The rally adopted the asset breaking out of a consolidation channel, the place it had traded for a number of days.

These days, a robust give a boost to stage at the chart suggests ZEREBRO may just climb even upper, doubtlessly achieving $0.80 or extra.

ZEREBRO has proven an outstanding upward trajectory, gaining 67.92% over the last month and an extra 35.90% within the remaining 24 hours. As of now, its marketplace capitalization stands at $541.6 million.

Whilst those features may recommend ZEREBRO is nearing its height and may just retrace, AMBCrypto’s research signifies that the asset stays bullish, with room for additional upside.

Is ZEREBRO in a position for additional features?

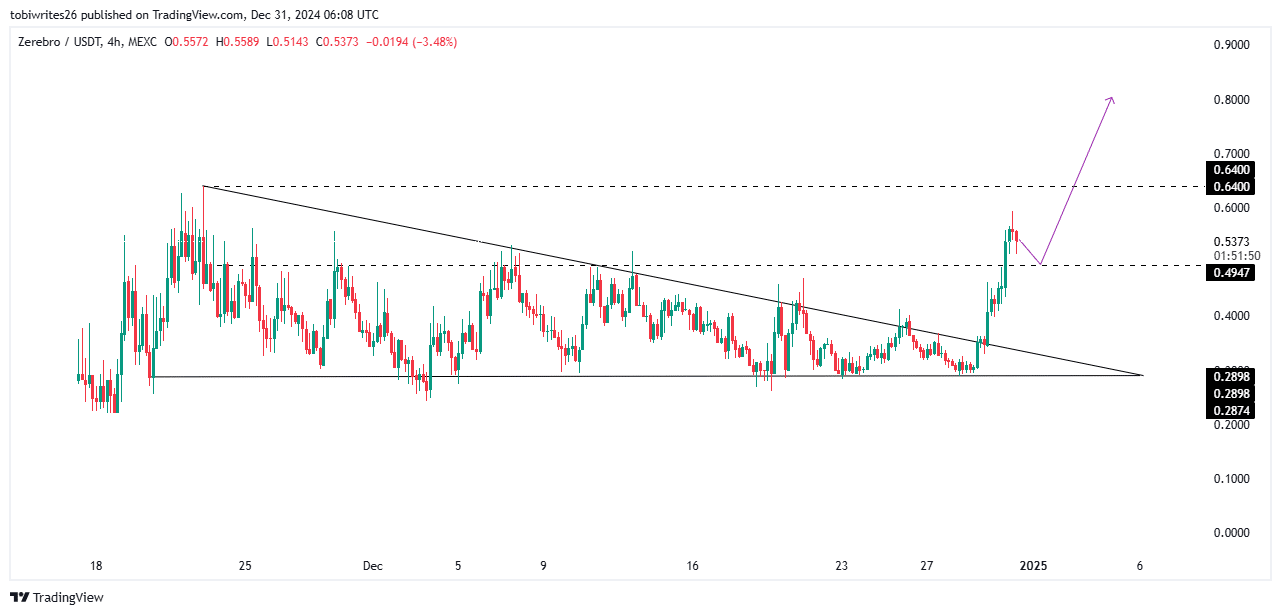

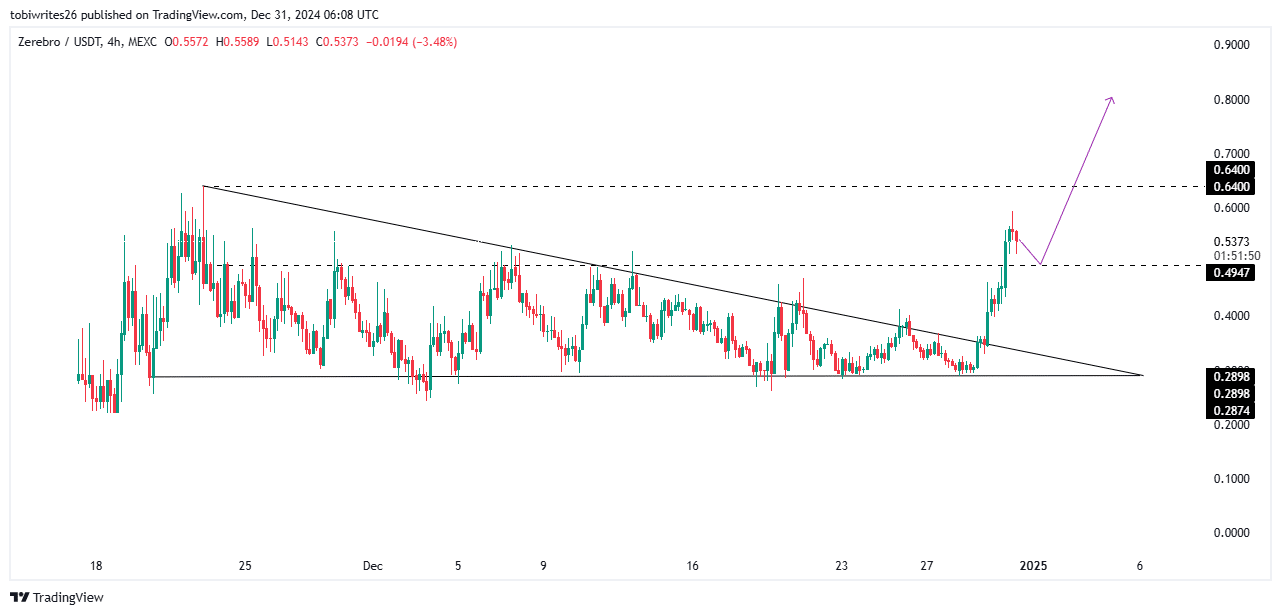

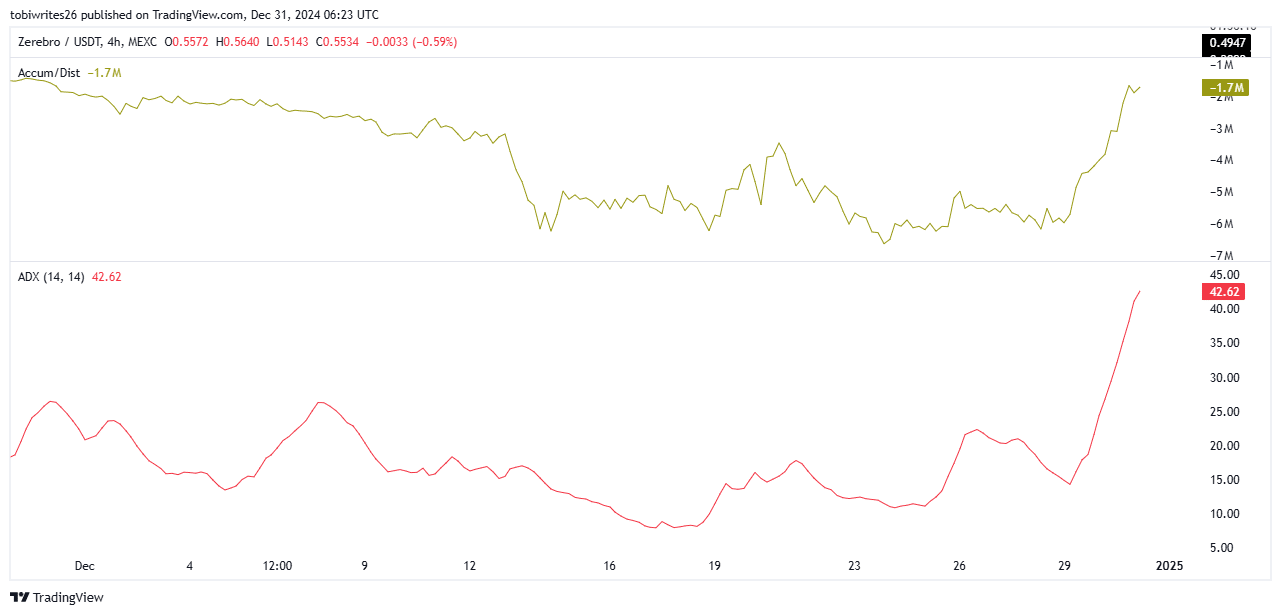

ZEREBRO’s fresh rally stems from the asset breaking out of a big consolidation channel that continued for weeks beginning in November, propelling it upper at the charts.

Most often, this breakout indicators a push towards a height of $0.64, however the asset is these days slowing down at $0.55. Research suggests two conceivable paths for ZEREBRO: achieving the $0.64 height or mountaineering upper to the $0.80–$1 vary.

Within the latter state of affairs, illustrated within the accompanying chart, ZEREBRO would first want to retrace to a give a boost to stage at $0.497. A rebound from this stage may just then push the asset towards $1, doubtlessly boosting its marketplace capitalization past $1 billion.

Supply: TradingView

Supply: TradingView

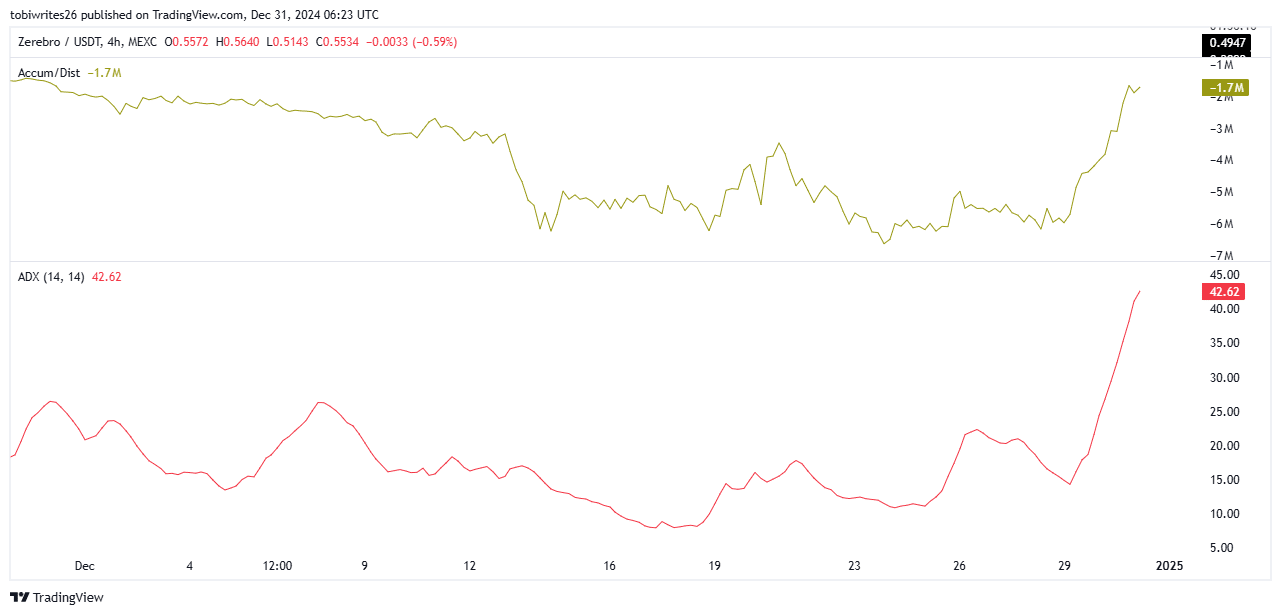

To evaluate the chance of sustained bullish momentum, AMBCrypto analyzed key technical signs, which showed that the bulls stay lively.

Emerging accumulation may just lead ZEREBRO upper

On the time of writing, ZEREBRO’s Accumulation/Distribution (A/D) indicator confirmed an accumulation section, showed via an upward-trending line.

The A/D indicator combines worth and quantity to gauge marketplace route. When it traits upward along worth motion, as observed right here, it suggests prime call for for the asset.

Supply: TradingView

Supply: TradingView

To verify the directional bias, the Reasonable Directional Index (ADX) was once analyzed. The ADX measures the power of a value development.

When an asset’s worth traits upper along a emerging ADX, it signifies sturdy bullish momentum. For ZEREBRO, an ADX studying of 42.62 reinforces this bullish outlook, suggesting the asset may just climb farther from its present worth level.

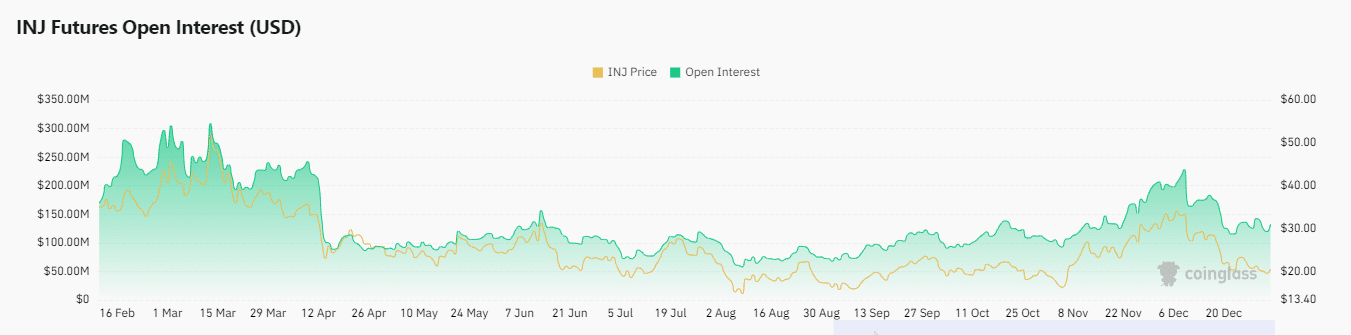

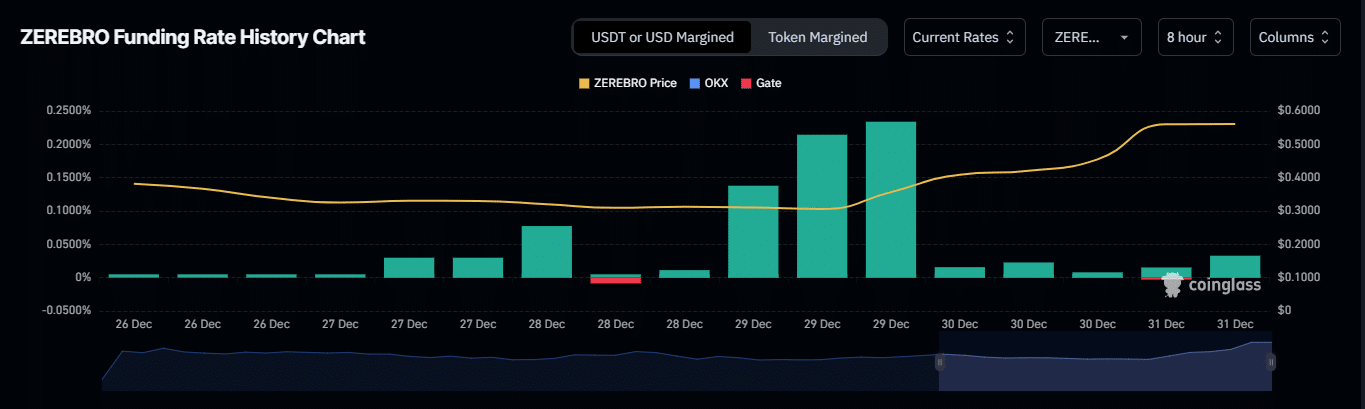

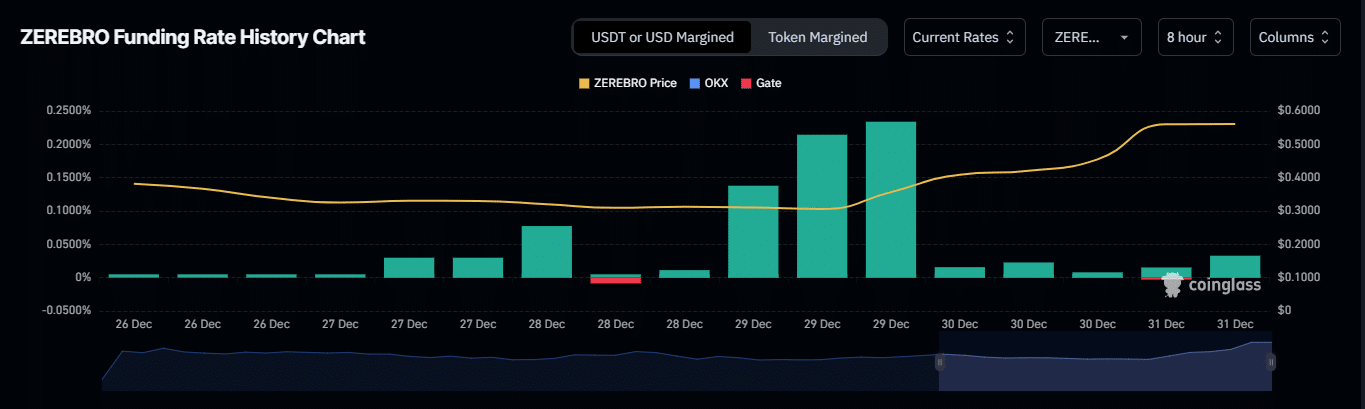

On-chain metrics additionally align with this development, appearing higher process amongst spinoff buyers out there.

Spinoff buyers pass lengthy

ZEREBRO has observed a surge in lengthy contracts throughout the derivatives marketplace. On the time of writing, the Investment Charge stands at 0.0320%, reflecting higher bullish sentiment amongst buyers.

A emerging investment charge usually signifies a bullish marketplace, as lengthy buyers (consumers) are are keen to pay a top class to deal with their positions.

Supply: Coinglass

Supply: Coinglass

This presentations self assurance in ZEREBRO’s upward momentum, with buyers protecting the associated fee distinction between the spot and futures markets.

If this development continues, ZEREBRO may just both enjoy a temporary dip ahead of a vital rally or head immediately towards a brand new all-time prime.

Subsequent: Fred Krueger: ‘Bitcoin gives awesome hedge towards inflation,’ right here’s why