The XRP metrics indicated that bulls may see some aid over the following week or two.

Investors wish to plan and be ready for 2 situations that may play out in July.

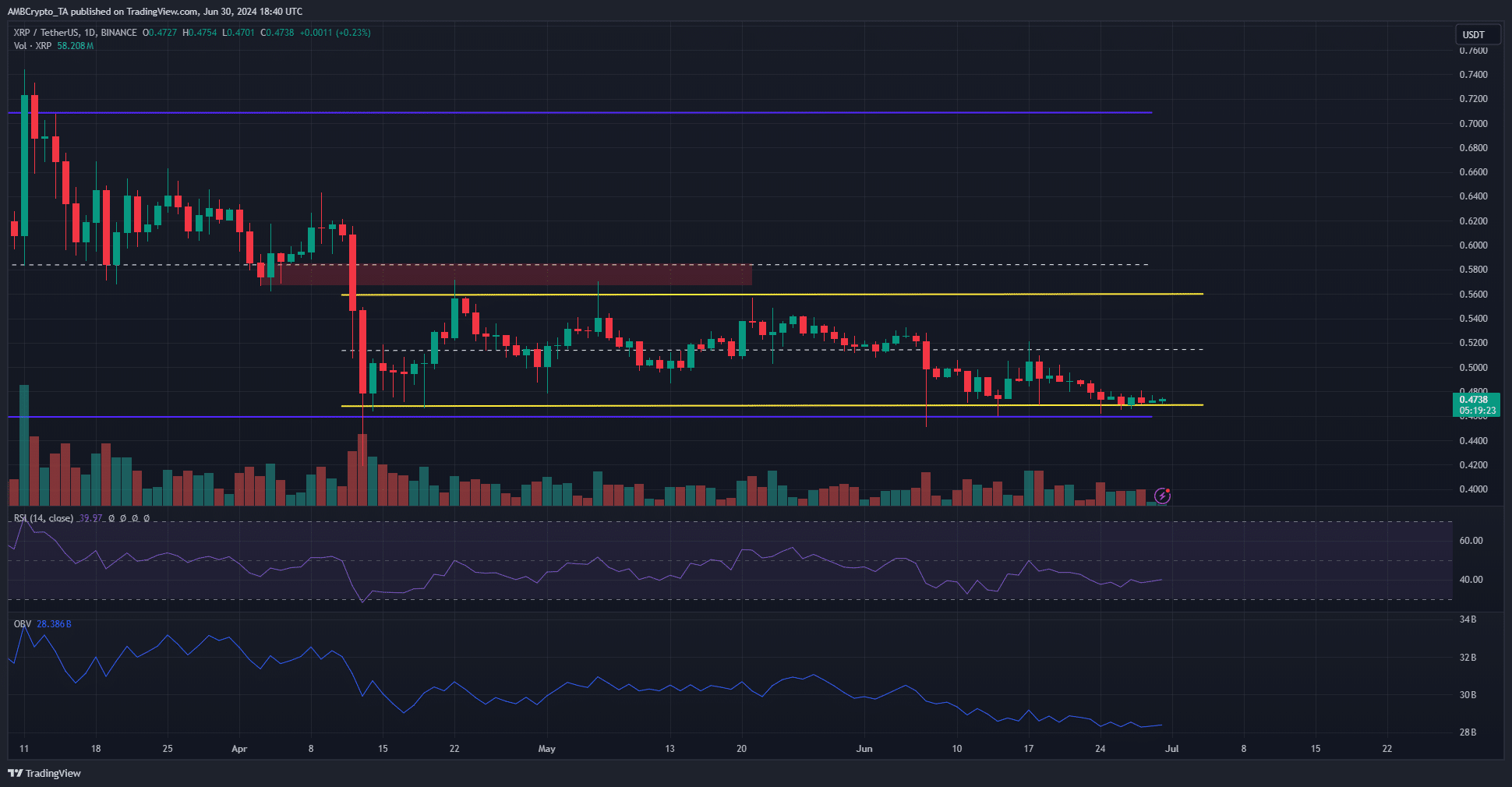

Ripple [XRP] was once buying and selling on the lows of a variety that stretched again to mid-April. A contemporary AMBCrypto document identified that the cost shaped a bullish development right through its contemporary days of consolidation.

Supply: XRP/USDT on TradingView

Supply: XRP/USDT on TradingView

If the cost can set up to wreck out of this wedge development, a 30-40% transfer upward would develop into much more likely. However as issues stand, the momentum and quantity signs spotlight bearish force.

XRP on-chain metrics sign a purchasing alternative

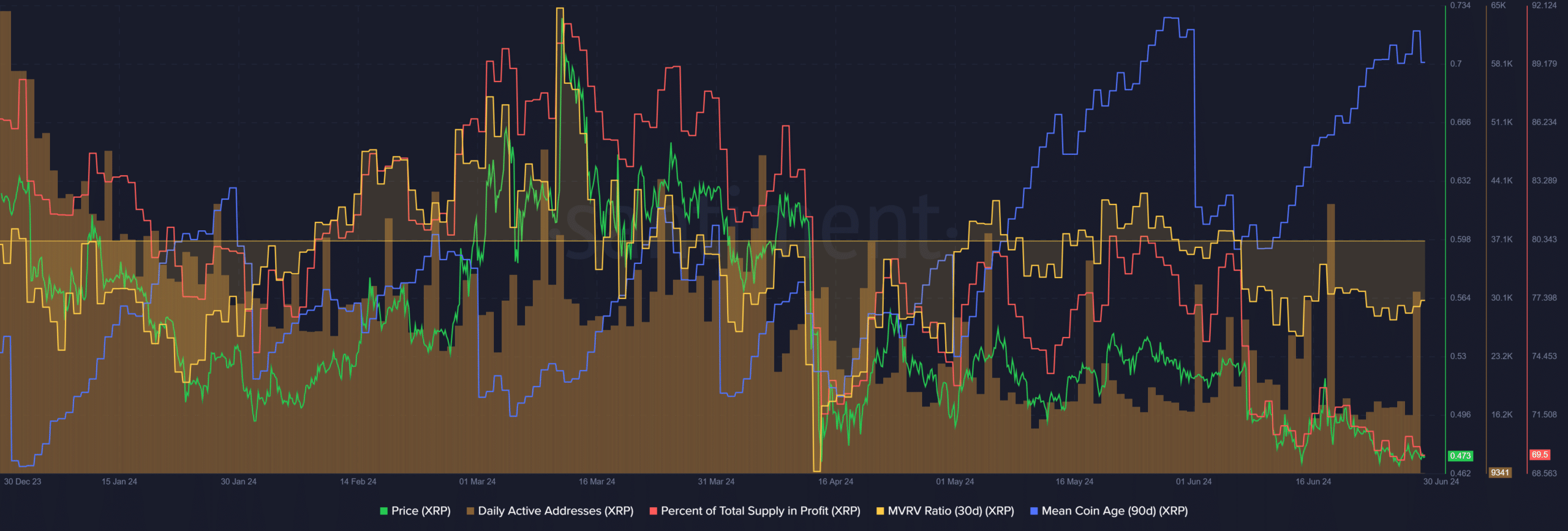

Supply: Santiment

Supply: Santiment

The day by day energetic addresses have slowly trended downward since past due March. On sure days there have been massive spikes in process however total the metric trended decrease. This was once a adverse signal and indicated decreased utilization and insist.

The p.c provide in benefit additionally went down with costs in June, unsurprisingly. The fee transfer noticed the 30-day MVRV drop into adverse territory.

Then again, previously month, the imply coin age started to pattern upward.

In combination, the emerging imply coin age and falling MVRV confirmed accumulation and an undervalued asset and was once a purchase sign. Must buyers take it?

The liquidation information and the 2 situations that may spread right here

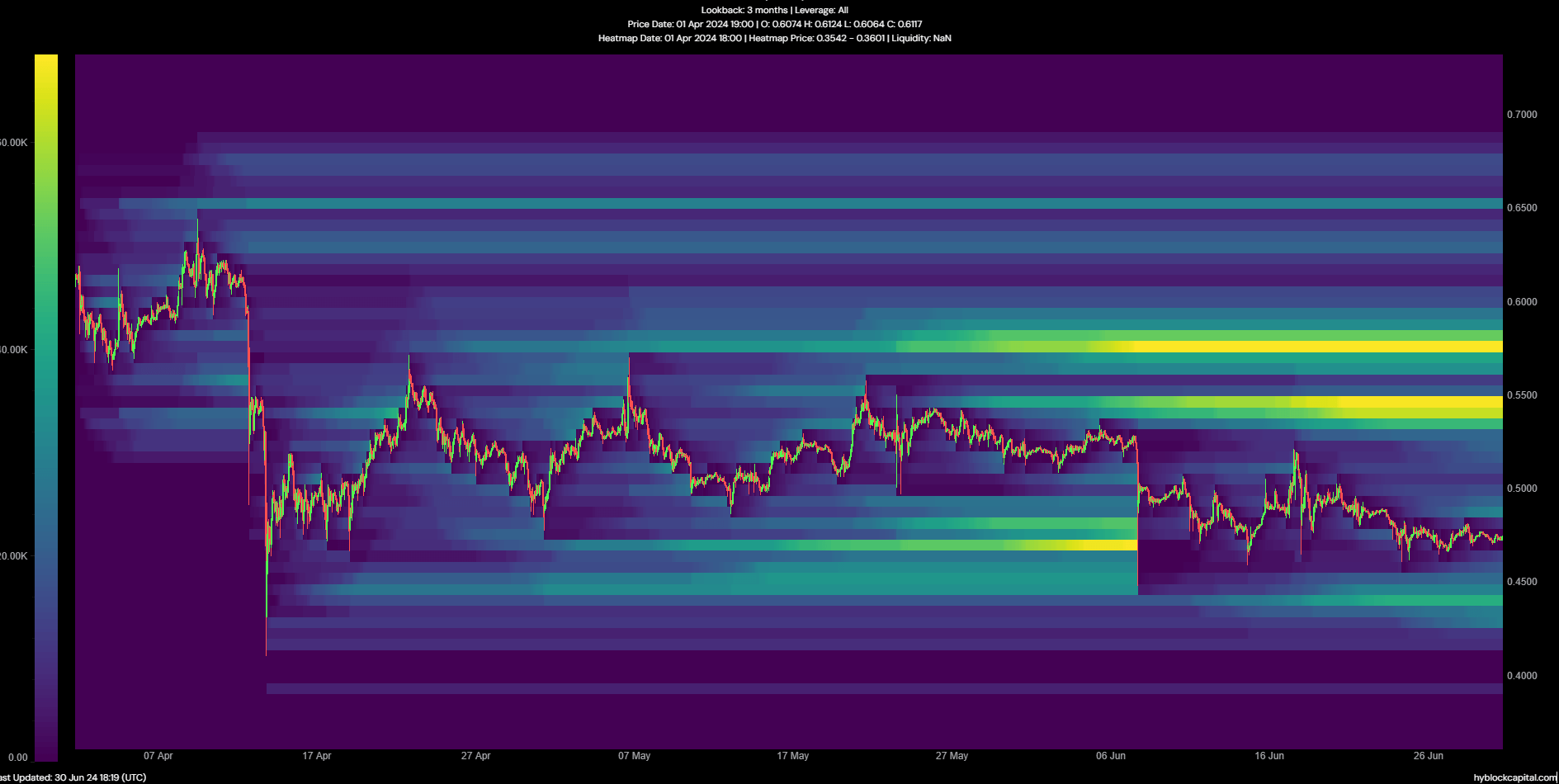

Supply: Hyblock

Supply: Hyblock

The liquidation heatmap confirmed a prime focus of liquidation ranges slightly below the $0.55 stage. This magnetic zone is most probably to draw costs upper towards the fast liquidations.

Then again, the $0.436 introduced any other sexy pocket of liquidity nearer to marketplace costs.

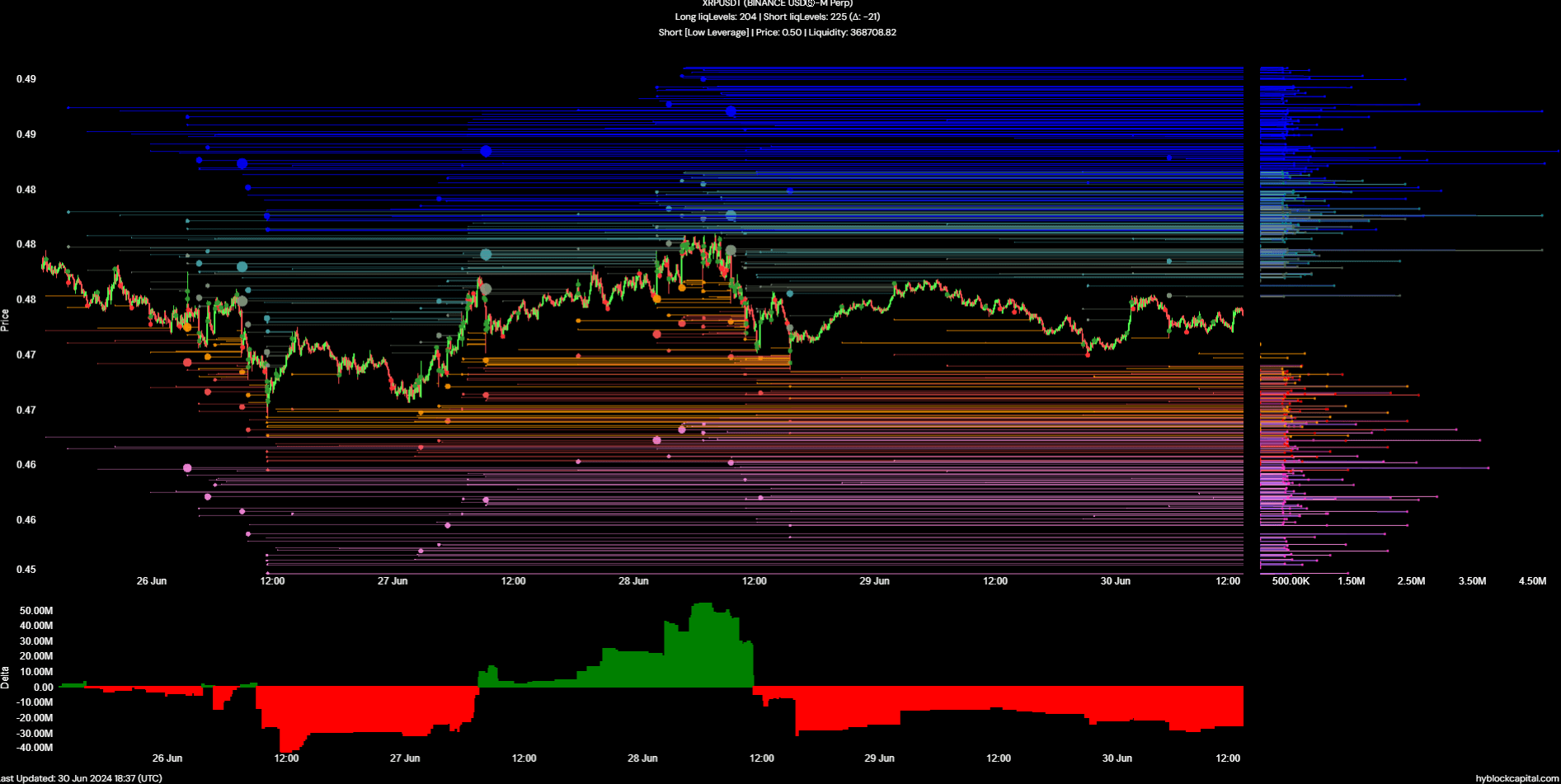

Supply: Hyblock

Supply: Hyblock

The cumulative liquidation ranges delta was once keenly adverse. This intended that the lengthy liquidation ranges have been outnumbered by way of the fast liquidation ranges by way of a sizeable quantity.

Real looking or now not, right here’s XRP’s marketplace cap in BTC’s phrases

In flip, it implied {that a} transfer upper may begin to squeeze out those brief dealers. The $0.485 stage is a key non permanent goal this is just about 2.5% above costs. In a single state of affairs, XRP reverses its contemporary losses and surges towards $0.55.

The opposite state of affairs may see XRP transfer to $0.485-$0.49, face rejection to fall to $0.436, after which begin a restoration that might ship costs towards the $0.56 vary prime. Investors should be ready and be in a position to conform in keeping with the location.