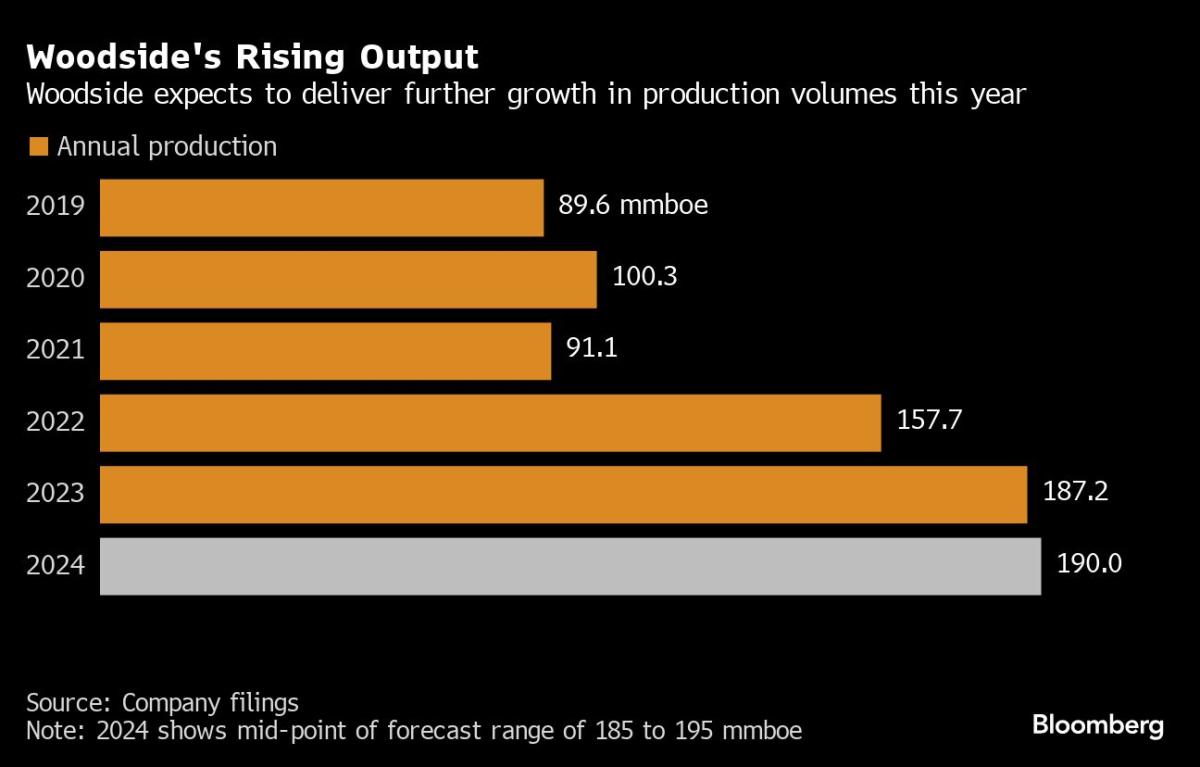

(Bloomberg) — Woodside Power Workforce Ltd. has agreed to shop for US liquefied herbal fuel export undertaking developer Tellurian Inc. for approximately $900 million in a chance on speedy expansion in world call for for the gasoline.Maximum Learn from BloombergAustralia’s largest oil and fuel manufacturer pays about $1 a percentage in money to take complete regulate of Tellurian, together with the proposed US Gulf Coast Driftwood LNG undertaking, it mentioned Monday. Woodside’s stocks fell 2.1% in Sydney, their largest one-day drop since Would possibly 1, after the scoop used to be introduced. Tellurian stocks rose over 65% in pre-market buying and selling Monday morning in New York.Woodside has been one of the vital vocal power firms in arguing that extra fuel will likely be had to supplement the growth of intermittent renewable power resources. It’s been at the hunt for doable US LNG investments to assist extend its provide portfolio and Driftwood is solely one of the most handful that haven’t been suffering from President Joe Biden’s pause on approvals in January.“The purchase of Tellurian and its Driftwood LNG building alternative positions Woodside to be a world LNG powerhouse,” Woodside Leader Govt Officer Meg O’Neill mentioned. “A complementary US place would permit us to higher serve shoppers globally and seize additional advertising and marketing optimization alternatives throughout each the Atlantic and Pacific Basins.”Woodside is concentrated on a last funding determination for the primary segment of the Driftwood undertaking from the primary quarter of 2025. If all 4 levels are finished, the Louisiana facility would be capable of export 27.6 million heaps a yr — virtually triple Woodside’s present capability and just about 6% of the worldwide general on the finish of closing yr.Tellurian has been suffering to carry the ability to fruition since its 2016 founding by means of LNG business pioneer Charif Souki, who left in December amid his personal non-public chapter court cases. Martin Houston — every other business veteran who co-founded Tellurian and is its present chairman — has vowed to slash prices, and there have been previous discussions to promote the trade.“Woodside entering into Driftwood supplies a top level of sure bet across the undertaking,” Houston mentioned in an interview.Driftwood has differed from different US LNG tasks by means of inking long-term contracts related to Asian and Eu spot costs. That revealed importers to the risky spot marketplace and in the end value Tellurian plenty of doable offers, together with with a significant Indian buyer, Shell Plc and Vitol SA.Tale continuesWoodside “can higher take ahead the undertaking than Tellurian can,” mentioned Saul Kavonic, an power analyst at Sydney-based MST Marquee. The Australian corporate “can treatment advertising and marketing relationships, investment, and operator capacity deficits. That is the type of deal Woodside will have to be doing — the place Woodside can input affordably and upload worth.”US personal fairness fuel driller Aethon Power has a non-binding settlement to shop for LNG from the Driftwood undertaking, after previous this yr obtaining Tellurian’s upstream fuel property. President Gordon Huddleston mentioned in an interview that the company appears to be like ahead to running with Woodside.Woodside has been exploring alternatives to spice up exports. Previous this yr, it ended talks with smaller rival Santos Ltd. that will have made it one the most important LNG manufacturers within the Asia-Pacific area. The corporate expects to carry doable companions into the Driftwood undertaking, and objectives to promote about 50%, it mentioned in a presentation.O’Neill mentioned on an analyst name that the corporate has already gained pastime to paintings in combination on US LNG. The transaction is anticipated to be finished within the fourth quarter.–With the help of Rob Verdonck and Elizabeth Elkin.(Updates with percentage worth in 2d paragraph.)Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

Woodside to Purchase Tellurian in $900 Million Wager on Fuel Call for