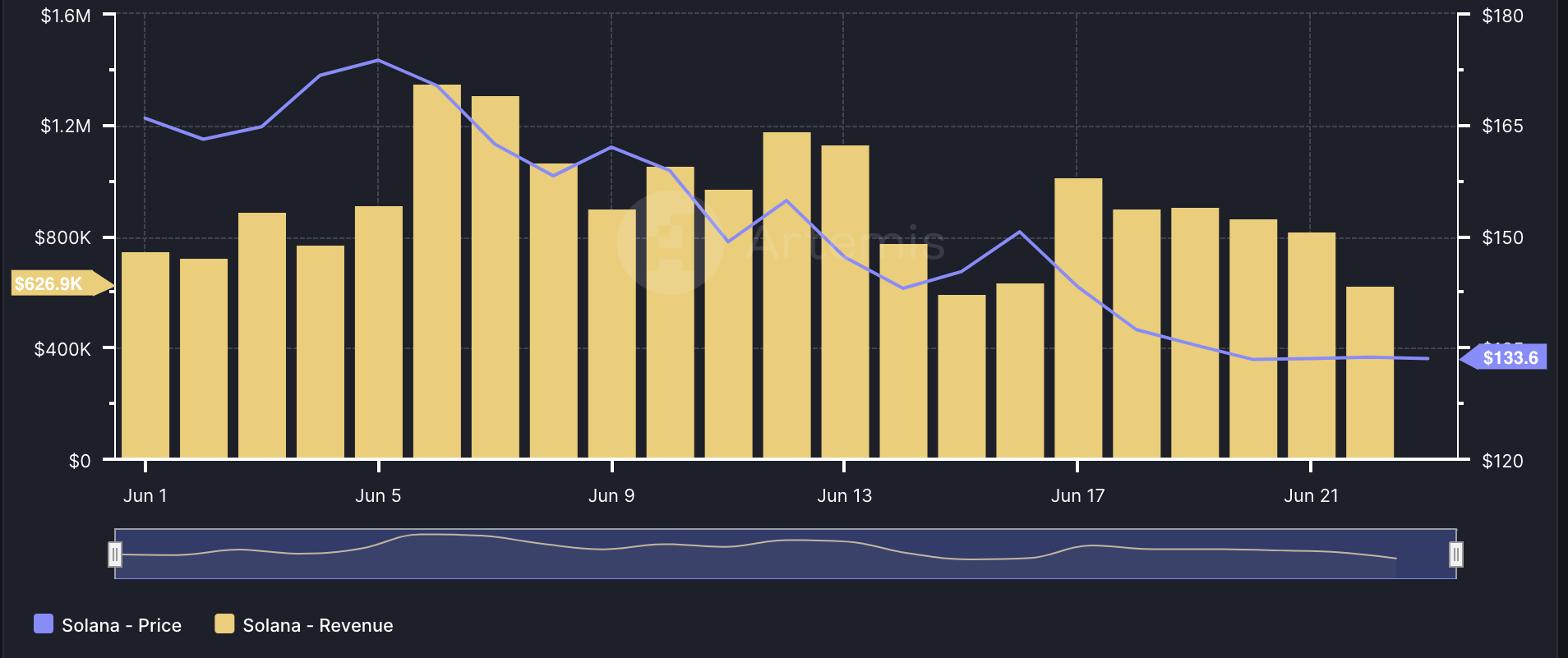

The Solana [SOL] blockchain took a success at the twenty third of June, as its income hit its lowest level within the final seven days. As of this writing, the mission’s income used to be $626,900.

The price used to be a sign of Solana’s financial price. The lower in income to at least one Solana improve that happened some days again.

At the tenth of June, AMBCrypto reported how the mission requested validators to improve to a brand new node.

The theory in the back of the advance used to be to unravel the congestion problems that the blockchain has been experiencing for a while.

Consequently, charges had been not more strangely top, and Solana looked as if it would have maintained its top throughput of two,000 to a few,000 Transactions Consistent with Seconds (TPS).

Supply: Artemis

Supply: Artemis

Good fortune isn’t ultimate for Solana

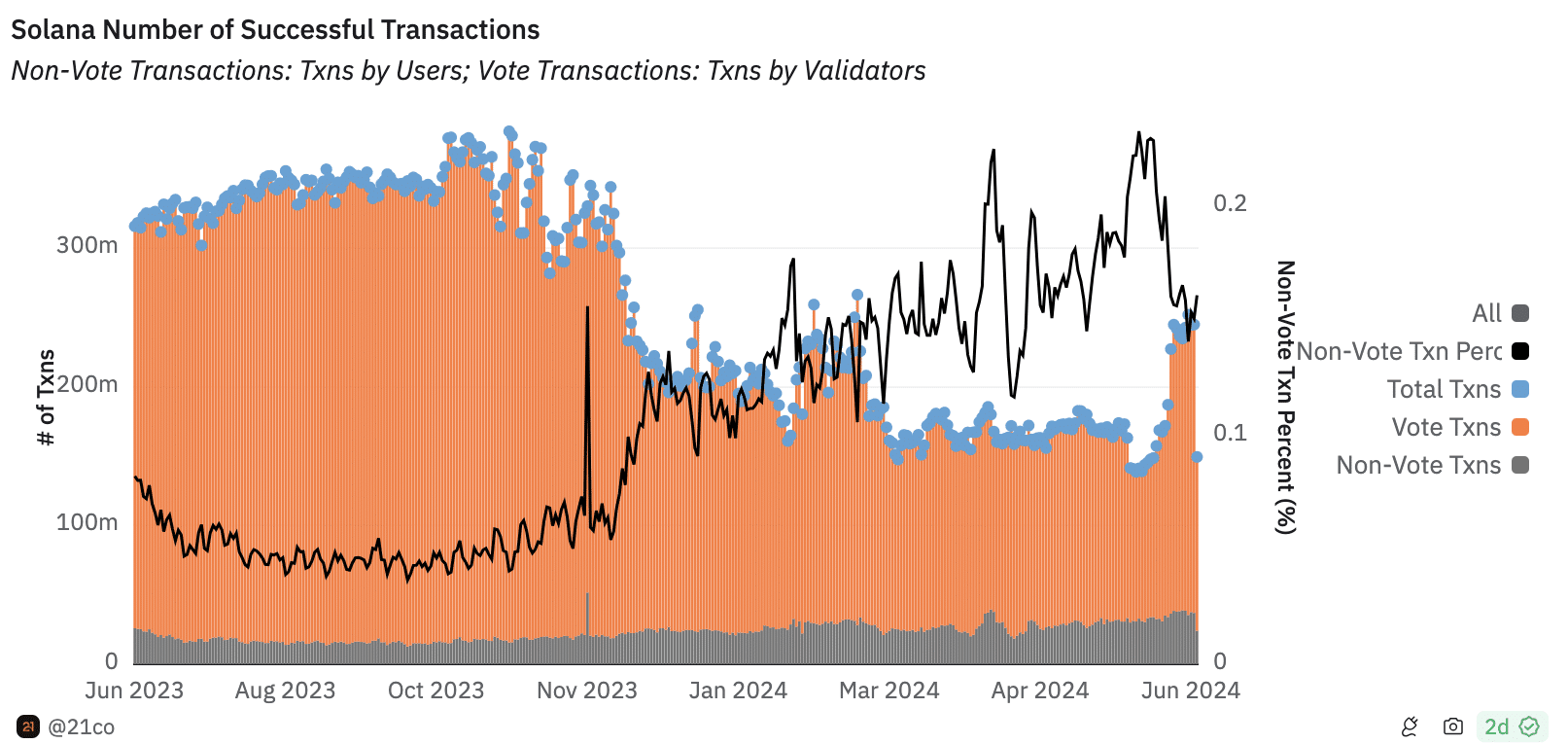

Proof of this mirrored within the collection of a hit transactions. In step with Dune, the collection of vote transactions used to be 206.94 million. Alternatively, non-vote transactions had been 37.57 million.

A non-vote transaction happens when marketplace individuals switch SOL between Solana accounts or sensible contracts. A vote transaction is one submitted via validators at the blockchain.

Due to this fact, the rise implied that almost all transactions pulled thru in comparison to the duration when about 75% of non-vote transactions failed.

Supply: Dune

Supply: Dune

Moreover, this construction may just have an effect on SOL’s value prediction. At press time, the cost of the token used to be $133.71. Whilst SOL tried to leap to $140 at the twenty second of June, bears disrupted the trouble.

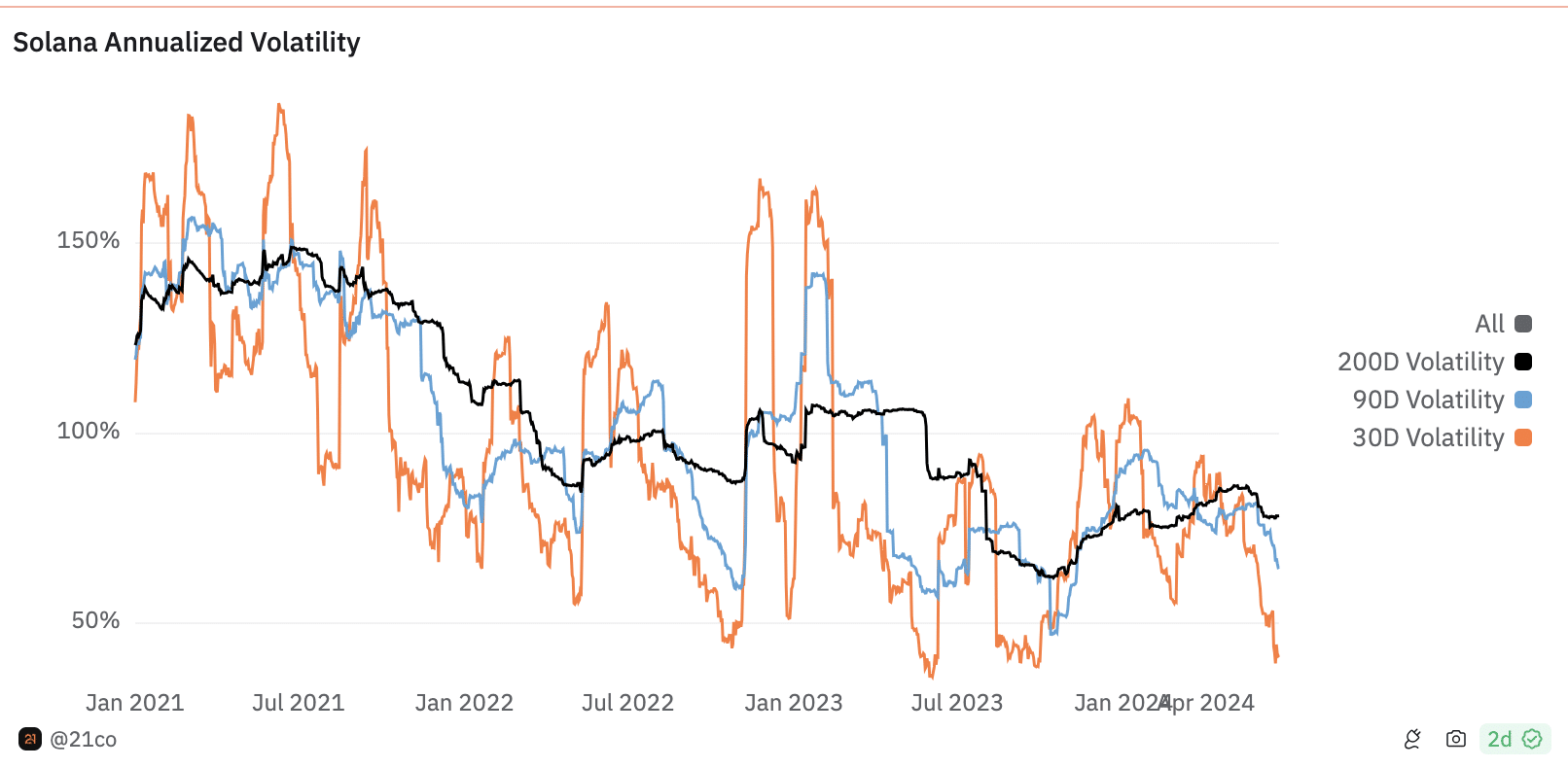

Alternatively, it might be difficult for the token to hit the next value within the quick time period. This used to be on account of the annualized volatility.

SOL to proceed sideways motion

Volatility presentations how temporarily costs can transfer. If the volatility stage is top, it approach the associated fee can leap to an especially top stage inside a brief duration.

Alternatively, low volatility implies another way. For Solana, the 200-day annualized volatility used to be 77.80%. Within the final 90 days, the 66.30%.

However at press time, it had dropped to 39.60%, Dune knowledge confirmed. The lower on this metric signifies that SOL would possibly stay swinging inside a good vary within the coming days.

Supply: Dune

Supply: Dune

Must this situation stay the similar, the price of the cryptocurrency would possibly transfer between $130 and $140.

As well as, the Relative Energy Index (RSI) displayed a bearish momentum. The RSI makes use of velocity and measurement of value adjustments to turn the momentum of a cryptocurrency.

Readings above 70 point out an asset is overbought, whilst the ones beneath 30 point out that it’s oversold. At press time, the RSI at the SOL/USD chart used to be right down to 45.00.

Learn Solana’s [SOL] Value Prediction 2024-2025

The downtrend of the indicator printed that the momentum used to be bearish.

Supply: Santiment

Supply: Santiment

Thus, SOL’s value prediction might be one who strikes downward within the quick time period. Alternatively, invalidation would possibly happen if costs within the wider marketplace start to building up.