![]()

![]()

contributor

Posted: December 29, 2024

XRP confronted bearish sentiment because the crucial $2.73 resistance remained unbroken, irritating buyers.

Futures Open Hobby plunged $1 billion, exposing skepticism over XRP’s near-term restoration possibilities.

XRP has been locked in a chronic consolidation section, soaring under crucial resistance ranges for over a month, without a indicators of a breakout.

This loss of upward momentum has pissed off buyers and eroded marketplace self assurance.

Fresh knowledge paints a bleak image: Within the remaining 48 hours, XRP Futures Open Hobby has nosedived via over $1 billion, highlighting a pointy decline in investor conviction. What’s riding this dramatic shift in sentiment?

XRP Futures OI sheds $1 billion

Supply: Coinglass

Supply: Coinglass

In 48 hours, XRP Futures OI dropped $1 billion, falling from $2.9 billion. This sharp decline adopted a failed breakout rally that in short fueled optimism.

As buyers withdrew capital, the drop in OI printed emerging bearish sentiment. The failure to breach key resistance ranges has larger skepticism about XRP’s near-term possibilities and marketplace task.

XRP: Vital investor uncertainty?

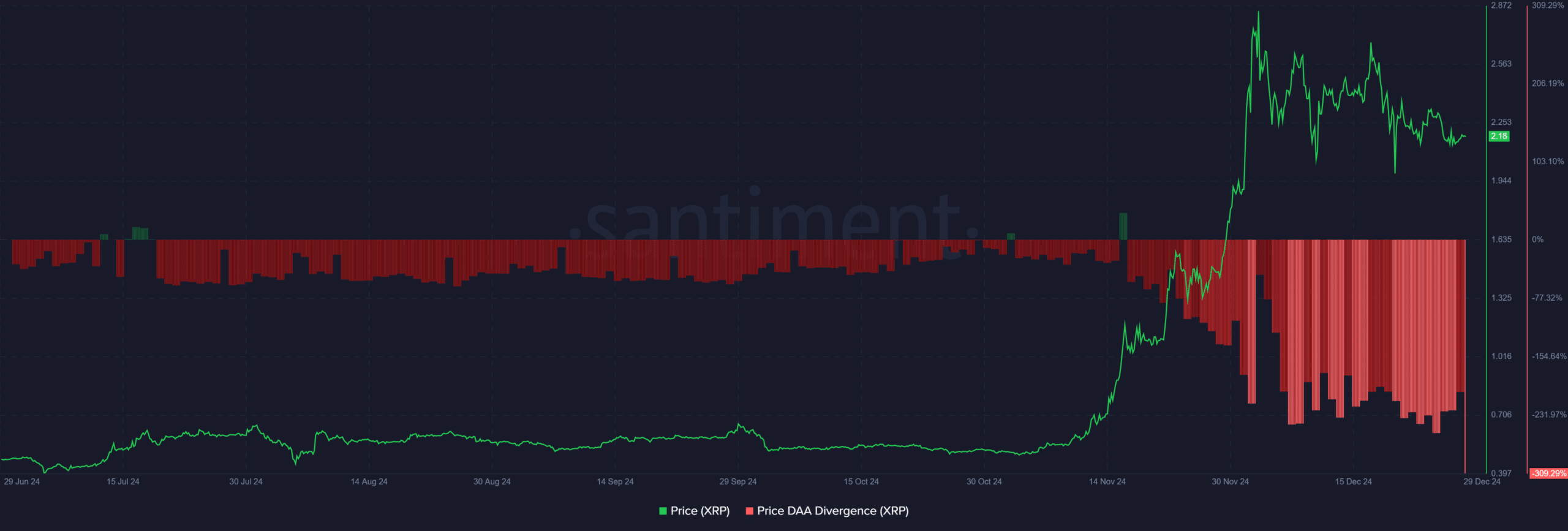

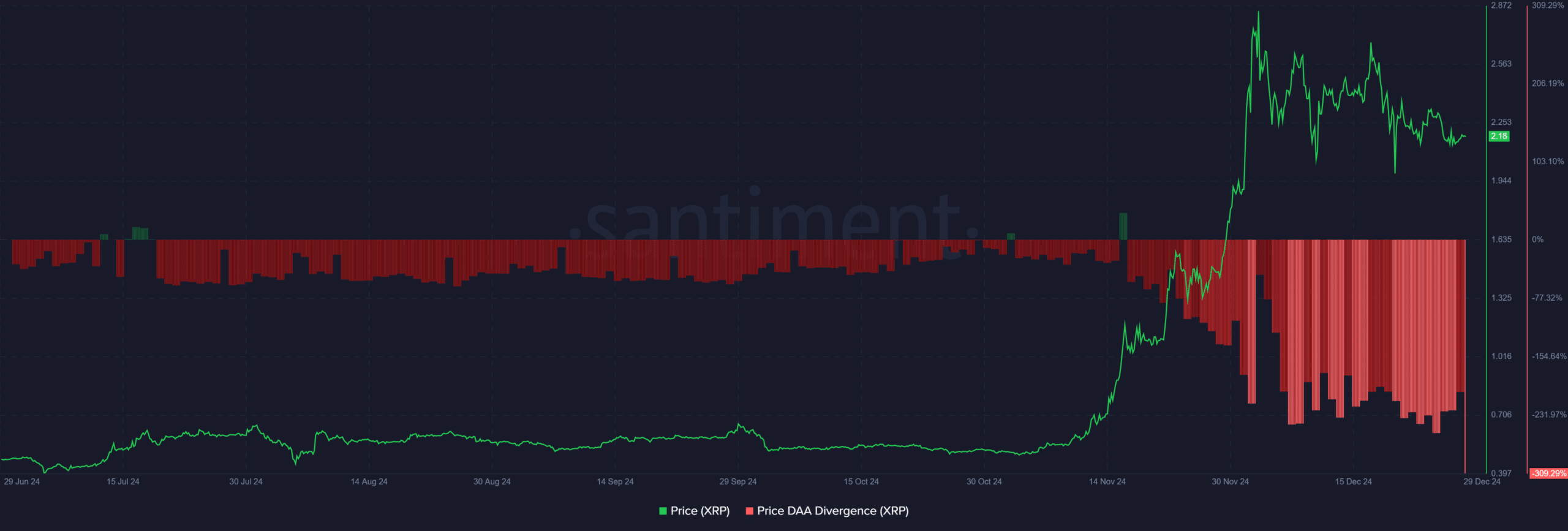

The XRP Value DAA Divergence chart highlighted a crucial mismatch between value efficiency and community task.

As XRP’s value surged in overdue November, DAA divergence grew to become sharply detrimental, signaling that community engagement didn’t scale along the rally.

This divergence suggests the associated fee motion used to be pushed extra via speculative buying and selling somewhat than natural community enlargement or application adoption.

Supply: Santiment

Supply: Santiment

Within the aftermath of the rally, DAA divergence remained in detrimental territory, reflecting power skepticism amongst on-chain individuals.

With out an uptick in lively addresses, the associated fee’s skill to maintain momentum could also be in jeopardy.

The absence of robust on-chain task — regardless of the hot surge — raises considerations concerning the sustainability of any near-term restoration and may stay XRP locked in a consolidated or downward development except community basics strengthen.

Key ranges to look at

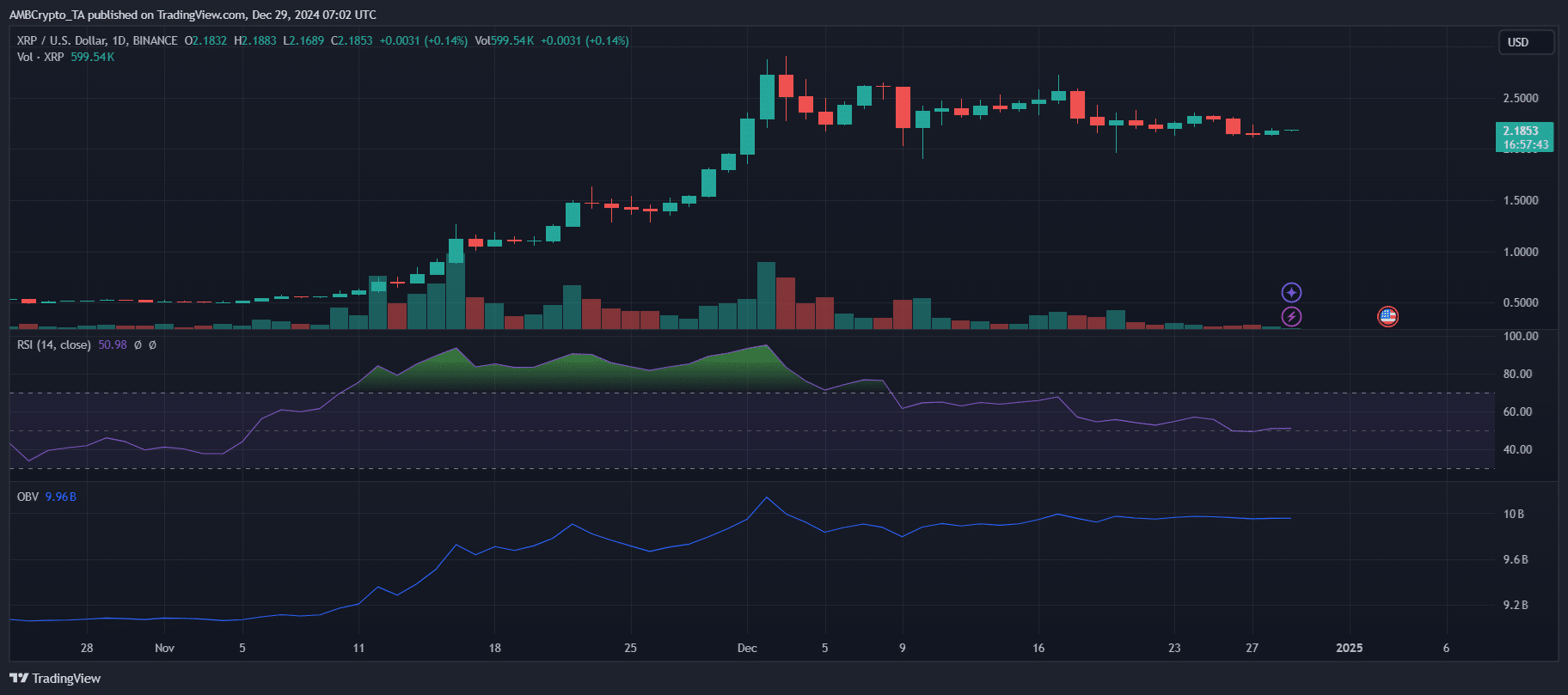

XRP’s value motion stays at a pivotal second, outlined via a chronic consolidation section underneath the $2.73 resistance degree.

Over the last month, the token has shed 20% of its price, but it has controlled to carry company above the crucial $2.00 improve.

This degree serves as each a mental and technical anchor, combating additional declines regardless of the mounting uncertainty in broader marketplace stipulations.

Supply: TradingView

Supply: TradingView

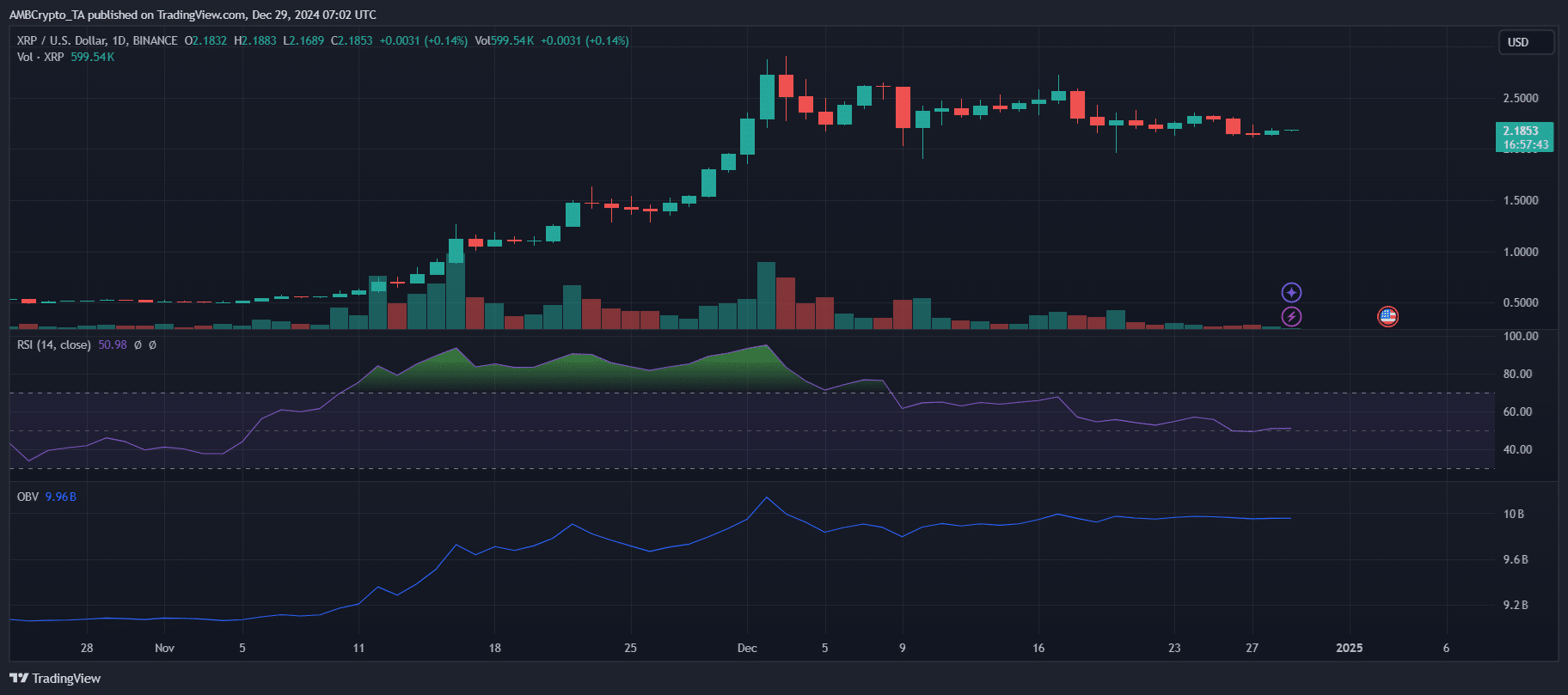

Signs paint a blended image for the token’s trajectory. The RSI hovers close to 50.98, reflecting a impartial marketplace stance and indecision amongst individuals.

Buying and selling quantity stays lackluster, underscoring the absence of vital purchasing drive required for a breakout.

In a similar fashion, OBV tendencies spotlight muted capital inflows, elevating questions concerning the token’s skill to maintain upward momentum with out renewed hobby.

A ruin above $2.73 may pave the best way for a rally towards XRP’s all-time top of $3.31, reigniting investor optimism.

Learn XRP’s Value Prediction 2025–2026

Conversely, a breach of the $2.00 improve would most probably exacerbate the present stagnation, deepening bearish sentiment.

Till a decisive catalyst emerges, XRP seems locked in a state of wary equilibrium, with its subsequent transfer resting on broader marketplace dynamics and the recovery of community self assurance.

Subsequent: Bitcoin change deposits drop to 2016 lows – Right here’s what it approach