The token’s worth declined through over 3% within the final seven days.

A couple of metrics regarded bullish, however marketplace signs instructed in a different way.

XRP bears ruled the marketplace final week as its worth dropped all through that duration. Issues may worsen for the token as a bearish development emerged at the token’s worth chart.

A bearish breakout may lead to a considerable loss within the token’s marketplace capitalization over the approaching days.

XRP bears getting able

CoinMarketCap’s knowledge printed that XRP witnessed a greater than 3% worth decline during the last seven days. On the time of writing, the token used to be buying and selling at $0.519 with a marketplace capitalization of over $28.7 billion, making it the 7th greatest crypto.

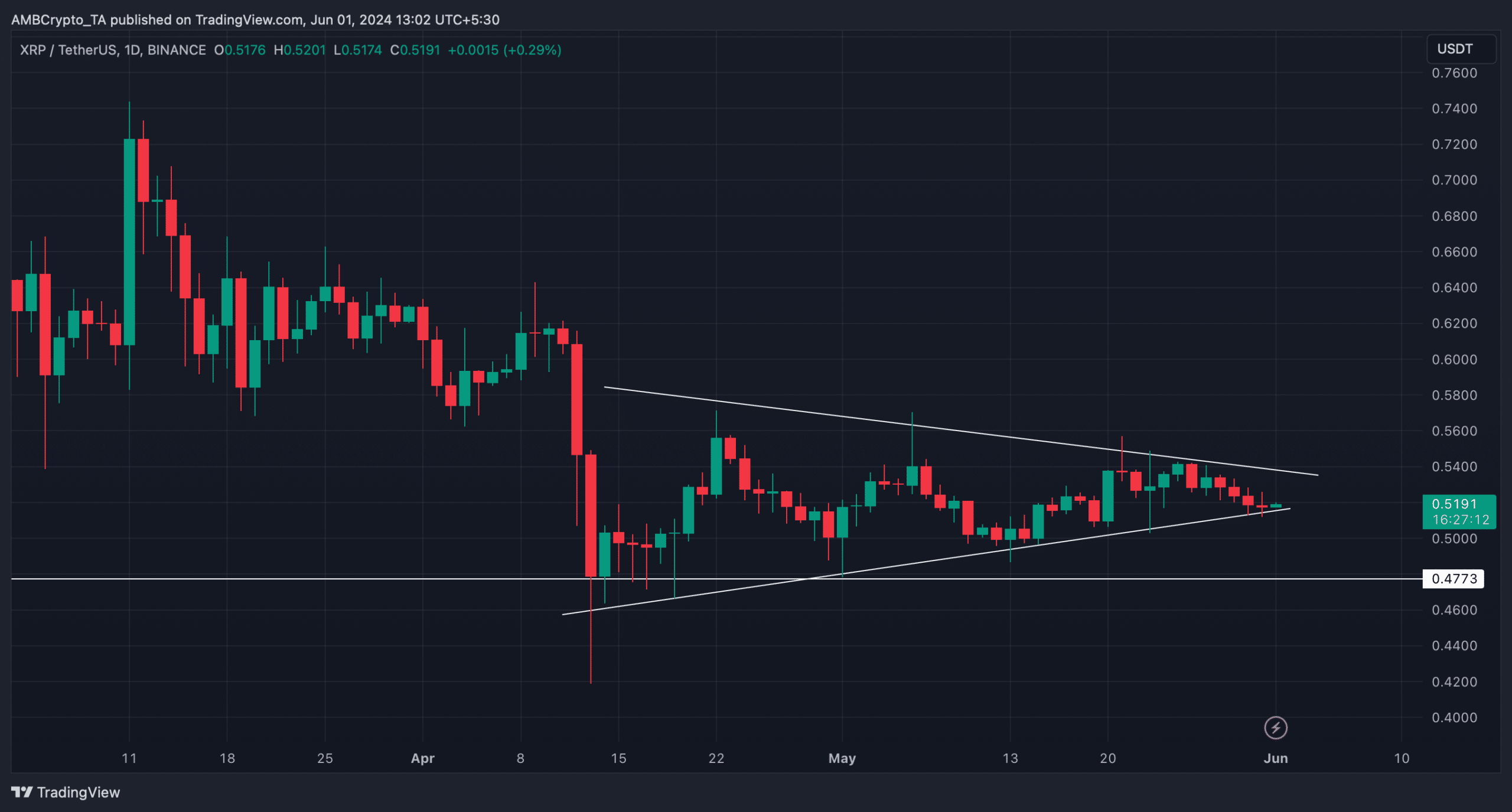

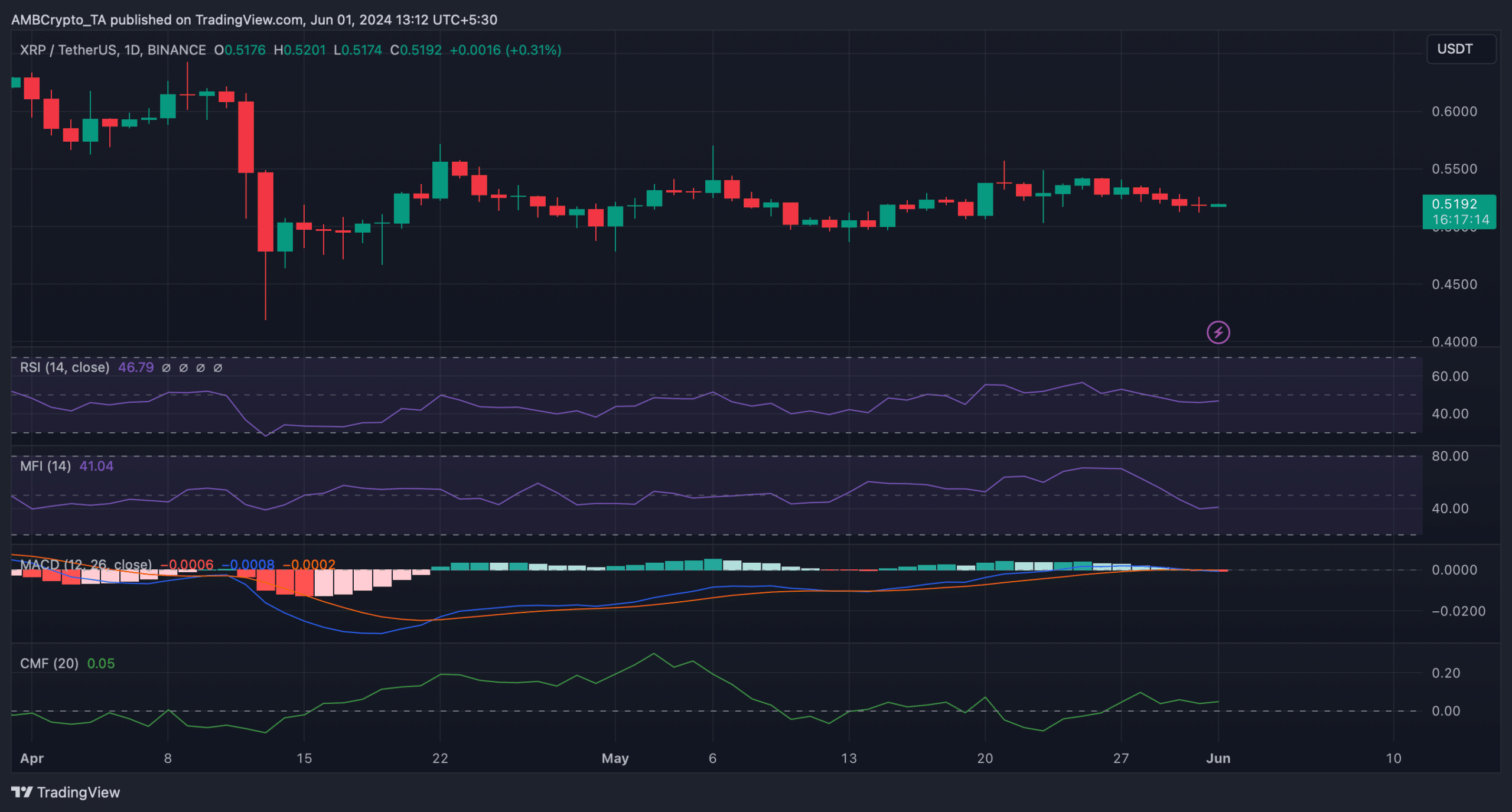

In the meantime, AMBCrypto’s research of the token’s worth chart printed a bearish pennant development.

Supply: TradingView

Supply: TradingView

The token’s worth entered this development in mid-April and because then has consolidated within the development. At press time, the token’s worth used to be trying out the decrease restrict of the development.

If bears stay keep watch over, then a southward breakout may occur quickly. If that seems to be true, then buyers may witness the token’s worth drop to $0.477.

Is a value decline inevitable?

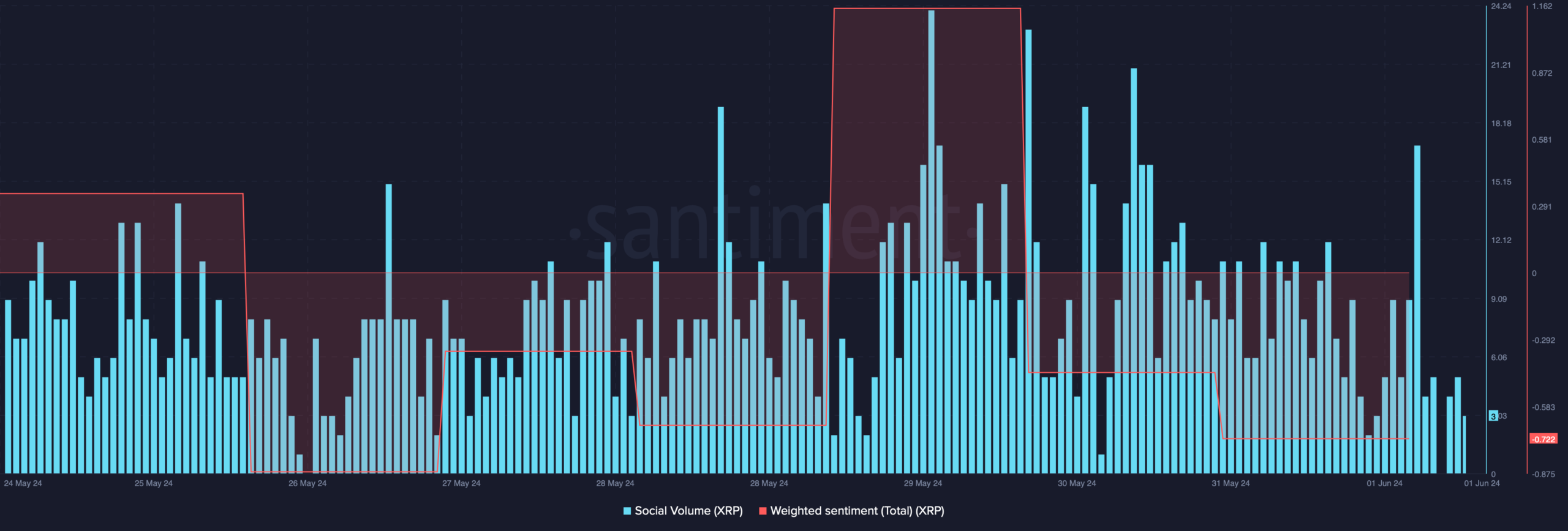

To grasp whether or not the potential of a value decline used to be most probably, AMBCrypto analyzed the token’s on-chain metrics. As in keeping with our research of Santiment’s knowledge, XRP’s social quantity remained top, reflecting its recognition within the crypto area.

Alternatively, its weighted sentiment remained within the damaging zone, which intended that bearish sentiment used to be dominant out there.

Supply: Santiment

Supply: Santiment

On most sensible of that, Coinglass’ knowledge printed that XRP’s lengthy/quick ratio registered a decline within the 4-hour time frame. A low ratio suggests bearish sentiment, additional hinting at a value decline.

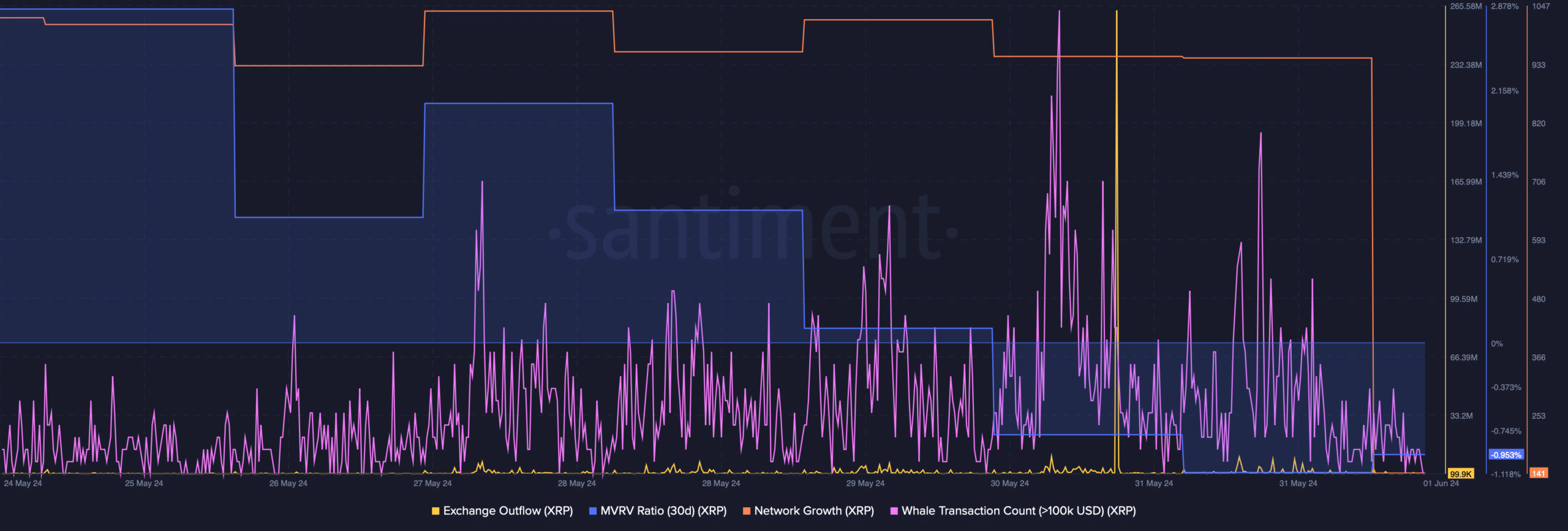

Moreover, its MVRV ratio dropped sharply, which may also be inferred as a bearish sign.

However, the remainder of the metrics supported the bulls. As an example, XRP’s trade outflow spiked final week. The token’s selection of whale transactions used to be rather top, suggesting that whales had been actively buying and selling the token.

Extra addresses had been created to switch the token, which used to be obvious from its top community enlargement.

Supply: Santiment

Supply: Santiment

We then analyzed its day-to-day chart to raised perceive which approach the token’s worth used to be headed. We discovered that the MACD displayed a bearish crossover. At press time, the Relative Power Index (RSI) had a price of 46.74, which means that it used to be bearish.

Real looking or no longer, right here’s XRP’s marketplace cap in BTC’s phrases

On most sensible of that, the token’s Cash Go with the flow Index (MFI) additionally registered a downtick and used to be resting below the impartial mark. Those marketplace signs instructed that the potential of a bearish breakout used to be top.

Alternatively, the Chaikin Cash Go with the flow (CMF) remained fairly bullish because it used to be nonetheless above the impartial mark.

Supply: TradingView

Supply: TradingView