Regardless of criminal readability, XRP faces marketplace struggles with falling process and value declines.

XRP’s bearish momentum persists, as vulnerable purchasing power and declining addresses sign wary sentiment.

Ripple will have gained the court docket struggle, however XRP is shedding floor available in the market. The SEC shedding its attraction will have to were a game-changer, cementing XRP’s non-security standing.

As a substitute, lively addresses have plummeted just about 70%, and the token’s value has slumped 11% in only a week.

Perhaps readability doesn’t all the time imply victory.

A criminal victory with “ripple” results

The U.S. SEC has dropped its attraction within the Ripple case, marking a pivotal second for the crypto trade.

After years of criminal wrangling, the verdict to not problem the 2023 ruling through U.S. District Pass judgement on Analisa Torres brings long-awaited readability to XRP’s regulatory standing.

The ruling showed that Ripple’s programmatic gross sales of XRP by means of secondary exchanges like Coinbase and Kraken didn’t violate securities rules, despite the fact that direct gross sales to institutional traders had been deemed securities violations, costing Ripple $125 million.

Professionals have emphasised the importance of the SEC’s resolution, because the Ripple case had stepped forward additional than different dropped circumstances, equivalent to the ones in opposition to Coinbase and Kraken.

With the criminal mud settling, the focal point now shifts to the opportunity of an XRP ETF, with marketplace optimism rising round doable approval in 2025.

However all isn’t what it sort of feels.

Falling process, declining value

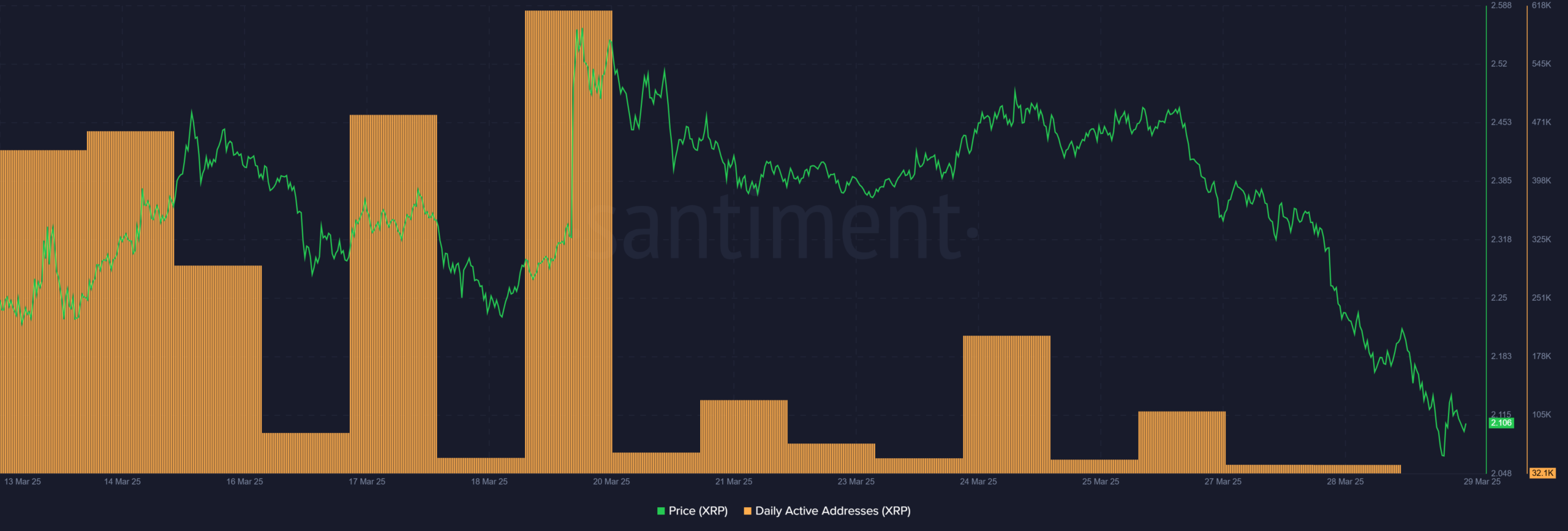

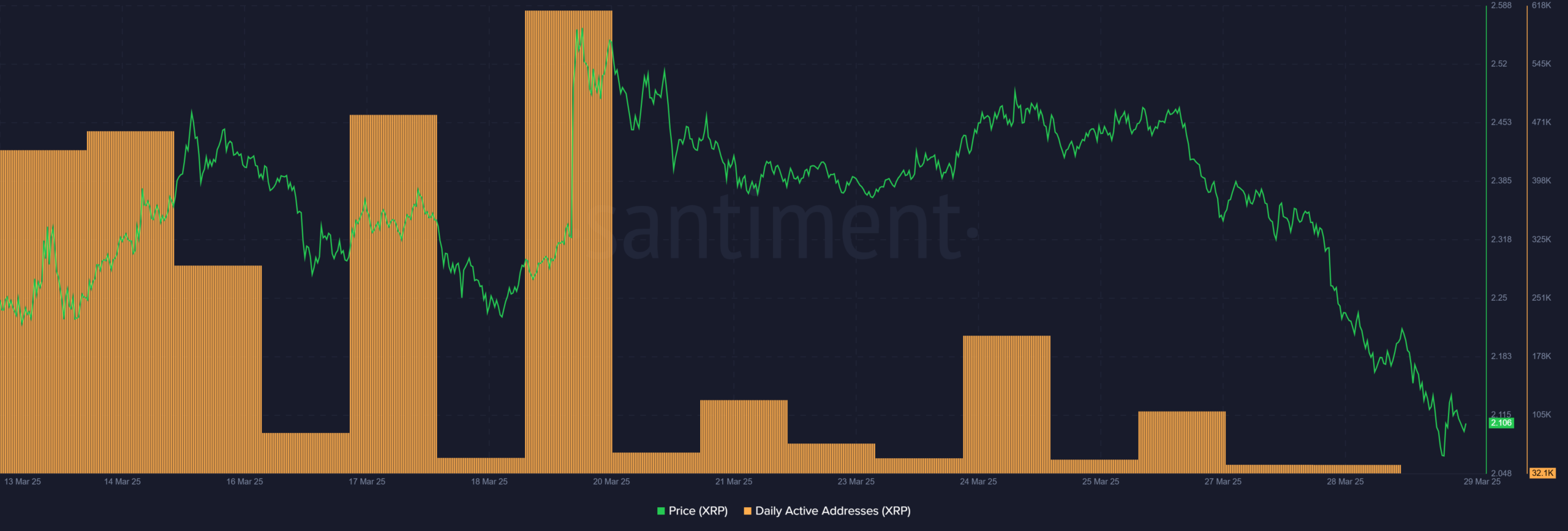

Regardless of the criminal victory, XRP’s marketplace efficiency tells a unique tale. On-chain information unearths a steep decline in day by day lively addresses, suggesting waning consumer engagement.

Supply: Santiment

Supply: Santiment

Traditionally, a pointy lower in lively addresses correlates with decrease liquidity and diminished speculative passion, which will exacerbate downward momentum.

Over the last two weeks, XRP has misplaced over 11% of its price, suffering to search out improve as promoting power mounts.

Supply: CoinMarketCap

Supply: CoinMarketCap

The drop in community process may just point out fading investor self belief, as buyers flip their consideration in different places.

With out renewed software or a basic catalyst, XRP dangers additional drawback except consumers go back to the marketplace in drive.

XRP: Will improve grasp?

XRP’s value motion stays bearish, with the token buying and selling at $2.18 at press time after a short lived reduction leap. The RSI sits at 42.65, signaling vulnerable momentum and room for additional drawback earlier than getting into oversold territory.

In the meantime, the OBV has been trending decrease, suggesting declining purchasing power.

Supply: TradingView

Supply: TradingView

The hot downtrend has noticed XRP lose key improve ranges, and and not using a sturdy reversal, additional dips towards $2.00 are conceivable. If bulls regain keep watch over, resistance close to $2.30 may just pose a problem.

A spoil above this stage could be wanted for a development shift. Alternatively, the declining OBV signifies that buyers stay wary.

If promoting power persists, XRP may just retest decrease helps, probably revisiting $1.90 within the coming days.

Subsequent: Gold at document highs: A danger for Bitcoin or a possibility to reclaim $100k?